Guys who are planning to learn and understand the topics of 10th Social Science Civics can grab this Tamilnadu State board solutions for Chapter 5 India’s International Relations Questions and Answers from this page for free of cost. Make sure you use them as reference material at the time of preparation & score good grades in the final exams.

Students who feel tough to learn concepts can take help from this Samacheer Kalvi 10th Social Science Book Solutions Guide Pdf, all the Questions and Answers can easily refer in the exams. Go to the below sections and get 10th Social Science Civics Chapter 5 India’s International Relations Tamilnadu State Board Solutions PDF.

Tamilnadu Samacheer Kalvi 10th Social Science Civics Solutions Chapter 5 India’s International Relations

Do you feel scoring more marks in the 10th Social Science Civics Grammar sections and passage sections are so difficult? Then, you have the simplest way to understand the question from each concept & answer it in the examination. This can be only possible by reading the passages and topics involved in the 10th Social Science Civics Board solutions for Chapter 5 India’s International Relations Questions and Answers. All the Solutions are covered as per the latest syllabus guidelines. Check out the links available here and download 10th Social Science Civics Chapter 5 textbook solutions for Tamilnadu State Board.

India’s International Relations Textual Exercise

I. Choose the correct answer.

Question 1.

Me Mahon Line is a border between ………………

(a) Burma and India

(b) India and Nepal

(c) India and China

(d) India and Bhutan

Answer:

(c) India and China

Question 2.

India is not a member of which of the following

(1) G20

(2) ASEAN

(3) SAARC

(4) BRICS

Select the correct option:

(a) 4 only

(b) 2 and 4

(c) 2, 4 and 1

(d) 1,2 and 3

Answer:

(b) 2 and 4

Question 3.

OPEC is ………..

(a) An international insurance Co.

(b) An international sports club

(c) An Organisation of Oil Exporting Countries

(d) An international company

Answer:

(c) An Organisation of Oil Exporting Countries

Question 4.

With which country does India share its longest land border?

(a) Bangladesh

(b) Myanmar

(c) Afghanistan

(d) China

Answer:

(a) Bangladesh

Question 5.

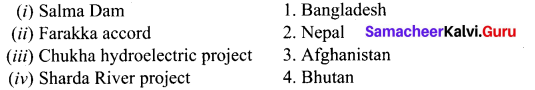

Match the following and choose the correct answer form the codes given below.

(a) 3 1 4 2

(b) 3 1 2 4

(c) 3 4 1 2

(d) 4 3 2 1

Answer:

(a) 3 1 4 2

Question 6.

How many countries share their border with India?

(a) 5

(b) 6

(c) 7

(d) 8

Answer:

(c) 7

Question 7.

Which two island countries are India’s neighbours?

(a) Sri Lanka and Andaman island

(b) Maldieves and Lakshadweep island

(c) Maldieves and Nicobar island

(d) Sri Lanka and Maldieves

Answer:

(d) Sri Lanka and Maldieves

Question 8.

Which Indian state is surrounded by three countries?

(a) Arunachal Pradesh

(b) Meghalaya

(c) Mizoram

(d) Sikkim

Answer:

(d) Sikkim

Question 9.

How many Indian states have their boundary with Nepal?

(a) Five

(b) Four

(c) Three

(d) Two

Answer:

(a) Five

Question 10.

Who drew up the borders for newly independent Pakistan?

(a) Lord Mountbatten

(b) Sir Cyril Radcliffe

(c) Clement Atlee

(d) None of the above

Answer:

(b) Sir Cyril Radcliffe

II. Fill in the blanks.

1. …………… is a small Himalayan kingdom.

2. India’s gateway to South East Asia is ………….

3. …………… is a buffer country between India and China.

4. A strip of land …………. belongs to India on West Bengal and Bangladesh border.

5. …………… is known as the Land of a thunderbolt.

6. India and Sri Lanka are separated by …………

Answers:

1. Bhutan

2. Myanmar

3. Nepal

4. Teen Bigha Corridor

5. Bhutan

6. Palk strait

III. Consider the following statement and tick the appropriate answer

Question 1.

The Kaladan transport project by India and Myanmar consists of which of the following modes of transport?

1. Roads

2. Railways

3. Shipping

4. Inland water transport

Select the correct answer using the codes given below

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Answer:

(b) 1, 3 and 4 only

Question 2.

Assertion (A): India and France launched International Solar Alliance.

Reason (R): It was done to bring together countries between Tropic of Cancer and Tropic of Capricorn for co-operation of solar energy.

(a) A is correct and R is the correct explanation of A

(b) A is correct and R is not the correct explanation of A

(c) A is wrong and R is correct

(d) Both are wrong

Answer:

(a) A is correct and R is the correct explanation of A

Question 3.

Which of the following statements are true?

Statement 1. ICCR has initiated a Tagore Chair in University of Dhaka.

Statement 2. Mayanmar is India’s gateway to western countries.

Statement 3. Nepal and Bhutan are land locked nations.

Statement 4. Sri Lanka is one of the partner in Nalanda University Project of India.

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 3 and 4

(d) 1, 2 and 4

Answer:

(c) 1, 3 and 4

Question 4.

Assertion (A): OPEC has vested interest in India’s economic growth.

Reason (R): Devoid of necessary oil resources India strongly focuses on agriculture and industrial production.

(a) A is correct and R explains A

(b) A is wrong and R is correct

(c) Both are correct

(d) Both are wrong

Answer:

(c) Both are correct

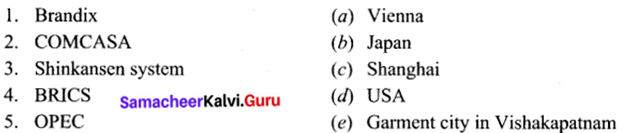

IV. Match the following.

Answers:

1. (e)

2. (d)

3. (b)

4. (c)

5. (a)

V. Give Short Answers.

Question 1.

Name the neighbouring countries of India.

Answer:

Afghanistan, Pakistan, Bhutan, China, Nepal, Bangladesh, Myanmar, Sri Lanka, and the Maldives.

Question 2.

Write a short note on Strategic partnetship Agreement (SPA).

Answer:

Indo-Afghan relation was strengthened by the Strategic Partnership Agreement (SPA). SPA provides assistance to re-build Afghan’s infrastructure, institutions, agriculture, water, education, health and providing duty-free access to the Indian market.

Question 3.

Mention the member countries of BRICS.

Answer:

Brazil,. Russia, India, China and South Africa.

Question 4.

What do you know about Kaladan Multi – Model Transit Transport?

Answer:

India is building the Kaladan Multi-Model Transit Transport, a road-river-port cargo transport project to link Kolkata to Sittwe in Myanmar. A project aiming to connect Kolkata with Ho Chi Minh City on the South Sea for the formation of an economic zone will have a road pass through Myanmar, Cambodia and Vietnam and work on the first phase connecting Guwahati with Mandalay is currently undemay.

Question 5.

How do you assess the importance of Chabahar agreement?

Answer:

- A trilateral agreement called the Chabahar Agreement was signed between India, Afghanistan and Iran, which has led to the establishment to transit and transport corridor among three countries using Chabahar port.

- This port is seen as golden gateway for India to access land locked markets of Afghanistan and central Asia by passing Pakistan.

Question 6.

List out any five global groupings in which India is a member.

Answer:

India is a member of formal groupings like UNO, NAM, SAARC, G20 and the Commonwealth.

Question 7.

What is the role of Japan India Institute of Manufacturing (JIM)?

Answer:

In the manufacturing sector Japan announced its co-operation of training 30,000 Indian people in the Japan India Institute of Manufacturing (JIM) providing Japanese style manufacturing skills to enhance India’s manufacturing Industry base and contribute to “Make in India” and “Skill India” initiatives.

VI. Answer in detail.

Question 1.

Highlight India and International organisation with special reference to any three India’s global groupings.

Answer:

India is potential superpower and has a growing international influence all around the world. Being a newly industralised county, India has great history of collaboration with several countries. It has acted as prominent member of several international organizations and has been a founding member of some. India is a member of formal grouping like UNO, NAM, SAARC, G20 and the Common Wealth.

India has been extending a helping hand to the UNO, in all its efforts in ending military conflicts, and in promoting peace and progress among the nations.

| Name of the Global Grouping | Name of the Member Countries | Objectives |

| IBSA | India, Brazil, South Africa | To focus on agriculture, education, energy, trade, culture and defence among others |

| BCIM | Bangladesh, China, India,Myanmar | To respond to threats such as natural disasters and data breaches and protect business interests |

| BBIN | Bangladesh, Bhutan, India, Nepal | For energy development |

Question 2.

Trace the reason for the formation of BRICS and write its objectives. BRICS:

Answer:

- Brazil, Russia, India, China, and South Africa are leading emerging economies and political powers at the regional and international level.

- The BRICS organisations headquarters is in Shangai, China.

- BRICS opened up a possibility for countries of Global South to challenge the Global North.

Reason for the formation of BRICS:

- To be an alternative to world bank and IMF to challenge U.S supremacy.

- To provide self owned and self – managed organisations to carry out developmental and economical plans in its member nations.

Objectives of BRICS

- To achieve regional development.

- It act as a bridge between developed and developing countries.

- To contribute extensively to development of humanity.

- To establish a more equitable and fair world.

- Boost intra BRICS trade in their local currencies to increase trade co-operation and cope with the current international financial crisis.

- To promote the technological information exchange among the member states.

- To enhance inclusive economic growth that will lead to an increase in the creation of jobs, fight against poverty and accelerate the economic transformation of members.

![]()

Question 3.

Mention OPEC missions and how does it help other countries?

Answer:

OPEC’s mission:

- To coordinate oil policies in its member countries

- Help stabilise oil markets

- To secure fair and stable income to petroleum producers

- An efficient, economic and regular supply of oil to consuming nations

- A fair return on capital to those investing in the petroleum industry

How does OPEC help other countries:

The OPEC Fund for International Development (OPID) is an institution that helps finance projects with low interest loans. It also provides grants to social and humanitarian projects. OPEC has an Information Centre with over 20,000 volumes including books, reports, maps and conference proceedings related to petroleum, energy and the oil market. The Information Centre is open to the public and is often used by researchers and students.

VII. Project and activity

Question 1.

Students can be asked to collect information form newspapers about India’s relatio with world countries.

Answer:

Do it yourself.

Question 2

Group project involving students to prepare an album with pictures on India’s latest projects with its neighboring countries.

Answer:

Do it yourself.

India’s International Relations Additional Questions

I. Choose the correct answer.

Question 1.

India was a dependent country till …………

(a) August 13, 1947

(b) August 15, 1947

(c) January 26, 1980

Answer:

(b) August 15, 1947

Question 2.

In which year Farakka accord on sharing of Ganga water signed?

(a) 1970

(b) 1973

(c) 1975

(d) 1977

Answer:

(d) 1977

Question 3.

In spite of past conflicts both ……………. are trying to come closer.

(a) India and Bangladesh

(b) India and Afghanistan

(c) India and Pakistan

Answer:

(c) India and Pakistan

Question 4.

…………….. is a landlocked nation.

(a) Bhutan

(b) Nepal

(c) Both (a) and (b)

(d) Pakistan

Answer:

(c) Both (a) and (b)

Question 5.

…………. was the first country to recoginse the Republic of china.

(a) England

(b) Russia

(c) India

Answer:

(c) India

Question 6.

Bangladesh got freedom from …………….. in …………

(a) India, 1951

(b) Nepal, 1961

(c) Pakistan 1971

Answer:

(c) Pakistan 1971

Question 7.

Which country is an important partner in our energy needs for petroleum and natural gas?

(a) Bangladesh

(b) Sri Lanka

(c) Myanmar

(d) All the above

Answer:

(c) Myanmar

II. Fill in the blanks :

1. ……………… relation was strengthened by the strategic-Partnership Agreement.

2. India was the first nation to acknowledge ……………. as an independent country.

3. By the Farakka Barrage issue, the distribution of …………. water was settled amicably.

4. India and Bangladesh share ……………. common rivers.

5. ………….. known as a land of thunder bolt.

6. India declared the bilateral trade relation known as …………. to …………..

7. ………….. being the manufacturing hub of the world.

8. Maldives is located south of Lakshadweep islands in the ……………

9. India’s second largest border is shared with …………….

10. …………… is a small land locked country.

Answers:

1. Indo-Afghan

2. Bangladesh

3. Ganga

4. 54

5. Bhutan

6. Bharat, Bhutan

7. China

8. Indian Ocean

9. Myanmar

10. Nepal

III. Match the following.

a.

| 1. | Pasupati and Janakpu | (a) | India |

| 2. | Maldives | (b) | The borderline between India and China |

| 3. | Bhutan | (c) | Nepal |

| 4. | Varanasi and four Dhaams | (d) | Himalayan kingdom |

| 5. | Me Mahoon Line | (e) | Indian Ocean |

Answer:

1. (c)

2. (e)

3. (d)

4. (a)

5. (b)

IV. Short Answer

Question 1.

Explain about LOC.

Answer:

- The ceasefire line determined in 1949 was called the LOC after 1972.

- This is the boundary that came to be agreed between India and Pakistan under the Shimla agreement of 1972.

- It was called Radcliffe line at the time of partition 1947. (Radcliffe was the chairman of the border commission) This is now called LOC.

Question 2.

Which is the fundamental factor of India’s foreign policy?

Answer:

The recognition of sovereign equality of all people living in various parts of the world is the fundamental factor in India’s foreign policy.

Question 3.

Give a short note on BRICS payment system.

Answer:

At the 2015 BRICS summit, ministers from the BRICS nations initiated consultation a payment system that would be an alternative to the society for world wide Inter Bank Financial Telecommunication system (SWIFT).

Question 4.

Explain India’s role towards China.

Answer:

When China became republic in 1949. India was the first country to recognize it. Both the countries have successfully attempted to restore the economic lines. China has formally declared that she will back India’s claim for becoming a permanent member of united Nation’s Security Council.

Question 5.

List out the important Pilgrimage destination in India.

Answer:

Pashupati and Janakpur are traditional centres in Nepal where as Varanasi and the four Dhaans (Badrinathpuri, Dwareka and Rameshwaram) are important pilgrimage destination in India.

Question 6.

Prove that India is a very good friend of Bangladesh.

Answer:

It is due to the effort and support of Smt.Indira Ghandhi, the Prime Minister of India, Bangladesh got freedom from Pakistan in 1971. In 1972, a 25 years treaty of friendship co-operation and peace was sighed in Dacca by India and Bangladesh. The Farakka Barrage issue regarding the distribution of Ganga water was settled amicably. Thus India is a very good friend of Bangladesh. Our friendship with Bangladesh will go on forever.

V. Detail.

Question 1.

Discuss India and its Neighbours?

Answer:

- India has always been known as a peace – loving country. India is surrounded by many neighbouring countries with whom she has traditionally tried to maintain friendly and good neighbourly relations.

- India’sposition is unique in its neighbourhood.

- India’s neighbours had been a part of a homogeneous culture prevailing in the Indian subcontinent for last five thousand years.

- India is a vast country with Pakistan and Afghanistan to the north – west.

- China, Nepal, Bhutan to the North.

- Bangladesh to the east.

- Myanmar to the Far East.

Sri Lanka (from South – East) and Maldives (from South – West) are two countries that lie close to India separated by the Indian ocean. India has cordial historical, religious, economic, ethnic and linguistic relationship will all of these countries.

We think the data given here clarify all your queries of Chapter 5 and make you feel confident to attempt all questions in the examination. So, practice more & more from Tamilnadu State Board solutions for 10th Social Science Civics Chapter 5 India’s International Relations Questions and Answers & score well. Need any information regarding this then ask us through comments & we’ll give the best possible answers very soon.