Students can Download Accountancy Chapter 8 Financial Statement Analysis Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 8 Financial Statement Analysis

Samacheer Kalvi 12th Accountancy Financial Statement Analysis Text Book Back Questions and Answers

I. Choose the Correct Answer

12th Accountancy 8th Chapter Question 1.

Which of the following statements is not true?

(a) Notes and schedules also form part of financial statements

(b) The tools of financial statement analysis include common – size statement

(c) Trend analysis refers to the study of movement of figures for one year

(d) The common – size statements show the relationship of various items with some common base, expressed as percentage of the common base

Answer:

(c) Trend analysis refers to the study of movement of figures for one year

12th Accountancy Chapter 8 Question 2.

Balance sheet provides information about the financial position of a business concern ………………

(a) Over a period of time

(b) As on a particular date

(c) For a period of time

(d) For the accounting period

Answer:

(b) As on a particular date

12th Accountancy 8th Chapter Solutions Question 3.

Which of the following tools of financial statement analysis is suitable when data relating to several years are to be analysed?

(a) Cash flow statement

(b) Common size statement

(c) Comparative statement

(d) Trend analysis

Answer:

(d) Trend analysis

Class 12 Accountancy Chapter 8 Solutions Question 4.

The financial statements do not exhibit ………………

(a) Non – monetary data

(b) Past data

(c) Short term data

(d) Long term data

Answer:

(a) Non – monetary data

Accountancy Class 12 Chapter 8 Solutions Question 5.

Which of the following is not a tool of financial statement analysis?

(a) Trend analysis

(b) Common size statement

(c) Comparative statement

(d) Standard costing

Answer:

(d) Standard costing

Accounting Chapter 8 Answer Key Question 6.

The term ‘fund’ refers to ………………

(a) Current liabilities

(b) Working capital

(c) Fixed assets

(d) Non – current assets

Answer:

(b) Working capital

Class 12 Accountancy Chapter 8 Question 7.

Which of the following statements is not true?

(a) All the limitations of financial statements are applicable to financial statement analysis also.

(b) Financial statement analysis is only the means and not an end.

(c) Expert knowledge is not required in analysing the financial statements.

(d) Interpretation of the analysed data involves personal judgement.

Answer:

(c) Expert knowledge is not required in analysing the financial statements

Financial Statements Of A Company Class 12 Solutions Question 8.

A limited company’s sales has increased from ? 1,25,000 to? 1,50,000. How does this appear in comparative income statement?

(a) + 20%

(b) + 120%

(c) – 120 %

(d) – 20 %

Answer:

(a) + 20 %

Financial Statements Questions And Answers Pdf Question 9.

In a common-size balance sheet, if the percentage of non – current assets is 75, what would be the percentage of current assets?

(a) 175

(b) 125

(c) 25

(d) 100

Answer:

(c) 25

Financial Statement Analysis Solutions Pdf Question 10.

Expenses of a business for the first year were ₹ 80,000. In the second year, it was increased to ₹ 88,000. What is the trend percentage in the second year?

(a) 10%

(b) 110%

(c) 90%

(d) 11%

Answer:

(b) 110 %

II. Very Short Answer Questions

Financial Statements Solutions Question 1.

What are financial statements?

Answer:

Financial statements are the statements prepared by the business concerns at the end of the accounting period to ascertain the operating results and the financial position.

Financial Statement Analysis Chapter 8 Solutions Question 2.

List the tools of financial statement analysis.

Answer:

- Comparative Statement.

- Common Size Statement.

- Trend Analysis.

- Funds Flow Analysis.

- Cash Flow Analysis.

Financial Statement Analysis Solutions Question 3.

What is working capital?

Answer:

Working capital statement or schedule of changes in working is prepared to disclose net changes in working capitals on two specific dates (generally two balance sheet dates). It is prepared from current assets and current liabilities.

Working Capital = Current Assets – Current Liabilities

Financial Statement Analysis Problems And Solutions Pdf Question 4.

When is trend analysis preferred to other tools?

Answer:

Trend analysis discloses the changes in financial and operating data between specific periods when data for more than two years are to be analyzed. It may be difficult to use comparative statement.

III. Short Answer Questions

Question 1.

‘Financial statements are prepared based on the past data’. Explain how this is a limitation?

Answer:

The nature of financial statement is historical. Past cannot be the index of future and cannot be cent percent basis for future estimation, forecasting, budgeting and planning.

Question 2.

Write a short note on cash flow analysis.

Answer:

Cash flow analysis concerned with preparation of cash flow statement which shows the inflow and outflow of cash and cash equivalents in a given period of time. Cash includes cash in hand and demand deposit with banks. Cash equivalents denotes short term investments which can be realised easily within a short period of time without much loss in value. Cash flow analysis helps in assessing the liquidity and solvency of a business concern.

Question 3.

Briefly explain any three limitations of financial statements.

Answer:

1. Lack of qualitative information:

Qualitative information, that is non – monetary information is also important for business decisions. For examole Efficiency of the employees and efficiency of the management. But this is ignored in financial statements.

2. Record of historical data:

Financial statement are prepared based on historical data. They may not reflect the current position.

3. Ignores price level changes:

Adjustments for price level changes are not made in the financial statements. Hence financial statements may not reveal the current position.

Question 4.

Explain the steps involved in preparing comparative statements.

Answer:

Following are the steps to be followed in preparation of comparative statement.

- Column 1 : In this column, particulars of items of income statements or balance sheet are written.

- Column 2 : Enter absolute amount of year 1.

- Column 3 : Enter absolute amount of year 2.

- Column 4 : Show the difference in amounts between year 1 and year 2. If there is an increase in year 2, put plus sign and there is a decrease put minus sign.

- Column 5 : Show percentage increase or decrease of the difference amount shown in column 4 by dividing the amount shown in column 4 (absolute amount of increase or decrease) by column 2 (year 1 amount)

Percentage increase (or) decrease = ![]()

Question 5.

Explain the procedure for preparing common – size statement.

Answer:

Common – size statements can be prepared with three columns. Following are the steps to be followed in preparation of common – size statement.

- Column 1. In this column, particulars of items of income statement or balance sheet are written.

- Column 2. Enter absolute amount.

- Column 3. Choose a common base as 100.

For example Revenue from operations can be taken as the base for income statement and total of balance sheet can be taken as the base for balance sheet. Work out the percentage for all the items of column 2 in terms of the common base and enter them in column 3.

IV Exercises

Question 1.

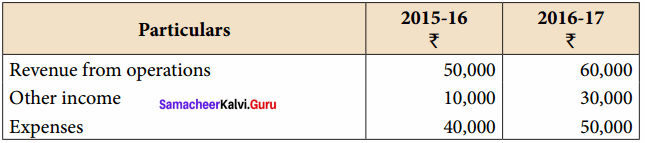

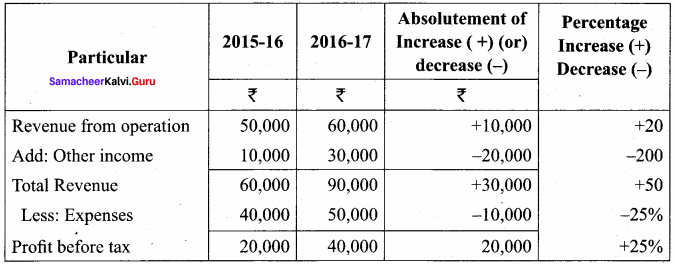

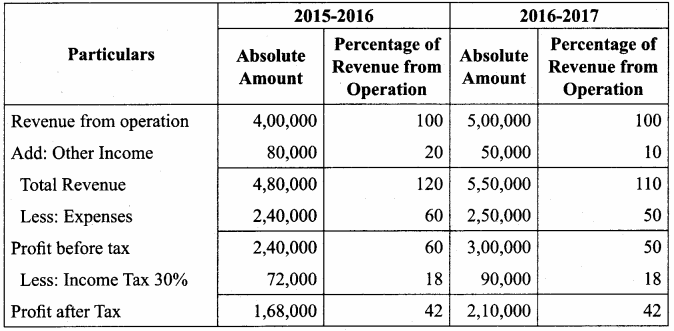

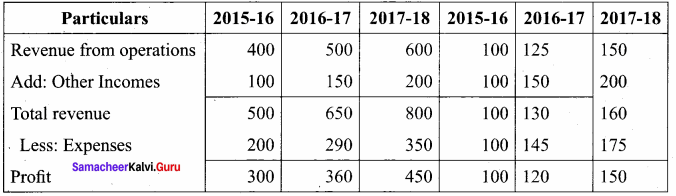

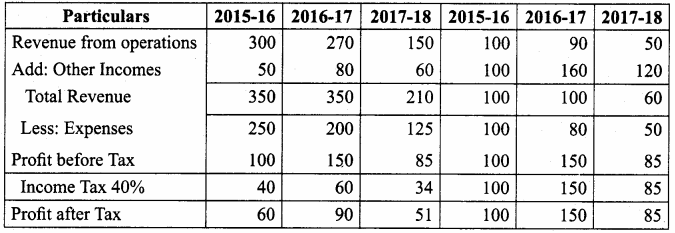

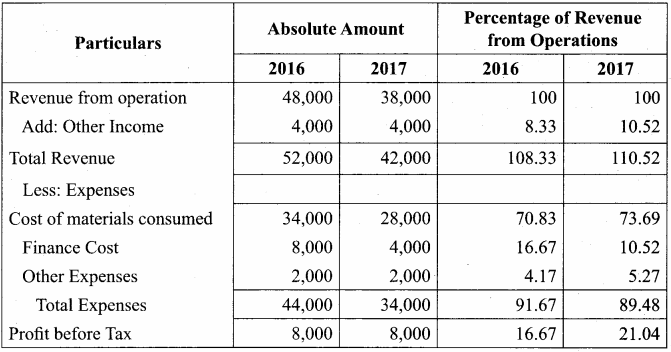

From the following particulars, prepare comparative income statement of Arul Ltd.

Answer:

Comparative Income Statement Analysis of Arul Ltd.

for the year ended 31.3.2016 to 31.3.2017

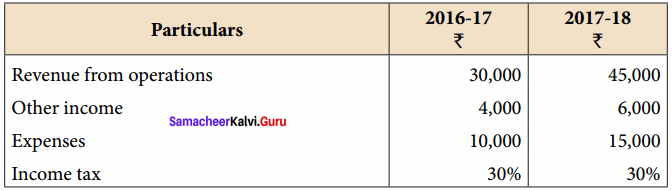

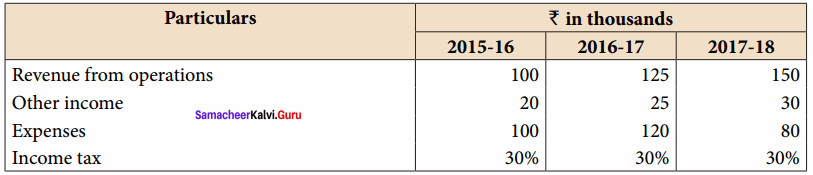

Question 2.

From the following particulars, prepare comparative income statement of Barani Ltd.

Answer:

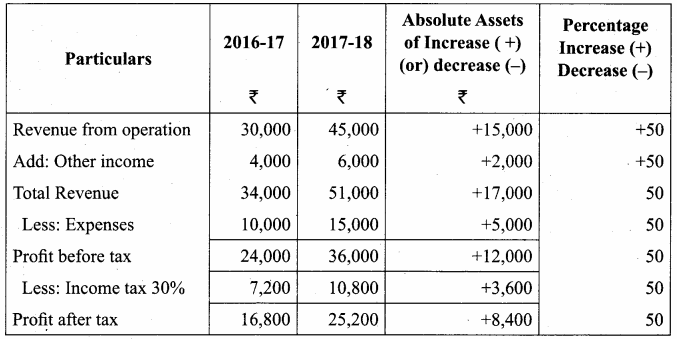

Comparative Income Statement of Barani Ltd. for the year ended 31st March 2017 to 31st March 2018

Question 3.

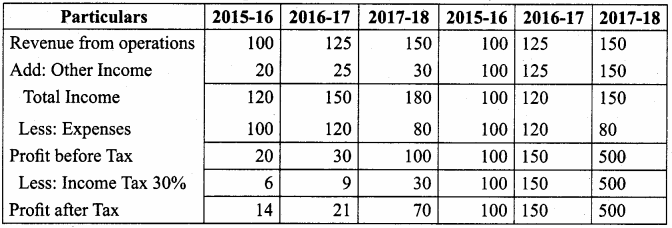

From the following particulars, prepare comparative income statement of Daniel Ltd.

Answer:

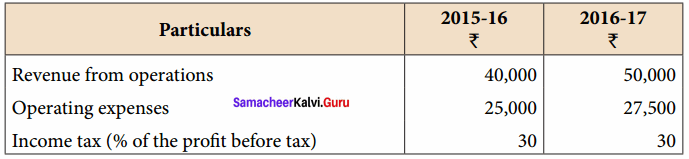

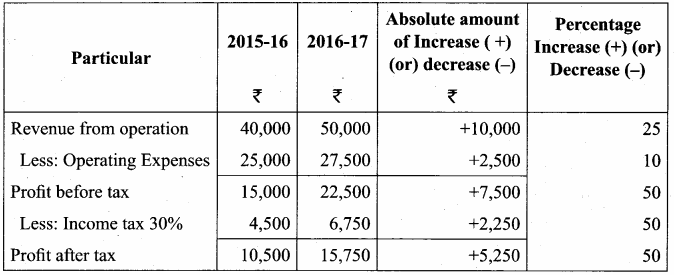

Comparative Income Statement of Daniel Ltd. for the year ended 31st March 2016 to 31st March 2017

Question 4.

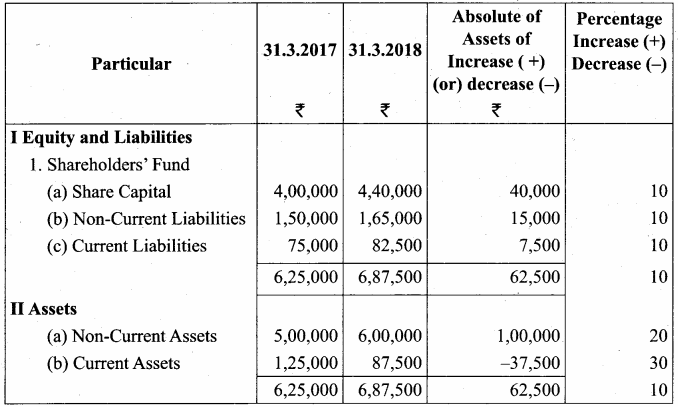

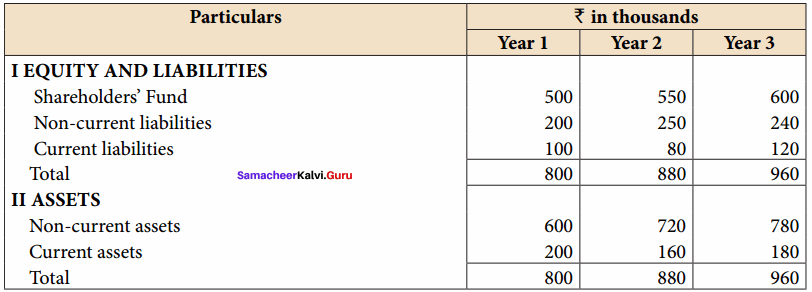

From the following particulars, prepare comparative statement of financial position of Muthu Ltd.

Answer:

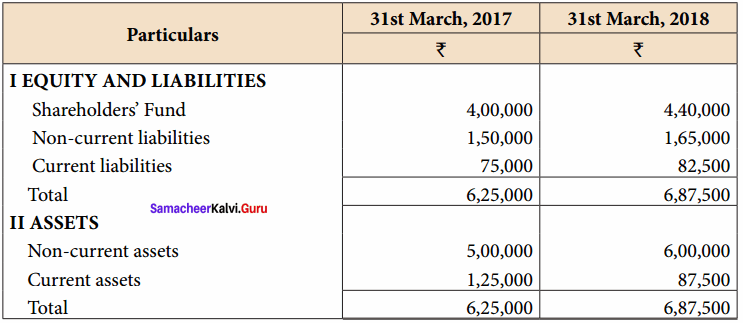

Comparative Balance Sheet of Muthu Ltd. as on 31st March 2017 to 31st March 2018

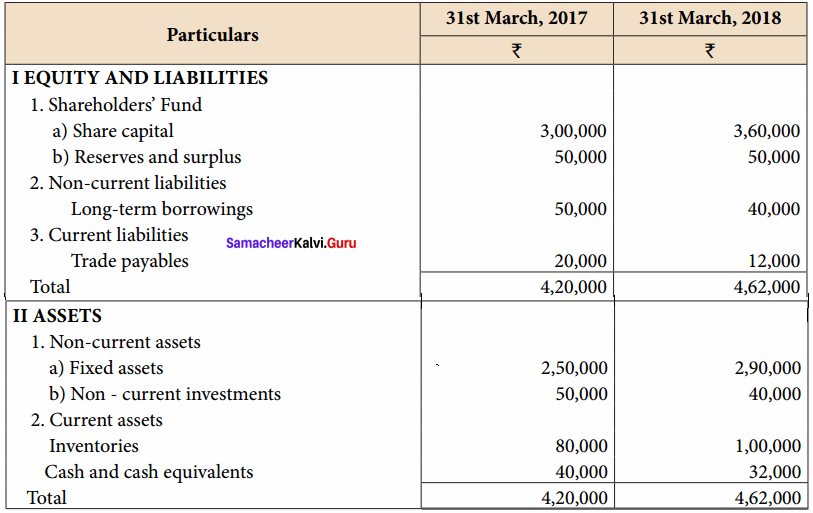

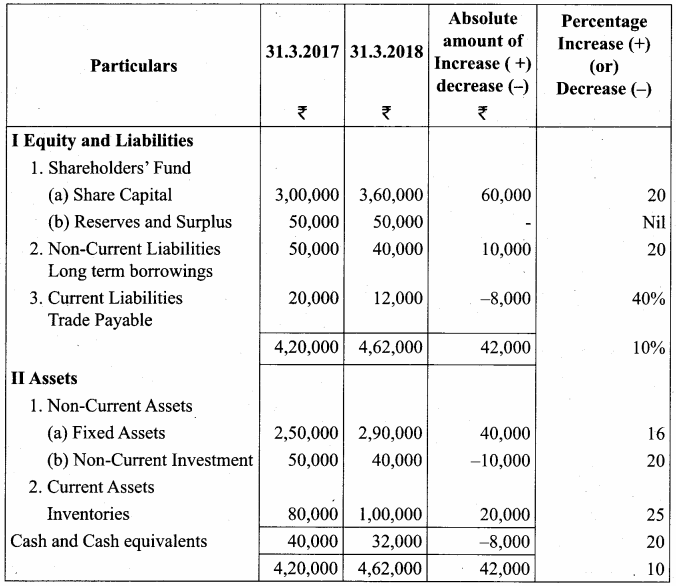

Question 5.

From the following particulars, prepare comparative statement of financial position of Kala Ltd.

Comparative Balance Sheet of Kala Ltd. as on 31st March 2017 and 31st March 2018

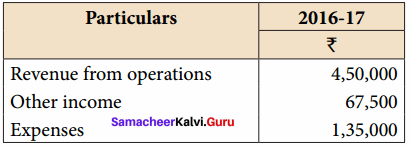

Question 6.

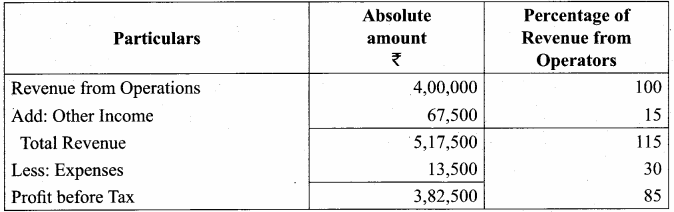

Prepare common – size income statement for the following particulars of Raja Ltd. for the year ended 31st March, 2017.

Answer:

Question 7.

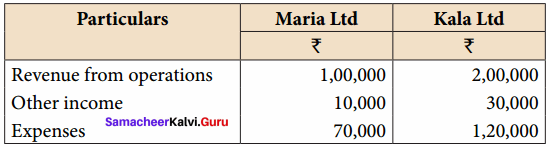

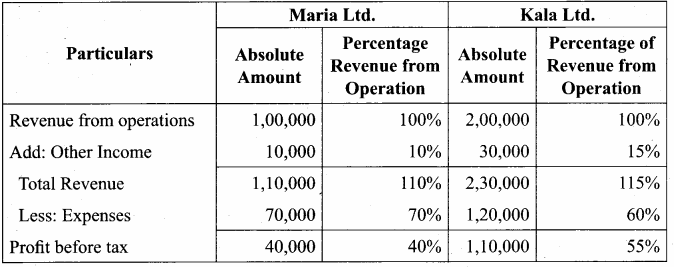

From the following particulars of Maria Ltd. and Kala Ltd. prepare a common – size income statement for the year ended 31st March, 2019.

Answer:

Common Size Income statement for the year ended 31st March 2019

Question 8.

Prepare common – size income statement for the following particulars of Sam Ltd.

Answer:

Common Size Income statement of Sam Ltd.

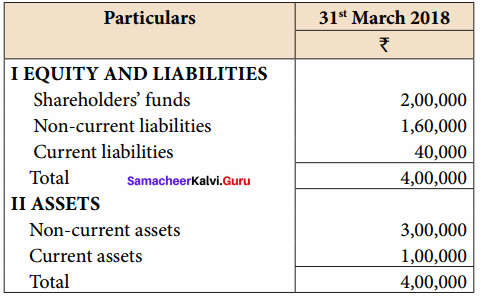

Question 9.

Prepare Common – size balance sheet of Meena Ltd. as on 31st March, 2018.

Answer:

Common Size Balance sheet of Meena Ltd. on 31st March 18

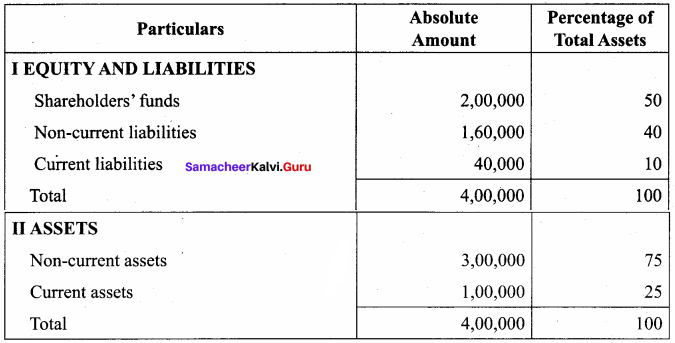

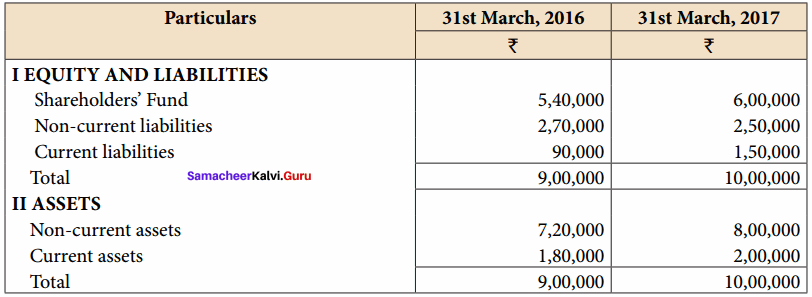

Question 10.

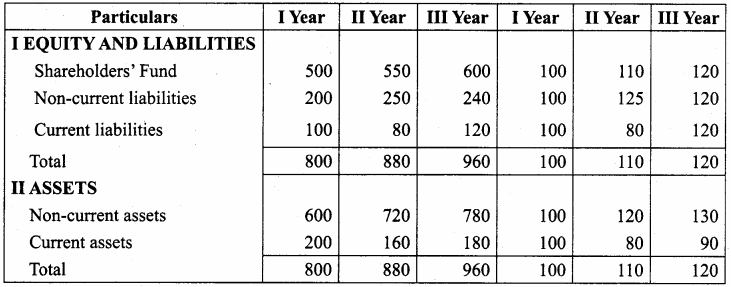

Prepare common – size statement of financial position for the following particulars of Rani Ltd.

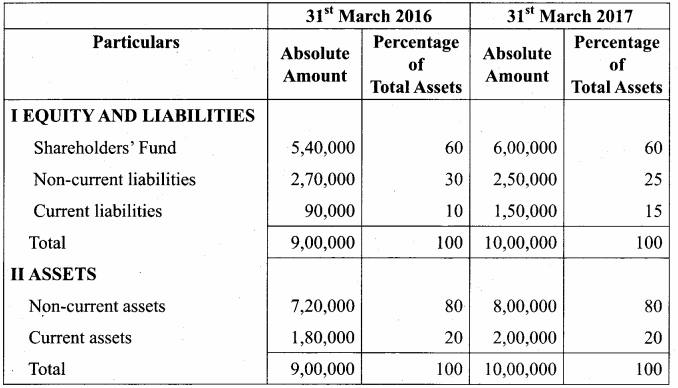

Answer:

Common Size Balance sheet of Rani Ltd. as on 31st March 2016 to 31st March 2017

Question 11.

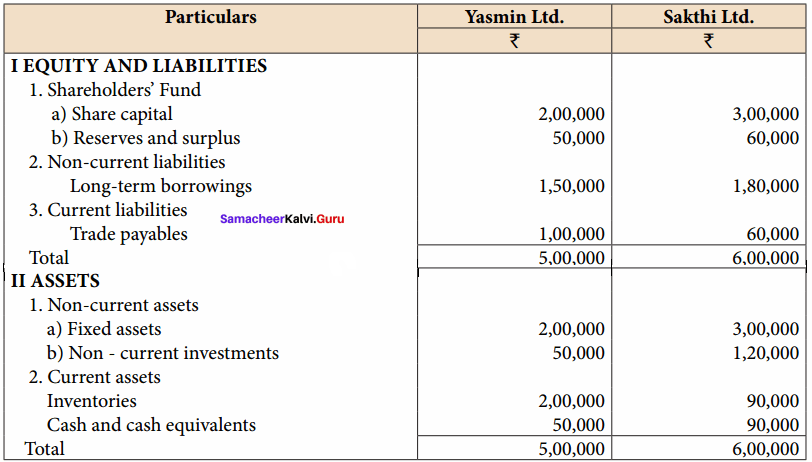

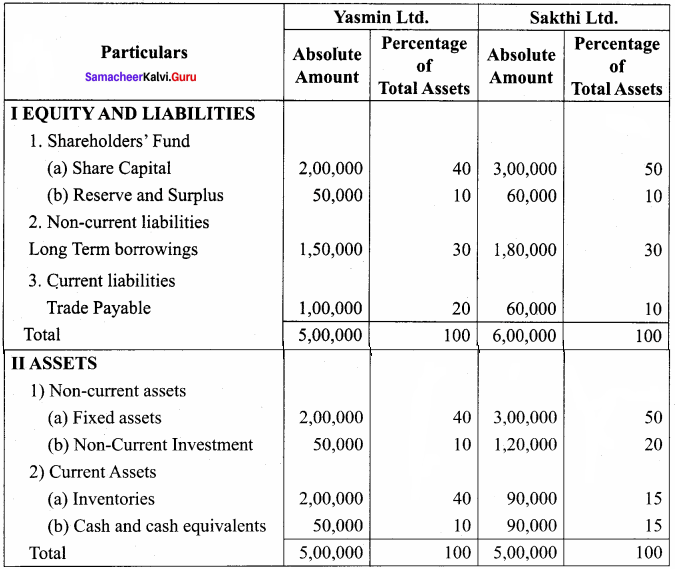

Prepare common – size statement of financial position for the following particulars of Yasmin Ltd. and Sakthi Ltd.

Common Size statement of Balance sheet

Question 12.

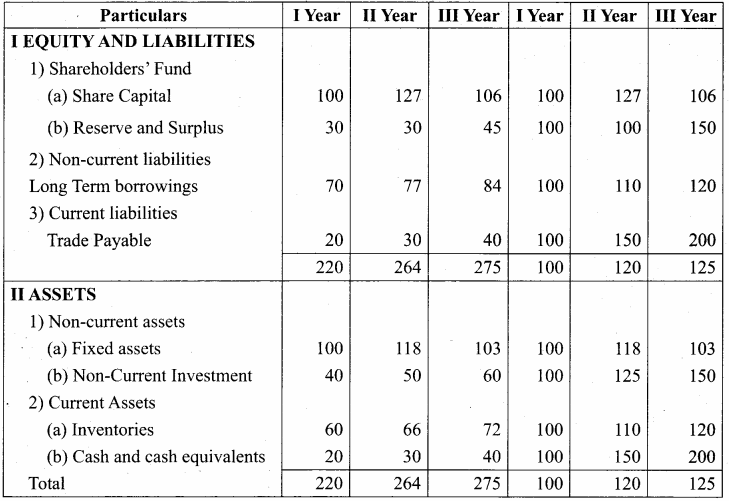

From the following particulars, calculate the trend percentages of Kala Ltd.

Answer:

Trend Analysis of Kala Ltd Trend Percentage

Question 13.

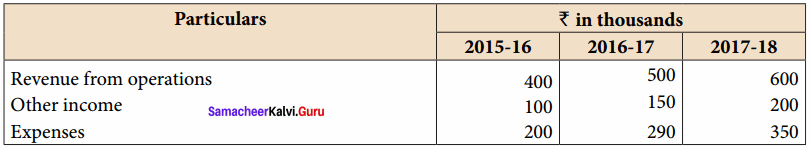

From the following particulars, calculate the Trend percentages of Kavitha Ltd.

Answer:

Trend Percentage of Kavitha Ltd (in thousands)

Question 14.

From the following particulars, calculate the trend percentages of Kumar Ltd.

Answer:

Trend Percentage of Kumar Ltd (in thousands ₹)

Question 15.

From the following particulars, calculate the trend percentages of Anu Ltd.

Answer:

Trend Percentage of Anu Ltd (In Thousands)

Question 16.

From the following particulars, calculate the trend percentages of Babu Ltd.

Answer:

Trend Percentage of Babu Ltd (In Thousands)

Samacheer Kalvi 12th Accountancy Financial Statement Analysis Additional Questions and Answers

I. Choose the correct answer

Question 1.

Financial statements are meaningful and useful only when they are ……………..

(a) verified

(b) presented to owners

(c) Analysed and Interpreted

(d) Published

Answer:

(c) Analysed and Interpreted

Question 2.

Interpretation of Financial statements includes processes like ……………..

(a) Journalising

(b) Ledger writing

(c) Establishing relationship between the account data

(d) None of these

Answer:

(c) Establishing relationship between the account data

Question 3.

Trend analysis is significant for ……………..

(a) Profit planning

(b) Working capital management

(c) Capital rationing

(d) Forecasting and Budgeting

Answer:

(d) Forecasting and Budgeting

Question 4.

The three most useful general purpose financial statements for management are ……………..

(a) Income statement, Statement of Retained Earning and Balance Sheet

(b) Income statement, Balance sheet, and statement of changes in financial position

(c) Income statemen, Statement of Retained Earnings, and Funds flow statement

(d) Statement of Retained Earnings, Balance sheet and Funds flow statement

Answer:

(b) Income statement, Balance sheet, and statement of changes in financial position

Question 5.

In the case of limited company, the term financial statement includes ……………..

(a) Profit and Loss Account and Balance Sheet

(b) Profit and Loss Account, Profit and loss Appropriation Account and Balance Sheet

(c) Balance Sheet

Answer:

(b) Profit and Loss Account, Profit and loss Appropriation Account and Balance Sheet

Question 6.

The term Current Assets does not include ……………..

(a) Payments in Advance

(b) Bills Receivable

(c) Long – Term Deferred Changes

Answer:

(c) Long – Term Deferred Changes

Question 7.

The following is a recorded fact ……………..

(a) Market value of Investment

(b) Debtors

(c) Replacement cost of machinery

Answer:

(b) Debtors

Question 8.

The term Fixed Assets includes ……………..

(a) Stock – in – Trade

(b) Furniture

(c) Payments in Advance

Answer:

(b) Furniture

II. Fill in the blanks

Question 9.

The two statements which are generally included in the definition of financial statements are ……………..

Answer:

Income statement and Balance sheet.

Question 10.

Income statement …………….. the revenues and costs incurred in the process of earning revenues.

Answer:

Matches.

Question 11.

Balance Sheet is a statement of …………….. of a business at a specific moment of time.

Answer:

Financial position.

Question 12.

Assets and liabilities in a Balance sheet may be arranged either according …………….. order or …………….. order.

Answer:

Liquidity, permanency.

Question 13.

Financial statements disclose only …………….. facts.

Answer:

Monetary.

Question 14.

Profit and loss account also called as …………….. statement.

Answer:

Income.

Question 15.

Rearrangement of figures is necessary for …………….. and ………………

Answer:

Analysis, Interpretation.

Question 16.

Analysis of Financial Statements is meant for deriving additional information for various …………….. parties.

Answer:

interested.

III. True or False

Question 17.

Financial statement analysis is carried out as per Government regulation.

Answer:

False.

Question 18.

Financial statement analysis is performed with the help of various techniques and tools.

Answer:

True.

Question 19.

Common – size statements is a technique used in Financial statement analysis.

Answer:

True.

IV. Short answer questions

Question 1.

What are the features of financial statements?

Answer:

- Financial statements are generally prepared at the end of an accouning period based on transactions recorded in the books of accounts.

- These statements are prepared for the organisation as a whole.

- Information is presented in a meaningful way by grouping items of similar nature such as fixed assets and current assets.

- Financial statements are prepared based on historical cost.

- Financial statements are prepared based on accounting principles and Accounting standards, which make financial statements comparable and realistic.

- Financial statements involve personal judgement in certain cases. For example, selection of method of depreciation and percentage of reserves, etc.

Question 2.

Explain the significance of financial statements.

Answer:

- To Management: Financial statements provide information to the management to take decision and to have control over business activities, in various areas.

- To Shareholders: Financial statements help the shareholders to know whether the business has potential for growth and to decide to continue their share holding.

- To potential investors: Financial statements help to value the securities and compare it with those of other business concerns before making their investment decisions.

- To Creditors: Creditors can get information about the ability of the business to repay the debts from financial statements.

- To Bankers: Information given in the financial statements is significant to the bankers to assess whether there is a adequate security to cover the amount of the loan or overdraft.

- To Government: Financial statements are significant to government to assess the tax liability of business concerns and to frame and amend industrial policies.

- To Employees: Through the financial statements, the employees can assess the ability of the business to pay salaries and whether they have future growth in the concern.

Question 3.

Explain the objectives of financial statement analysis.

Answer:

- To analyse the profitability and earing capacity.

- To study the long term and short term solvency of the business.

- To determine the efficiency in operations and use of assets.

- To determine the efficiency of the management and employees.

- To determine the trend in sales and production, etc.

- To forecast for future and prepare budgets.

- To make inter – firm and intra – firm comparisons.

V. Exercise

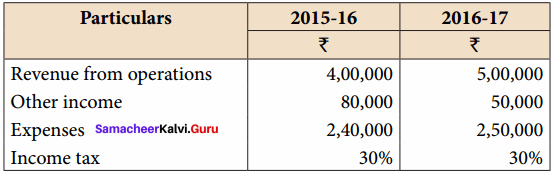

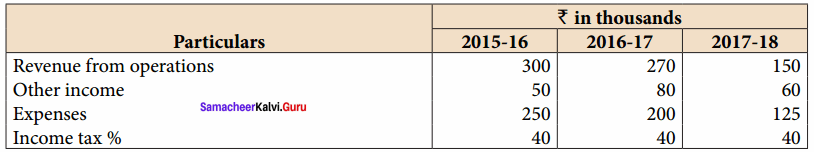

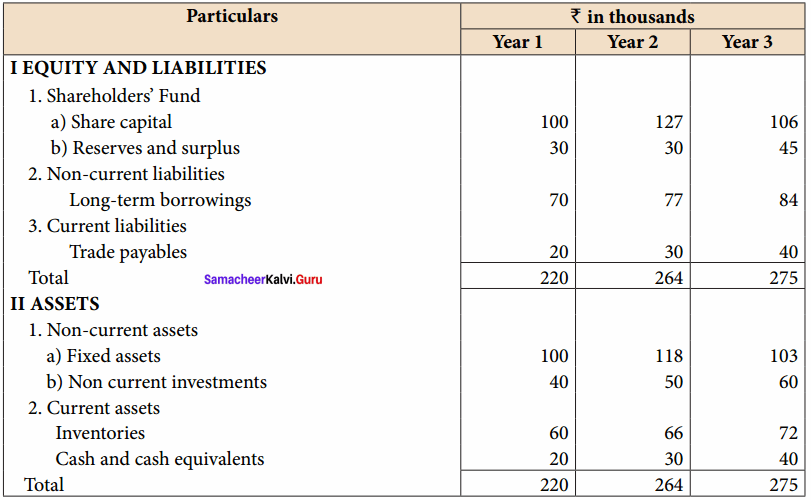

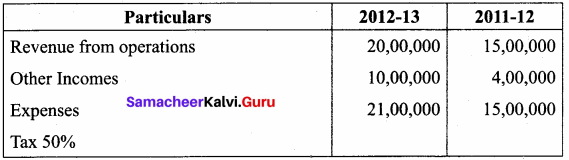

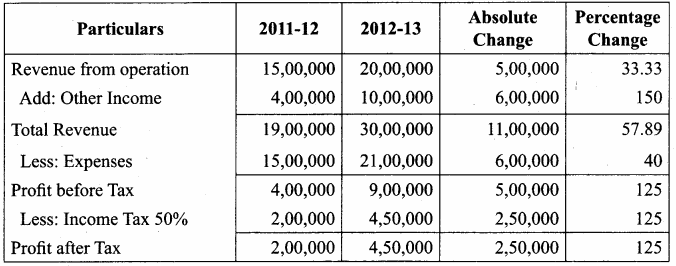

Question 1.

From the following prepare “Comparative Statement of Proft and Loss” of Good Service Ltd.

Answer:

Comparative Statement of Profit and Loss for the years ended 31st March 2012 and 2013

Question 2.

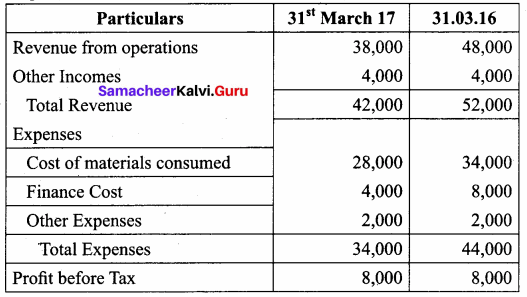

Prepare Common – size statement of Genius Paper work Ltd.

Answer:

Common – size Income Statement for the year ended 31st March 2016 and 2017

Question 3.

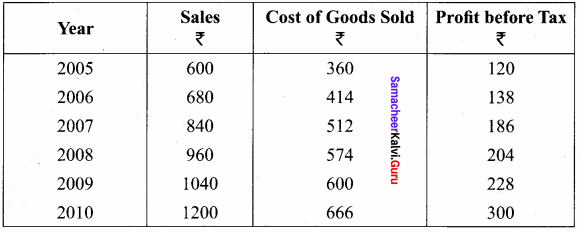

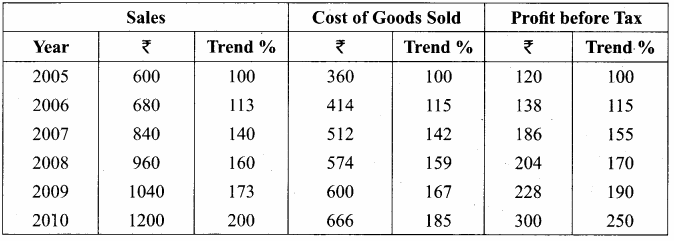

From the following figures compute trend percentage using 2005 as the base year.

Answer:

Question 4.

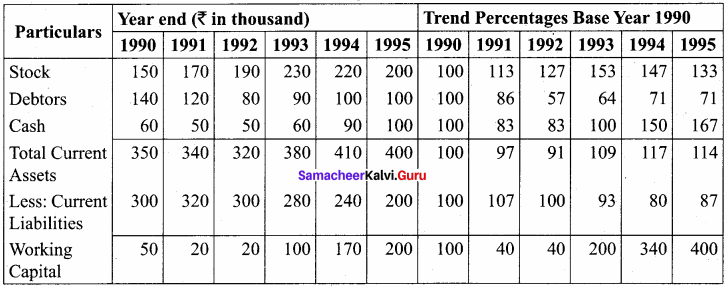

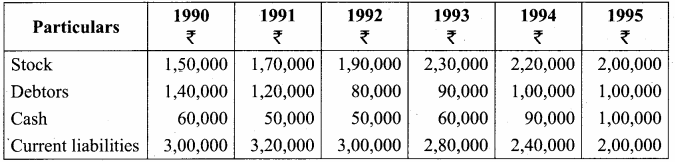

From the following balance sheet extracts, compute trend percentage and comment on the liquidity positon of X ltd. You may take 1990 as base year.

Answer:

Statement showing Trend Percentages