Students can Download Accountancy Chapter 10 Computerised Accounting System-Tally Questions and Answers, Notes Pdf, Samacheer Kalvi 12th Accountancy Book Solutions Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Accountancy Solutions Chapter 10 Computerised Accounting System-Tally

Samacheer Kalvi 12th Accountancy Computerised Accounting System-Tally Text Book Back Questions and Answers

I. Choose the Correct Answer

Question 1.

Accounting report prepared according to the requirements of the user is ……………..

Answer:

(a) Routine accounting report

(b) Special purpose report

(c) Trial balance

(d) Balance sheet

Answer:

(b) Special purpose report

Question 2.

Function key F11 is used for ……………..

(a) Company Features

(b) Accounting vouchers

(c) Company Configuration

(d) None of these

Answer:

(a) Company Features

![]()

Question 3.

Which submenu displays groups, ledgers and voucher types in Tally?

(a) Inventory vouchers

(b) Accounting vouchers

(c) Company Info

(d) Account Info

Answer:

(d) Account Info

Question 4.

What are the predefined Ledger(s) in Tally?

(i) Cash

(ii) Profit and Loss A/c

(iii) Capital A/c

(a) Only (i)

(b) Only (ii)

(c) Both (i) and (ii)

(d) Both (ii) and (iii)

Answer:

(c) Both (i) and (ii)

Question 5.

Contra voucher is used for ……………..

(a) Master entry

(b) Withdrawal of cash from bank for office use

(c) Reports

(d) Credit purchase of assets

Answer:

(b) Withdrawal of cash from bank for office use

Question 6.

Which is not the default group in Tally?

(a) Suspense account

(b) Outstanding expense

(c) Sales account

(d) Investments

Answer:

(b) Outstanding expense

Question 7.

Salary account comes under which of the following head?

(a) Direct Incomes

(b) Direct Expenses

(c) Indirect Incomes

(d) Indirect Expenses

Answer:

(d) Indirect Expenses

Question 8.

₹ 25,000 withdrawn from bank for office use. In which voucher type, this transaction will be recorded ……………..

(a) Contra Voucher

(b) Receipt Voucher

(c) Payment Voucher

(d) Sales Voucher

Answer:

(a) Contra Voucher

Question 9.

In which voucher type credit purchase of furniture is recorded in Tally ……………..

(a) Receipt voucher

(b) Journal voucher

(c) Purchase voucher

(d) Payment voucher

Answer:

(b) Journal voucher

![]()

Question 10.

Which of the following options is used to view Trial Balance from Gateway of Tally?

(a) Gateway of Tally -> Reports -> Trial Balance

(b) Gateway of Tally -> Trial Balance

(c) Gateway of Tally -> Reports -> Display -> Trial Balance

(d) None of these

Answer:

(c) Gateway of Tally -> Reports -> Display -> Trial Balance

II. Very Short Answer Questions

Question 1.

What is automated accounting system?

Answer:

Automated accounting is an approach to maintain up-to-date accounting records with the aid of accounting software.

Question 2.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

Question 3.

State any five accounting reports.

Answer:

- Day books/Joumal

- Ledger

- Trial Balance

- Income statement

- Balance sheet

![]()

Question 4.

What is Accounting Information system (AIS)?

Answer:

Accounting Information (AIS) system is one of the system in MIS. It collects financial data (AIS) processes them and provides information to the various users.

Question 5.

What is a group in Tally. ERP9?

Answer:

Group is a collection of ledgers of the same nature. There are predefined groups of accounts which are widely used in accounts of many organisation. Groups are categorised as primary groups and sub – groups.

III. Short Answer Questions

Question 1.

Write a brief note on accounting vouchers?

Answer:

Following are some of the major accounting vouchers in an organisation:

- Receipt Voucher

- Payment Voucher

- Contra Voucher

- Purchase Voucher

- Sales Voucher

- Journal Voucher

Question 2.

What are the pre – defined ledgers available in Tally.ERP9?

Answer:

Tally has two pre – defined ledgers, cash and profit and loss A/c. The user has to create various other ledgers based on their requirements. Predefined group/ledger cannot be deleted.

Question 3.

Mention the commonly used voucher types in Tally.ERP9?

Answer:

Voucher is a document which contains details of transaction. Transactions are to be recorded through voucher entries. Tally has a set of predefined vouchers such as purchase, sales, payment, receipt and contra. To view the list of voucher type Gateway of Tally > Masters > Accounts Info > Voucher Types > Display

As per the requirement of users, additional voucher type can be created.

![]()

Question 4.

Explain how to view profit and loss statement in Tally.ERP9?

Answer:

To view profit and loss account in Tally ERP9.

F10: A/c Reports > Profit and Loss A/c > Alt FI (detailed)

or

Gateway of Tally > Reports > Profit and Loss A/c > Alt FI (detailed)

Question 5.

Explain any five applications of computerised accounting system (CAS).

Answer:

The applications of CAS are as follows

- Maintaining accounting records

- Inventory management

- Pay – roll preparation

- Report generation

- Data Import/Export

- Taxation

IV. Exercises

Question 1.

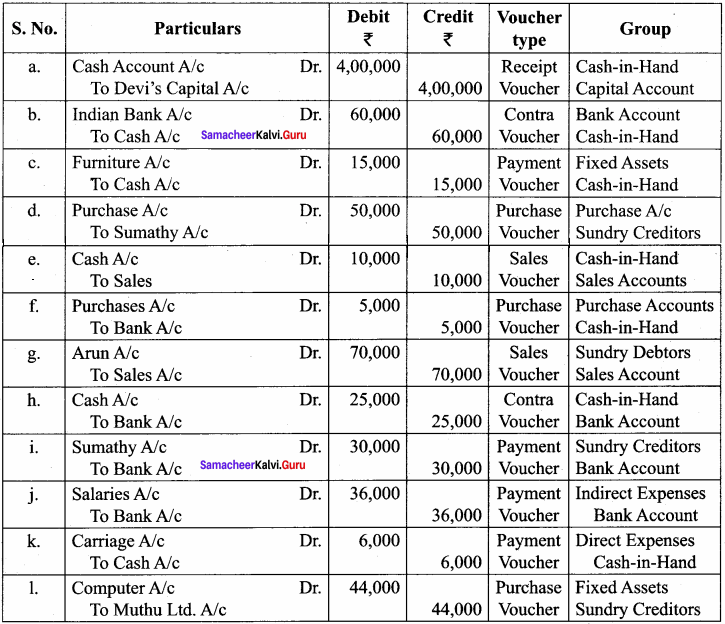

Record the following transactions in Tally.

(a) Devi commenced a business with a capital of ₹ 4,00,000

(b) An account was opened with Indian Bank and deposited ₹ 60,000

(c) Purchased furniture by paying cash ₹ 15,000

(d) Goods purchased on credit from Sumathy for ₹ 50,000

(e) Cash sales made for ₹ 10,000

(f) Goods purchased from Raja for ₹ 5,000 and paid by cheque

(g) Goods sold to Aran on credit for ₹ 70,000

(h) Money withdrawn from bank for office use ₹ 25,000

(i) Part payment of ₹ 30,000 made to Sumathy by cheque

(j) Aran made part payment of ₹ 10,000 by cash

(k) Salaries paid to staff through ECS ₹ 36,000

(l) Carriage on purchases of ₹ 6,000 paid by cash

(m) Purchased computer from Muthu Ltd. on credit ₹ 44,000

Analysis of Transactions, Passing Journal entries. Identification of Voucher type and group.

Solution:

1. Following Steps are to be followed to enter the transactions in Tally ERP9,

1. To Create Company:

Company Info > Create Company

Type the Name as Devi and keep all other fields as they are and choose. “Yes” to accept

2. To maintain accounts only:

Gateway of Tally > Fll Accounting Features > General > Maintain Accounts only: Yes > Accept Yes

3. To Create Ledger Accounts:

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Create

(i) To Create Devi’s Capital A/c

Name: Devi’s Capital A/c

Under: Capital Account Accept: Yes

(ii) To Create Indian Bank A/c

Name: Indian Bank A/c Under: Bank Accounts Accept: Yes

(iii) To Create Furniture A/c

Name: Furniture A/c Under: Fixed Assets Accept: Yes

(iv) To Create Purchases A/c

Name: Purchases A/c Under: Purchase Accept: Yes

(v) To Create Sumathy A/c Name: Sumathy A/c Under: Sundry Creditors Accept: Yes

(vi) To Create Sales A/c Name: Sales A/c Under: Sales Account Accept: Yes

(vii) To Create Aran A/c Name: Aran A/c Under: Debtors A/c Accept: Yes

(viii) To Create Salaries A/c Name: Salaries A/c Under: Indirect Expenses Accept: Yes

(ix) To Create Carriage A/c Name: Carriage A/c Under: Direct Expenses Accept: Yes

(x) To Create Computer A/c Name: Computer A/c Under: Assets A/c Accept: Yes

(xi) To Create Muthu Ltd A/c Name: Muthu Ltd A/c Under: Sundry Creditors Accept: Yes

4. To enter transactions through vouchers

Gateway of Tally > Transaction > Accounting vouchers

(i) Devi commenced a business with a capital of Rs.4,00,000

F6: Receipt Voucher Accounts: Cash

Particulars: Devi’s Capital A/c (Choose from List of Ledger Accounts)

Enter the Amount of Capital of Rs. 4,00,000

Narration: Capital introduced. Accept: Yes

(ii) An Account was opened with Indian Bank and deposited Rs. 60,000

F4: Contra Voucher Accounts: Indian Bank

Particulars: Cash Amount: Rs. 30,000

Narration: Opened Bank Account in Indian Bank Accept: Yes

(iii) Purchased furniture by paying cash Rs. 15,000

F5: Payment Voucher Account: Cash

Particulars: Furniture A/c Amount: Rs. 15,000 Narration: Furniture bought by cash Accept: Yes

(iv) Goods purchased on credit from Sumathy for Rs. 50,000

F9: Purchase Voucher Party’ A/c, Name: Sumathy A/c

Particulars: Purchase A/c Amount: Rs. 50,000

Narration: Goods purchased on credit from Sumathy Accept: Yes

(v) Cash Sales made forRs. 10,000

F8: Sales Voucher Account: Cash

Particulars: Sales A/c Amount: Rs. 10,000

Narration: Cash Sales made Accept: Yes

(vi) Goods purchased from Raja Rs. 5,000 and paid by Cheque

F9: Purchase Voucher Account: Bank

Particulars: Purchase A/c Amount: Rs. 5,000

Narration: (Bank) Purchase by cheque

(vii) Goods sold to Arun on credit for Rs. 70,000

F8: Sales Voucher Party A/c Name: Arun A/c Amount: Rs. 70,000

Narration: Goods sold on credit to Arun Accept: Yes (viii) Money withdrawn from bank for office use Rs. 25,000 F4: Contra Voucher Account: Cash Particulars: Indian Bank Amount: Rs. 25,000 Narration: Cash withdrawn from bank Accept: Yes

(ix) Part Payment of Rs. 30,000 to Sumathy by Cheque

F5: Payment Voucher Account: Indian Bank

Particulars: Sumathy A/c Amount: Rs. 30,000

Narration: Payment made to Sumathy by Cheque Accept: Yes

(x) Salaries paid to staff through ECS Rs. 36,000

F5: Payment Voucher Account: Indian Bank

Particulars: Salaries A/c Amount: Rs. 36,000

Narration: Salaries paid through ECS Accept: Yes

(xi) Carriage of Rs. 6,000 paid by cash

F5: Payment Voucher Account: Cash

Particulars: Carriage A/c Amount: Rs. 6,000

Narration: Carriage paid by Cash Accept: Yes

(xii) Purchase computer from Muthu Ltd. on credit Rs. 44,000

F7: Journal Voucher Particulars: Computer

Amount Rs. 44,000 To Muthu Ltd Amount: Rs. 44,000

Narration: Computer bought on credit from Muthu Ltd. Accept: Yes

5. To view reports:

(i) To view Trial Balance

Gateway of Tally > Reports > Display > Trial Balance > Alt FI (detailed)

(ii) To view Profit and Loss Account

F10: A/c Reports > Profit and Loss A/c > Alt FI (detailed) (or)

Gateway of Tally > Reports > Profit and Loss A/c Alt FI (detailed)

(iii) To view Balance Sheet

F10: A/c Reports > Balance Sheet > Alt FI (detailed) (or)

Gateway of Tally > Reports > Balance Sheet > Alt FI (detailed)

(iv) To view Ratio Analysis

F10: A/c Reports > Ratio Analysis (or)

Gateway of Tally > Reports > Ratio Analysis

(v) To view Day Book

F10: A/c Reports > Day Book> Alt FI (detailed) (or)

Gateway of Tally > Reports > Display > Day Book > Alt FI (detailed)

Question 2.

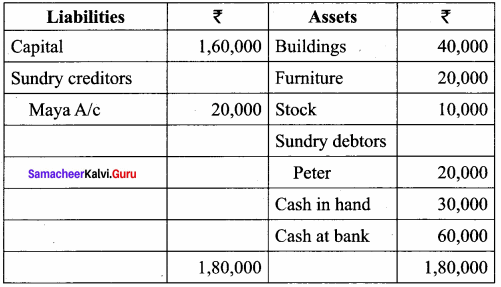

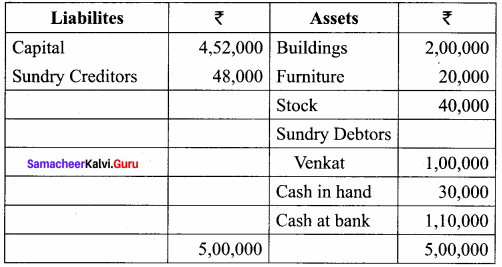

The following balance sheet has been prepared from the books of Pearl on 1 – 4 – 2018.

During the year the following transactions took place:

(a) Wages paid by cash ₹ 4,000

(b) Salaries paid by cheque ₹ 10,000

(c) Cash purchases made for ₹ 4,000

(d) Good purchased on credit from Yazhini ₹ 30,000

(e) Goods sold on credit to Jothi ₹ 40,000

(f) Payment made to Yazhini through NEFT ₹ 6,000

(g) Cash received from Peter ₹ 10,000

(h) Cash sales made for ₹ 4,000

(i) Depreciate buildings at 20%

(j) Closing stock on 31.03.2019 ₹ 9,000

You are required to prepare trading and profit and loss account for the year ended 31-03-2019 and a balance sheet as on that date using Tally.

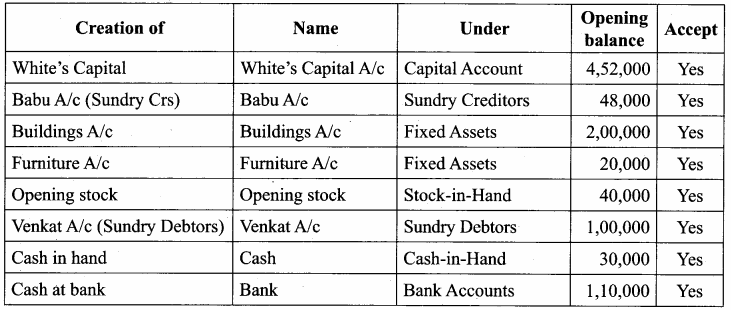

1. To Create Company Company Info > Create Company

Type the Name as Pearl and keep all other fields as they are and choose. “Yes” to accept

2. To maintain accounts only

Gateway of Tally F11 Accounting Features > General > Maintain Accounts only: Yes > Accept: Yes

3. To Create Ledger Accounts with Opening Balances

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Create

Note: Cash account need not be created as it is a default ledger. Only the opening balance has to be recorded by altering the cash account.

To record the opening balances of cash

Gateway of Tally > Masters > Accounts Info > Ledger > Single Ledger > Alter

After creating the Ledgers and recording the opening balances of ledger accounts the balance

sheet of Pearl is shown as in the following figure.

3. To Create Ledger Accounts for Transactions

4. To enter transaction through vouchers

Gateway of Tally > Transactions > Accounting Vouchers .

Example: Wages of Rs. 4,000 paid by cash

F5: Payment Voucher

Account: Cash

Particulars: Wages A/c

Amount: Rs. 4,000

Narration: Wages paid by Cash

Accept: Yes

In the similar way, recorded the other transactions. Use payment voucher for salaries paid

and payments to yazhini.

Use purchase voucher for credit sales to Jothi and Cash sales. Use Receipt voucher for cash received from Peter.

Use Journal voucher for depreciation.

5. To record closing stock:

Since maintain accounts only is set to ‘Yes’ and integrate accounts and inventory is set to ‘No’ under accounting features. Stock has to be recorded manually. Hence the closing stock has to be recorded by altering the stock account and while entering the date of closing stock, the date of opening stock has to be entered. The following procedure is to be followed: Gateway of Tally > Masters > Accounts Info > Ledger > Single Ledger > Alter > Stock > Closing Balance > Date (Opening date) > Amount > Accept: Yes

6. To view reports

(i) To view Profit and Loss Account

F10 A/c Reports > Profit and Loss A/c > Alt F1 (detailed)

(or) Gateway of Tally > Reports > Profit and Loss A/c > Alt FI (detailed)

(ii) To view Balance Sheet

F10 A/c Reports > Balance Sheet > Alt FI (detailed) (or)

Gateway of Tally > Reports > Balance Sheet > Alt FI (detailed).

Samacheer Kalvi 12th Accountancy Computerised Accounting System-Tally Additional Questions and Answers

I. Choose the correct answer

Question 1.

Tally is designed to meet the requirements of ………………

(a) All types of companies

(b) Small company

(c) Small and medium company

(d) None of the above

Answer:

(c) small and medium company

Question 2.

Gateway of Tally screen to separated into ………………

(a) Six sections

(b) Five sections

(c) Seven sections

(d) Eight sections

Answer:

(a) Six sections

![]()

Question 3.

For creating a company we use ………………

(a) Alt + F3

(b) Alt + FI

(c)Alt + F2

(d) ESC key

Answer:

(a) Alt + F3

Question 4.

For selecting a company we use ………………

(a) Alt + FI

(b) FI

(c) Ctrl + FI

(d) F2

Answer:

(b) FI

Question 5.

Groups are ………………

(a) Collection of ledgers initially

(b) type of voucher entry

(c) both of the above

(d) None of the above

Answer:

(a) collection of ledgers initially

Question 6.

The 15 primary groups are ………………

(a) 12 sub – groups

(b) 13 sub – groups

(c) 11 sub – groups

(d) 10 sub – groups

Answer:

(b) 13 sub – groups

Question 7.

Bank Accounts comes under ………………

(a) Current Assets

(b) Loans

(c) Current Liabilities

(d) Capital Account

Answer:

(a) Current Assets

Question 8.

Nature of the primary group is among one of the following ………………

(a) Assets, Liabilities, Revenue and Capital

(b) Balance Sheet and Profit and Loss Account

(c) Assets, Liabilities, Income and Expenses

(d) None of the above

Answer:

(c) Assets, Liabilities, Income and Expenses

Question 9.

When group behaviour is like sub-ledger is set to No ………………

(a) It behaves like ledger

(b) The same will display all the ledgers grouped under the same in details mode

(c) All of the above

(d) None of the above

Answer:

(b) The same will display all the ledgers grouped under the same in details mode

Question 10.

Choose the correct statement:

(a) All the transactions are recorded through voucher entry

(b) All the transactions are recorded through Journal entry

(c) All the transactions are recorded through Receipts and Payment entry

(d) All of the above

Answer:

(a) All the transactions are recorded through voucher entry

Question 11.

How to enter the Receipt voucher? Option is ………………

(a) Gateway of Tally > Accounting vouchers > F6 – Receipt

(b) Gateway of Tally > Transactions > F6 – Receipt

(c) Gateway of Tally > Transactions > Accounting vouchers > F6 – Receipt

(d) Gateway of Tally ? F6 – Receipt > Transactions

Answer:

(c) Gateway of Tally > Transactions > Accounting vouchers > F6 – Receipt

![]()

Question 12.

How to enter the contra voucher? Option is ………………

(a) Gateway of Tally > Transactions > Accounting > F4 – Contra

(b) Gateway of Tally > Accounting vouchers > F4 – Contra

(c) Gateway of Tally > Transactions > F4 – Contra

(d) None of these

Answer:

(a) Gateway of Tally > Transactions > Accounting > F4 Contra

Question 13.

How to enter the sales voucher? Option is ………………

(a) Gateway of Tally > Transaction > F8 – Sales

(b) Gateway of Tally > Transaction > Accounting voucher > F8 – Sales

(c) Gateway of Tally > Accounting vouchers > F8 – Sales

(d) None of the above

Answer:

(b) Gateway of Tally > Transaction > Accounting voucher > F8 – Sales

Question 14.

How to enter the Journal vouchers? Option is ………………

(a) Gateway of Tally > Transactions > F7 – Journal

(b) Gateway of Tally > Accounting vouchers > F7 – Journal

(c) Gateway of Tally > Accounting voucher > Transactions > F7 – Journal

(d) Gateway of Tally > Transactions > Accounting voucher > F7 – Journal

Answer:

(d) Gateway of Tally > Transactions > Accounting voucher > F7 – Journal

II. Very short answer questions

Question 1.

What are the steps involved in designing accounting reports?

Answer:

The following are the steps involved in designing accounting reports.

- Define the objectives of generating report

- Specify the structure of the report.

- Creating database queries to interact with the database to retrieve, modify, add or delete data from the records.

Question 2.

What is meant by ‘Tally ERP9”?

Answer:

A number of readymade accounting software are available off – the – shelf, i.e. ready to use such as Tally. Busy and Fact. But the most commonly and widely used accounting software is Tally. Accounting and Inventory management softwares available are fast, powerful and , multi – lingual.

![]()

Question 3.

What are the main area of Tally?

Answer:

The main area is separated into two:

- Left hand side area: It provides current period, current date and list of selected companies.

- Right hand side area: Company Information such as select a company, create a company and Back up a company.

Question 4.

What is F – 11 Company Feature contents?

Answer:

F – 11 Features menu is displayed as shown.

- Accounting Features

- Inventory Features

- Statutory Features

- Tally_NET Features

- Tax Audit Features

Question 5.

What are thePre – defined Groups in Tally.ERP – 9?

Answer:

By default Tally. ERP9 provides a list of groups called pre-defined groups. The primary group cannot be deleted. However it can be renamed which is not suggested. There are 28 Pre¬defined Groups in Tally. ERP9. Out of which 15 are primary groups and 13 are sub-groups.

Question 6.

What is meant by Hot Keys?

Answer:

Hot Keys are capitalised and are red in colour on all the menu screen. Using the Hot Keys in the company Info Screen will take you to that particular screen or display the sub – menus within that option.

III. Short answer questions

Question 1.

What are the salient features of computerised accounting system?

Answer:

- Simplicity: They are easy to set up and simple to use.

- Speed: They are capable of generations instant and accurate report.

- Power: They are capable of maintaining accounts of multiple companies and with unlimited levels of classification.

- Flexibility: They provide flexibility to generate instant reports for given period.

Question 2.

What are the advantages of computerised accounting system?

Answer:

- Speed

- Accuracy

- Reliability

- Up – to – date

- Scalability

- Ligibility

- Efficiency

- Quality Report

- MIS Report

- Automated document production

- Real – time user interface

- Storage

- Motivation and Retrieval Employees interest.

Question 3.

What are the voucher entry in accounting system Tally ERP9?

Answer:

The following are the basic voucher types considered

- Receipts: To record receipts of money by cash, cheque and basic transfer.

- Payments: To record payment of money by cash and cheque.

- Journal: To record all Non-cash transactions.

- Contra: To record transfer of funds between cash and bank accounts.

Voucher Entry Screen is divided into three parts.

- Main voucher entry

- Button Bar

- Calculator

![]()

Question 4.

How too Quitting do Tally ERP9?

Answer:

To quit working and Tally ERP9

- Press ESC until you see the message Quit?

Yes or No. Press Enter or Y or Click Yes to quit Tally ERP9. - Alternatively to exit without confirmation, Press Ctrl + Q from the Gateway of Tally

- You can also enter while the option Quit is selected from Gateway of Tally.

Question 5.

How to shut a company in Tally.ERP9?

Answer:

Go to the Gateway of Tally > Alt + F3 > Company Info > Shut company. Select the company which you need to shut down from the list of companies, you can also use Alt + FI to shut a company from the Gateway of Tally Screen.

Question 6.

How to alter the company details in Tally.ERP9?

Answer:

Go to the Gateway of Tally > Alt + F3 > Company Info > Alter. Select the Company which you need to alter from the list of companies and press Enter to view the company Alternation screen Alter the company details as required and, accept the screen.

IV. Exercise

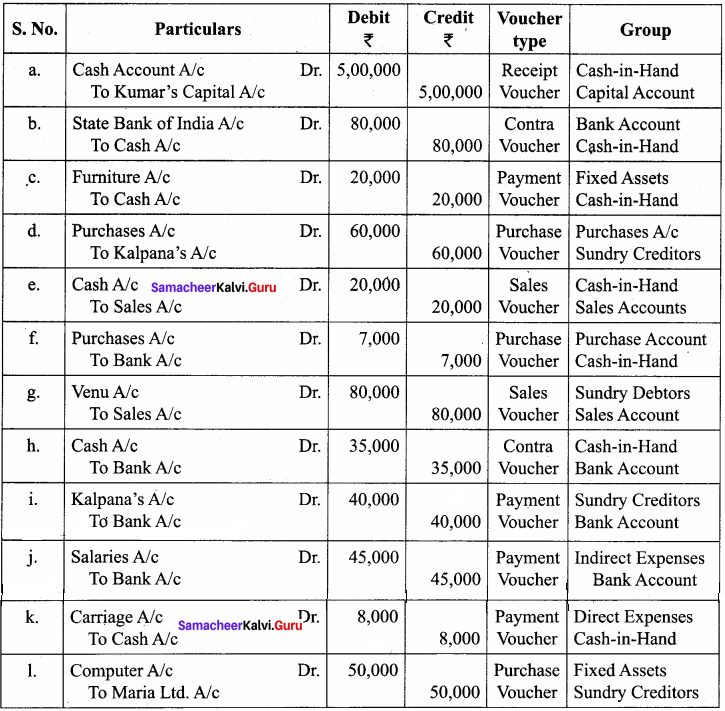

Question 1.

Record the following transactions in tally.

(a) Kumar commenced a business with a capital of Rs. 5,00,000

(b) Opened an account with SBI and deposited Rs. 80,000

(c) Purchased furniture by paying cash Rs. 20,000

(d) Goods purchased on credit from Kalpana for Rs. 60,000

(e) Cash sales for Rs. 20,000

(f) Goods purchased from Ramu for Rs. 7,000 paid by cheque

(g) Goods sold to Venu on credit for Rs. 80,000

(h) Money withdrawn from bank for office use Rs. 35,000

(i) Part payment of Rs. 40,000 made by Kalpana by cheque.

(j) Aran made part payment of Rs. 20,000 by Cash

(k) Salaries paid to staff through ECS Rs. 45,000

(l) Carriage on purchase of Rs. 8,000 paid by cash

(m) Purchased computer from Maria Ltd on Credit Rs. 50,000

Solution:

Following Steps are to be followed to enter the transactions in Tally ERP9,

1. To Create Company Company Info > Create Company

Type the Name as Kumar and keep all other fields as they are and choose. “Yes” to accept

2. To maintain accounts only

Gateway of Tally > FI 1 Accounting Features > General > Maintain Accounts only: ‘Yes’ > Accept: Yes

3. To create ledger accounts

Gateway of Tally > Masters > Accounts Info > Ledger > Single Ledger > Create

(i) To create Kumar’s Capital A/c

Name: Kumar’s Capital A/c

Under: Capital Account Accept: Yes

(ii) To create State Bank of India A/c

Name: State Bank of India A/c

Under: Bank Accounts

Accept: Yes

(iii) To create Furniture A/c

Name: Furniture A/c

Under: Fixed Assets

Accept: Yes

(iv) To create Purchases A/c

Name: Purchases A/c

Under: Purchase

Accept: Yes

(v) To create Kalpana A/c

Name: Kalpana

Under: Sundry Creditors

Accept: Yes

(vi) To create Sales A/c

Name: Sales A/c

Under: Sales Account

Accept: Yes

(vii) To create Venu A/c

Name: Venu A/c

Under: Sundry Debtors A/c

Accept: Yes

(viii) To create Salaries A/c

Name: Salaries A/c

Under: Indirect Expenses

Accept: Yes

(ix) To create Carriage A/c

Name: Carriage A/c

Under: Direct Expenses

Accept: Yes

(x) To create Computer A/c

Name: Computer A/c

Under: Assets

Accept: Yes

(xi) To create Maria Ltd A/c

Name: Maria Ltd A/c

Under: Sundry Creditors

Accept: Yes

4. To enter transactions through vouchers

Gateway of Tally > Transactions > Accounting vouchers

(i) Kumar commenced a business with a capital Rs. 5,00,000

F6: Receipt Voucher Account: Cash

Particulars: Kumar’s Capital A/c

(Choose from the List of Ledger Accounts)

Enter the amount of capital: Rs. 5,00,000

Narration: Capital introduced Accept: Yes

(ii) An Account was opened with State Bank of India and deposited Rs. 80,000

F4: Contra Voucher Account: State Bank of India

Particulars: Cash Amount: Rs. 80,000

Narration: Opened Bank Account in SBI

Accept: Yes

(iii) Purchased furniture by paying cash Rs. 20,000

F5: Payment Voucher Account: Cash

Particulars: Furniture A/c

Amount: Rs. 20,000

Narration: Furniture bought by cash

Accept: Yes

(iv) Goods purchased on credit from Kalpana Rs. 60,000

F9: Purchase Voucher Party A/c Name: Kalpana A/c

Particulars: Purchases A/c Amount: Rs. 60,000

Narration: Goods purchased on credit from Kalpana Accept: Yes

(v) Cash Sales made for Rs. 20,000

F8: Sales Voucher Account: Cash

Particulars: Sales A/c Amount: Rs. 20,000

Narration: Cash Sales made Accept: Yes

(vi) Goods purchased from Arun for Rs. 7,000 and money deposited in CDM.

F9: Purchase Voucher Account: Cash

Particulars: Purchase A/c Amount: Rs. 7,000

Narration: Cash Purchases made Accept: Yes

(vii) Goods sold to Venu on credit for Rs. 80,000

F8: Sales Voucher Party A/c Name: Venu A/c

Particulars: Sales A/c Amount: Rs. 80,000

Narration: Goods sold on credit to Venu Accept: Yes

(viii) Money withdrawn from bank for office use Rs. 35,000

F4: Contra Voucher Account: Cash

Particulars: State Bank of India A/c Amount: Rs. 35,000

Narration: Cash withdrawn from bank Accept: Yes

(ix) Part Payment of Rs. 40,000 made to Kalpana by Cheque

F5: Payment Voucher Account: State Bank of India

Particulars: Kalpana Amount: Rs. 40,000

Narration: Payment made to Kalpana by Cheque Accept: Yes

(x) Salaries paid to staff through ECS Rs. 45,000

F5: Payment Voucher Account: State Bank of India

Particulars: Salaries A/c Amount: Rs. 45,000

Narration: Salaries paid through ECS Accept: Yes

(xi) Carriage of Rs. 8,000 paid by cash

F5: Payment Voucher Account: Cash

Particulars: Carriage A/c Amount : Rs. 8,000

Narration: Carriage paid by Cash Accept: Yes

(xii) Purchases computer from Maria Ltd. on credit Rs. 50,000

F7: Journal Voucher

Particulars: Computer

Amount: Rs. 50,000 To Maria Ltd. Amount: Rs. 50,000

Narration: Computer bought on credit from Maria Ltd. Accept: Yes

5. To view reports

(i) To view Trial Balance

Gateway of Tally > Reports > Display > Trial Balance > Alt FI (detailed)

(ii) To view Profit and Loss Account

F10: A/c Reports > Profit and Loss A/c > Alt FI (detailed) or

Gateway of Tally > Reports > Profit and Loss A/c and Alt FI (detailed)

(iii) To view Balance Sheet

F10: A/c Reports > Balance Sheet > Alt FI (detailed) (or)

Gateway of Tally > Reports > Balance Sheet > Alt FI (detailed)

(iv) To view Ratio Analysis

F10: A/c Reports > Ratio Analysis (or)

Gateway of Tally > Reports > Ratio Analysis

(v) To view Day Book

F10: A/c Reports > Day Book> Alt FI (detailed) (or)

Gateway of Tally > Reports > Display > Day Book > Alt FI (detailed)

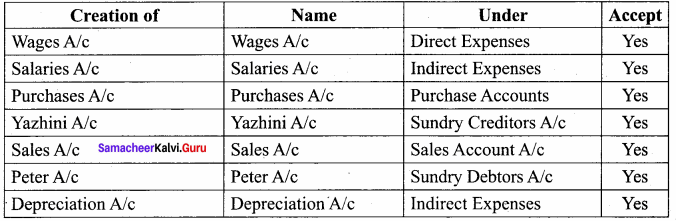

Question 2.

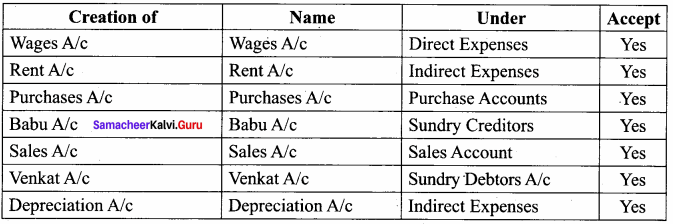

The following balance sheet has been prepared from the books of white on 1.4.2018

During the year the following transactions took place:

(a) Wages paid by cash ₹ 4,000

(b) Rent paid by cheque ₹ 10,000

(c) Cash purchases made for ₹ 6,000

(d) Good purchased on credit from Mathi ₹ 30,000

(e) Goods sold on credit to Kala ₹ 50,000

(f) Payment made to Mathi by cheque ₹ 10,000

(g) Cash received from Venkat ₹ 60,000

(h) Cash sales made for ₹ 12,000

(i) Depreciate Buildings @ 10%

(j) Closing stock on 31.03.2019 ₹ 30,000

You are required to prepare trading and profit and loss account for the year ended 31-03-2019 and a balance sheet as on that date using Tally.

Solution:

Following steps are to be followed to enter the transactions in Tally ERP9.

1. To Create Company Company Info > Create Company

Type the Name as White and keep all other fields as they are and choose. ‘Yes’ to accept

2. To maintain accounts only

Gateway of Tally > F11 Accounting Features > General > Maintain Accounts only: Yes > Accept: Yes

3. To create ledger accounts with opening balances

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Create

Note: Cash account need not be created as it is a default ledger. Only the opening balance has to be recorded by altering the cash account.

To record the opening balance of cash:

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Alter

After creating the ledgers and recording the opening balances of ledger accounts the balance

sheet of White is shown as in the following figure.

3. To create ledger accounts for transactions

4. To enter transactions through vouchers

Gateway of Tally > Transactions > Accounting Vouchers

Example: Wages of Rs. 4,000 paid by cash

F5: Payment Voucher

Account: Cash

Particulars: Wages A/c

Amount: Rs. 4,000

Narration: Wages paid by Cash

Accept: Yes

In the similar way, record the other transactions. Use payment voucher for rent paid and payments to Babu.

Use purchase voucher for credit purchase from Babu and Cash purchases.

Use Sales voucher for credit sales to Venkat and Cash sales Use Receipt voucher for cash received from Venkat Use Journal voucher for depreciation.

5. To record closing stock:

Since maintain accounts only is set to “Yes” and integrate accounts and inventory is set to ‘No’ under accounting features. Stock has to be recorded manually. Hence, the closing stock has to be recorded by altering the stock account and while entering the date of closing stock, the date of opening stock has to be entered. The following procedure is to be followed: Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Alter > Stock > Closing Balance > Date (Opening date) > Amount > Accept: Yes

6. To view reports:

(i) To view Profit and Loss Account

F10: A/c Reports > Profit and Loss A/c > Alt FI (detailed)

(or)

Gateway of Tally > Reports > Profit and Loss A/c > Alt FI (detailed)

(ii) To view Balance Sheet

F10: A/c Reports > Balance Sheet > Alt FI (detailed)

(or)

Gateway of Tally > Reports > Balance Sheet > Alt F