Tamilnadu Samacheer Kalvi 11th Chemistry Notes Chapter 1 Basic Concepts of Chemistry and Chemical Calculations Notes

Chemistry – Chemistry is the science which deals with all kinds of matter occurring on this Earth and in the outside universe.

Importance of Chemistry – Chemistry is the centre of life. It finds numerous applications in everyday life and it is indispensible for modem civilization.

Matter – It is anything which has mass and occupies space.

Physical classification of matter – They are solids, liquids and gases.

Chemical classification of matter – (i) Pure substances such as elements and compounds (ii) mixture such as homogenous and heterogeneous (iii) Inorganic compounds and organic compounds.

Plasma state – Gaseous state of matter at very high temperature containing gaseous ions and free electron is referred to as the Plasma state.

Atom – An atom is the ultimate smallest electrically neutral, being made up of fundamental

particles such as proton, neutron and electron.

Element – An element consists of only one type of atoms.

Classifications of elements – metals, non-metals and metalloids.

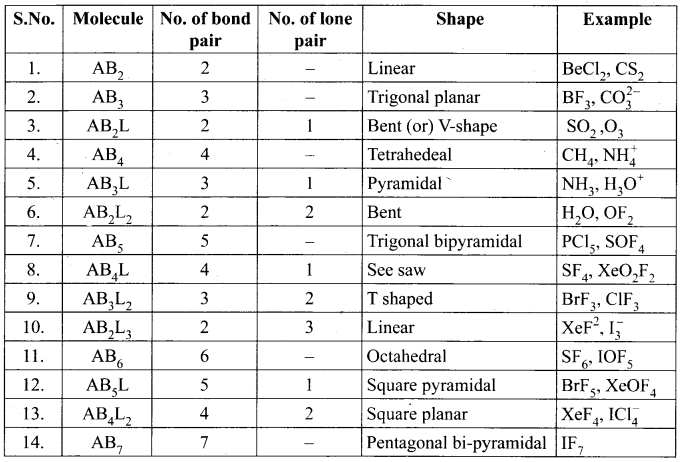

Molecule – It is the smallest particle made up of one or more than one atom in a definite ratio having stable and independent existence.

Classification of molecule – (i) monoatomic molecule (Sodium and Copper) (ii) diatomic (H2 and Cl2) and (iii) polyatomic (O3, P4 and S8).

Compound – A molecule which contains two or more atoms of different elements are called a compound molecule, e.g. H20 (Water) and C02 (Carbon dioxide).

Atomic mass – It is the mass of an atom of an element expressed as a number relative to the mass of one atom of hydrogen or oxygen or carbon.

amu – One atomic mass unit is equal to l/12th of the mass of an atom of C-12 isotope.

1amu= 1.66056 x 10-24 gram.

Molecular mass – Molecular mass of a substance represents the number of times the molecule of that substance is heavier than 1/12th of the mass of an atom of C-12 isotope.

Molecular mass = 2 x Vapour density

Formula mass – The sum of the atomic masses of all the atoms in a formula unit of a substance is called formula mass.

Mole Concept – The mole is defined as the amount of a substance which contains 6.023 x 1023 particles such as atoms, molecules or ions. Mole is represented by the letter “n”. Avogadro’s hypothesis – ‘Equal volume of all gases under the same conditions of temperature and pressure contain the same number of molecules’.

Avogadro number (N) – It is the number of atoms present in one mole of an element or number of molecules present in one mole of a compound. The value of Avogadro number (N) = 6.023 x 1023.

Molar mass – The mass of one mole of any substance in gram is called molar mass.

Molar volume – : It is the volume occupied by one mole of a substance in the gaseous state at STP. It is equal to 2.24 x 10-2m3 (22.4 L).

Equivalent mass – The equivalent mass of an element is defined as the number of parts of the acid which contains one 1.008 part by mass of replaceable hydron atom

Equivalent mass = \(\frac{\text { Molar mass of the acid }}{\text { Basicity }}\)

Equivalent mass – The equivalent mass of an element is defined as the number of parts of the mass of an element which combines with or displaces 1.008 parts of hydrogen or 8 parts of oxygen or 35.5 parts of chlorine.

\(\frac{\text { Atomic mass }}{\text { Valency }}\)

Equivalent mass of acid – It is defined as the number of parts by mass of the acid which contains 1.008 part by mass of replaceable hydrogen atom.

Equivalent mass of an acid = \(\frac{\text { Molar mass of the acid }}{\text { Basicity }}\)

Basicity – It is the number of replaceable hydrogen atoms present in a molecule of the acid.

Equivalent mass of a base – It is defined as the number of parts by mass of the base which contains one replaceable hydroxyl ion.

Equivalent mass ot a base = \(\)\frac{\text { Molar mass of the base }}{\text { Acidity }}\(\)

Acidity – It is the number of hydroxyl ions present in one mole of a base.

Equivalent mass of a salt – It is defined as the number of parts by mass of the salt that is produced by the neutralization of one equivalent of an acid by a base.

Equivalent mass of the salt = Molar mass of the salt

Equivalent mass of an oxidizing agent – It is defined as the number of parts by mass which can furnish 8 parts by mass of oxygen for oxidation.

Equivalent mass of a reducing agent – It is defined as the number of parts by mass of the reducing agent which is completely oxidised by 8 parts by mass of oxygen.

Empirical formula – It shows the ratio of number of atoms of different elements in one molecule of the compound.

Molecular formula – It shows the actual number of different types of atoms present in one molecule of the compound. Molecular formula = (Empirical formula)n

Stoichiometry equation – It is a short scientific representation of a chemical reaction.

Limiting reagents – The reactant used up first in a reaction is called the limiting reagent.

Oxidation reaction – It is a process of adding of oxygen or removal of hydrogen.

Reduction reaction – It is a process of removal of oxygen or addition of hydrogen.

Electronic concept of oxidation and reduction – The reaction that involves loss of electrons is called an oxidation reaction and reaction that involves gain of electrons is called a reduction reaction.

OIL – Oxidation Is Loss of electrons.

RIG – Reduction Is Gain of electrons.

Oxidation number – It refers to the number of charges an atom would have in a molecule or an ionic compound if electrons were transferred completely.

Types of redox reactions – (i) Combination reactions (ii) Decomposition reactions (iii) Displacement reactions (iv) Disproportionation reactions (v) Competitive Electron transfer reactions.

Combination reactions – When two or more substances combine to form a single substance, the reactions are called combination reactions.

A + B → C

Decomposition reactions – The reaction in which a compound splits up into two or more simpler substances are called decomposition reaction.

AB → A + B

Displacement reactions – The reactions in which one ion or atom in a compound is replaced by an ion or atom of the other element are called displacement reactions.

AB + C → AC + B

Disproportionation reactions – The reactions in which an element undergoes simultaneously both oxidation and reduction are called as disproportionation reactions.

Competitive electron transfer reactions – These are the reactions in which redox reactions take place in different vessels and it is an indirect redox reaction. In this reaction, there is a competition for the release of electrons among different metals take place.

Methods of balancing of redox reactions – (i) Oxidation number method (ii) Ion-electron method.

Samacheer Kalvi 11th Chemistry Notes

Read More: