Immediately get Chapter Wise Tamilnadu State Board Solutions for 11th Economics to gain more marks and start Quick Revision of all Chapters. All Chapters Pdf is provided along with the Questions and Answers. You Can Dowload Samacheer Kalvi 11th Economics Book Solutions Questions and Answers for Chapter wise are given with a clear explanation. Tamilnadu State Board Solutions for 11th Economics Chapter 5 Market Structure and Pricing Questions and Answers is for free of cost.

Tamilnadu Samacheer Kalvi 11th Economics Solutions Chapter 5 Market Structure and Pricing

Tamilnadu State Board Solutions for 11th Economics Chapter 5 Market Structure and Pricing Questions and Answers PDF has all given in Chapter Wise Section. Check Out daily basis with Tamilnadu State Board Solutions 11th Economics PDF will help to improve your score. Improve your level of accuracy to answer a question by reading with Samacheer Kalvi 11th Economics Book Solutions Questions and Answers PDF.

Samacheer Kalvi 11th Economics Market Structure and Pricing Text Book Back Questions and Answers

Part – A

11th Economics Chapter 5 Book Back Answers Multiple Choice Questions

Economics Class 11 Chapter 5 Question 1.

In which of the following is not a type of market structure Price will be very high?

(a) Perfect competition

(b) Monopoly

(c) Duopoly

(d) Oligopoly

Answer:

(a) Perfect competition

Samacheer Kalvi Guru 11 Economics Question 2.

Equilibrium condition of a firm is …………………….

(a) MC = MR

(b) MC > MR

(c) MC < MR

(d) MR = Price

Answer:

(a) MC = MR

Class 11 Economics Chapter 5 Solutions Question 3.

Which of the following is a feature of monopolistic competition?

(a) One seller

(b) Few sellers

(c) Product differentiation

(d) No entry

Answer:

(c) Product differentiation

11th Economics Chapter 5 Exercise Question 4.

A firm under monopoly can earn ………………… in the short run.

(a) Normal profit

(b) Loss

(c) Supernormal profit

(d) More loss

Answer:

(c) Supernormal profit

Economics Chapter 5 Class 11 Question 5.

There is no excess capacity under ______

(a) Monopoly

(b) Monopolistic competition

(c) Oligopoly

(d) Perfect competition

Answer:

(d) Perfect competition

Economics Class 11 Question 6.

Profit of a firm is obtained when ……………………

(a) TR < TC (b) TR – MC (c) TR > TC

(d) TR = TC

Answer:

(c) TR > TC

Samacheer Kalvi Guru 11th Economics Question 7.

Another name of price is ______

(a) Average Revenue

(b) Marginal Revenue

(c) Total Revenue

(d) Average Cost

Answer:

(a) Average Revenue

11th Economics Book Price Question 8.

In which type of market, AR and MR are equal ………………………

(a) Duopoly

(b) Perfect competition

(c) Monopolistic competition

(d) Oligopoly

Answer:

(b) Perfect competition

Chapter 5 Economics Class 11 Question 9.

In monopoly, MR curve lies below ______

(a) TR

(b) MC

(c) AR

(d) AC

Answer:

(c) AR

Question 10.

Perfect competition assumes ……………………..

(a) Luxury goods

(b) Producer goods

(c) Differentiated goods

(d) Homogeneous goods

Answer:

(d) Homogeneous goods

Question 11.

Group equilibrium is analysed in ______

(a) Monopolistic competition

(b) Monopoly

(c) Duopoly

(d) Pure competition

Answer:

(a) Monopolistic competition

Question 12.

In monopolistic competition, the essential feature is …………………….

(a) Same product

(b) Selling cost

(c) Single seller

(d) Single buyer

Answer:

(b) Selling cost

Question 13.

Monopolistic competition is a form of ______

(a) Oligopoly

(b) Duopoly

(c) Imperfect competition

(d) Monopoly

Answer:

(c) Imperfect competition

Question 14.

Price leadership is the attribute of ………………………

(a) Perfect competition

(b) Monopoly

(c) Oligopoly

(d) Monopolistic competition

Answer:

(c) Oligopoly

Question 15.

Price discrimination will always lead to ______

(a) Increase in output

(b) Increase in profit

(c) Different prices

(d) b and c

Answer:

(d) b and c

Question 16.

The average revenue curve under monopolistic competition will be …………………….

(a) Perfectly inelastic

(b) Perfectly elastic

(c) Relatively elastic

(d) Unitary elastic

Answer:

(c) Relatively elastic

Question 17.

Under perfect competition, the shape of demand curve of a firm is ______

(a) Vertical

(b) Horizontal

(c) Negatively sloped

(d) Positively sloped

Answer:

(b) Horizontal

Question 18.

In which market form, does absence of competition prevail?

(a) Perfect competition

(b) Monopoly

(c) Duopoly

(d) Oligopoly

Answer:

(b) Monopoly

Question 19.

Which of the following involves maximum exploitation of consumers?

(a) Perfect competition

(b) Monopoly

(c) Monopolistic competition

(d) Oligopoly

Answer:

(b) Monopoly

Question 20.

An example of selling cost is ………………………

(a) Raw material cost

(b) Transport cost

(c) Advertisement cost

(d) Purchasing cost

Answer:

(c) Advertisement cost

Part – B

Answer the following questions in one or two sentences

Question 21.

Define Market.

Answer:

In economics, the term ‘Market’ refers to a system of exchange between the buyers and the sellers of a commodity. Exchange may be direct or indirect.

Question 22.

Who is price – taker?

Answer:

A large number of buyers’ implies that each individual buyer buys a very, very small quantum of a product as compared to that found in the market. This means that he has no power to fix the price of the product. He is only a price taker and not a price-maker.

Question 23.

Point out the essential features of pure competition.

Answer:

- The absence of any monopoly element.

- There is a large buyers and sellers.

- Homogenous product and uniform price.

- Free entry and exit.

Question 24.

What is selling costs?

Answer:

- Selling Cost is the discussion of “ Product differentiation”.

- We can infer that the producer under monopolistic competition has to incur expenses to popularize his brand.

- This involved in selling the product is called selling cost.

- According to Prof. Chamberlin, selling cost is “ The cost incurred in order to alter the position or shape of the demand curve for a product”.

Question 25.

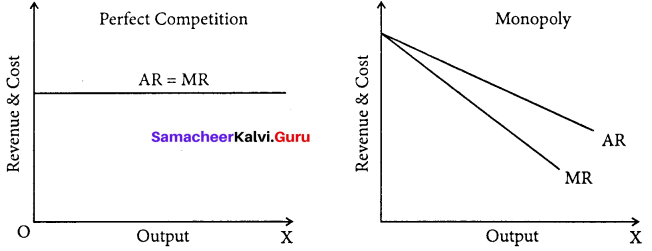

Draw demand curve of a firm for the following:

Answer:

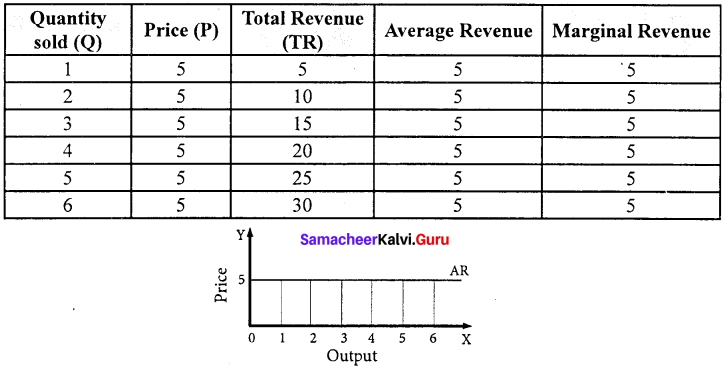

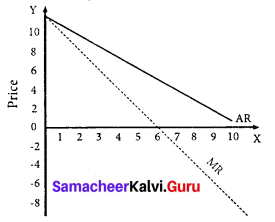

(a) Perfect Competition

(b) Monopoly

Under perfect competition, as uniform price prevails AR = MR and the demand curve (AR) is horizontal to X-axis.

A monopoly firm faces a downward-sloping demand curve.

Question 26.

Mention any two type of price discrimination?

Answer:

- Personal: Different prices are charged for different individuals. For example, the railways give tickets at concessional rate to the ‘Senior citizens’ for the same journey.

- Geographical: Different prices are charged at different places for the same product. For example, a book sold within India at a price is sold in a foreign country at lower price.

Question 27.

Define “Excess capacity”.

Answer:

Excess capacity is the difference between the optimum output that can be produced and the actual output produced by the firm.

Part – C

Answer the following questions in One Paragraph

Question 28.

What are the features of a market?

Answer:

A market has the following characteristic features:

- Buyers and sellers of a commodity or a service.

- A commodity to be bought and sold.

- Price agreeable to buyer and seller.

- Direct or indirect exchange.

Question 29.

Specify the nature of entry of competitors in perfect competition and monopoly.

Answer:

Perfect competition :

Under perfect competition, there is the possibility of free entry and exit of the firm. In the short run, if an efficient producer produces supernormal profits, it attracts new firms to enter the industry. When a large number of firms enter, the supply would increase, resulting in lower price. An inefficient producer, disturbed by the loss, quit the market. It results in a decrease in supply so the price will go up.

Monopoly :

In a monopoly, there is a strict barrier for entry of any new firm.

Question 30.

Describe the degree of price discrimination?

Answer:

Degrees of Price Discrimination:

Price discrimination has become widespread in almost all monopoly markets. According to A.C.Pigou, there are three degrees of price discrimination.

1. First degree price discrimination:

A monopolist charges the maximum price that a buyer is willing to pay. This is called as perfect price discrimination. This price wipes out the entire consumer’s surplus. This is maximum exploitation of consumers. Joan Robinson named it as “Perfect Discriminating Monopoly”.

2. Second degree price discrimination:

Under this degree, buyers are charged prices in such a way that a part of their consumer’s surplus is taken away by the sellers. This is called as imperfect price discrimination. Joan Robinson named it as “Imperfect Discriminating Monopoly”.

Under this degree, buyers are divided into different groups and a different price is charged for each group. For example, in cinema theatres, prices are charged for same film show from viewers of different classes. In a theatre the difference between the first row of first class and the last row in the second class is smaller as compared to the differences in charges.

3. Third degree price discrimination:

The monopolist splits the entire market into a few sub-market and charges different price in each sub-market. The groups are divided on the basis of age, sex and location. For example, railways charge lower fares from senior citizens. Students get discounts in museums, and exhibitions.

Question 31.

State the meaning of selling cost with an example.

Answer:

Under monopolistic competition as the products are differentiated, the producer has to incur expenses to make his brand popular. The expenditure involved in selling the product is called “selling cost”.

According to Prof.Chamberlin, selling cost is the cost incurred in order to alter the position or shape of the demand curve for a product.

Under perfect competition and monopoly there is soiling COM.

(Eg.) Advertisements, Free services, Home delivery etc.,

Question 32.

Mention the similarities between perfect competition and monopolistic competition,

Answer:

- In both perfect competition and monopolistic competition number of firms are large.

- Competition exists between the firms.

- There are no barriers for entry and exit in both the markets.

- Equilibrium occurs at the point where MC curve intersects MR curve.

- In short run there is supernormal profit or loss and in long run there is only normal profits in both market structures.

Question 33.

Differentiate between ‘firm’ and ‘industry’.

Answer:

Firm :

A firm refers to a single production unit in an industry, producing a large or a small quantity of a commodity or service, and selling it at a price in the market. Its main objective is to earn a profit.

Industry :

An industry refers to a group of firms producing the same product or service in an economy.

(Eg.) A group of firms producing cement is called a cement industry.

Question 34.

State the features of duopoly.

Answer:

- Each seller is fully aware of his rival’s motive and actions.

- Both sellers may collude (they agree on all matters regarding the sale of . commodity)

- They may enter into cut-throat competition.

- There is no product differentiation.

- They fix the price for their product with a view to maximising their profit.

Part – D

Answer the following questions in about a page

Question 35.

Bring out the features of perfect competition.

Answer:

According to Joan Robinson, “Perfect competition prevails when the demand for the output of each producer is perfectly elastic. It is an ideal but imaginary market. 100% of perfect competition cannot be seen.

Features of the perfect competition :

(a) Large number of buyers and sellers :

Each individual buyer buys a very very small quantum of a product as compared to that found in the market. This means that he has no power to fix the price of the product. He is only a price-taker and not a price-maker. As the number of sellers is large the seller is also a price – taker.

(b) Homogenous product and uniform price :

The. products are homogenous in nature and are perfectly substitutable. All the units of the product are identical. Therefore a uniform price prevails in the market.

(c) Free entry and exit:

In the short run, if the very efficient producer earns super normal profits, new firms enter into the industry. When large number of firms enter, the supply would increase, resulting in lower price. If a inefficient producer incurs loss, the loss incuring firms quit the market. So the existing firms could earn more profit as supply decreases.

(d) Absence of transport cost:

The prevalence of the uniform price is also due to the absence of the transport cost. . e) Perfect mobility of factors of production :

As there is perfect mobility of the factors of production, uniform price exists. As they enjoy perfect freedom of mobility the price gets adjusted.

(f) Perfect knowledge of the market:

All buyers and sellers have a thorough knowledge of the quality of the product, prevailing price etc.

(g) No government intervention :

There is no government regulation on supply of raw materials and in the determination of price etc.

Question 36.

How price and output are determined under the perfect competition?

Answer:

In the short run at least a few factors of production are fixed. The firms under perfect .competition take the price (10) from the industry and start adjusting their quantities produced.

For example

Qd = 100 -5P and

Qs = 5p

At equilibrium Qd = Qs

100 – 5p = 5p

100 = 5p + 5p

p = 10

Qd = 100 – 5(10)

= 50

Qs = 5(10) = 50

Qd = Qs

50 = 50

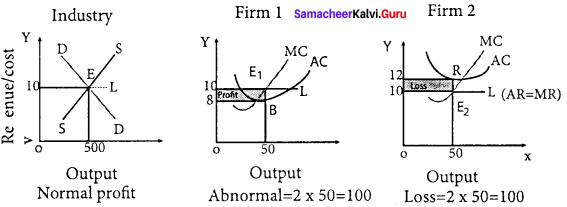

SS – market supply, DD – market demand, AR – Average Revenue, AC – Average Cost, MR – Marginal Revenue, MC – Marginal Cost This diagram consists of three panels.

First part:

The equilibrium of an industry is explained. The demand and supply forces of the firms interact and the price is fixed as Rs.10. The equilibrium of an industry is obtained at 50 units of output.

Second part:

AC curve is lower than the price line. Equilibrium is achieved where

MC = MR. Equilibrium quantity is 50. With price Rs. 10, it experiences supernormal profit

AC = Rs. 8

AR = Rs. 10

TR – 50 x 10 = 500

TC = 50 x 8 = 400

Profit = 500-400= 100.

Third part:

Firm’s cost curve is above the price line. Equilibrium MC = MR. Quantity is 50 with price Rs. 10, it experiences loss (AC > AR)

TR = 50 x 10 = 500

TC = 50 x 12 = 600

Loss = 600-500= 100

If profit prevails in the market, new firms emerge results in declining price and if loss occurs the existing loss making firm exits results in increasing price consequent upon the entry and exit of new firms into the industry, firms always earn ‘normal profit’ in the long run.

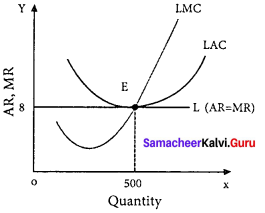

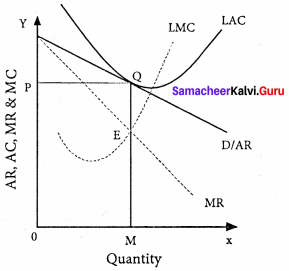

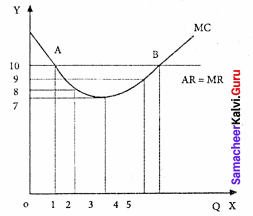

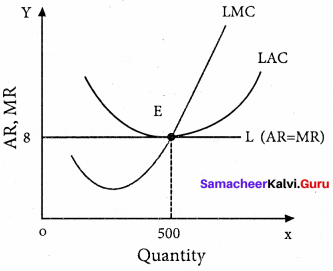

Price and output determination in long run :

Long run equilibrium of the firm is illustrated in the diagram. Under perfect competition, long run equilibrium is only at minimum point of LAC. At point E,

LMC = MR = AR = LAC

In the diagram AR = AC. Equilibrium is at point E where price is 8 and output is 500. At this point, the profit of the firm is only normal. Thus condition for long run equilibrium of the firm is

Price = AR = MR = Minimum AC

At equilibrium SAC > LAC. Hence in the long run equilibrium price is lower and quantity is larger compared to the short run equilibrium price and quantity.

Question 37.

Describe the features oligopoly.

Answer:

1. Few large firms :

Very few big firms own the major control of the whole market by producing major portion of the market demand.

2. Interdependence among firms :

The price and quality decisions of a particular firm are dependent on the price and . quality decisions of the rival firms.

3. Group behaviour :

The firms under oligopoly realise the importance of mutual co-operation.

4. Advertisement cost :

The oligopolist could raise sales either by advertising or improving the quality of the product.

5. Nature of the product:

Perfect oligopoly means homogeneous products and imperfect oligopoly deals with heterogenous products.

6. Price rigidity :

It implies that prices are difficult to be changed. The oligopolist firms do not change their prices due to the fear of rival’s reaction.

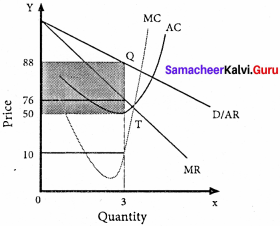

Question 38.

Illustrate price and output determination under monopoly.

Answer:

Monopoly is a market structure characterized by a single seller, selling the unique product with the restriction for a new firm to enter the market.

Price and Output Determination under Monopoly :

Nature of cost and revenue curves :

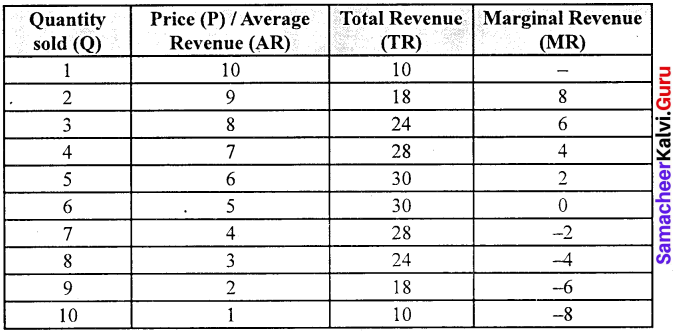

A monopoly is a one-firm industry. Therefore, a monopolist firm faces a downward-sloping demand curve. Since AR falls, MR lies below the AR curve (MR < AR)

The monopolist will continue to sell his product as long as his MR > MC

Condition for equilibrium :

Monopolists attain equilibrium at the level of output when MC = MR.

From the diagram, till he sells 3 units output, MR is greater than MC, and when he exceeds this output level, MR is less than MC. At equilibrium where MR = MC, price (AR) is Rs. 88. To know the profit of monopolists at equilibrium output, the average revenue curves and the average cost curves are used at equilibrium Output 3

AR= 88

AC = 50

Profit per unit = 88-50

= 38

= (AR – AC) × Total output

= (88 – 50) × 3

= 38 × 3

= 114

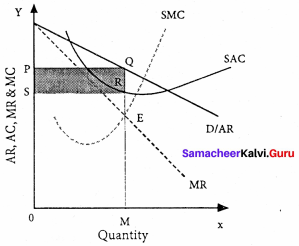

Question 39.

Explain price and output determined under monopolistic competition with help of diagram.

Answer:

Monopolistic competition refers to a market situation where there are many firms selling a differentiated product.

Price and output determination :

Nature of cost and revenue curves :

The monopolistic firm sell large quantity at less price. So, it faces a downward sloping demand curve. AR curve is fairly elastic. MR curve falls below AR. AC curve will be ‘U’ shaped.

Condition for equilibrium :

MC = MR, MC curve should cut MR from below. If MC is less than MR, the sellers will find it profitable to expand their output.

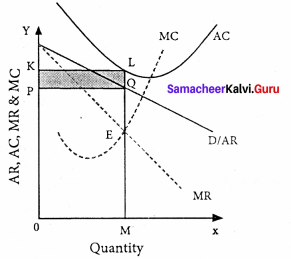

Short – run equilibrium :

Profit is maximised when MC = MR. From the diagram.

OM – Equilibrium output OP – Equilibrium price

TR – OMQP TC – OMRS

Profit = OMQP-OMRS

= PQRS

This is super normal profit under short-run.

A monopolistic competitive firm may also incur loss in the short-run.

As shown in the diagram, the AR and MR curves are fairly elastic.

At equilibrium output is OM , price is OP

TR – OMQP

TC-OMLK

Total loss = TR-TC

= OMQP – OMLK

= PQLK

Long – run equilibrium :

In the long run AR curve is more elastic or flatter. Hence, the firms will only earn normal profit.

Samacheer Kalvi 11th Economics Market Structure and Pricing Additional Questions and Answers

Part -A

Choose the best options

Question 1.

In the real world what type of market we see?

(a) Imperfect

(b) Perfect

(c) Monopoly

(d) Oligopoly

Answer:

(a) Imperfect

Question 2.

First condition for equilibrium of the firm _______

(a) AC = AR

(b) AC = MC

(c) MC = MR

(d) AR = MR

Answer:

(c) MC = MR

Question 3.

How many types of price discrimination under monopoly?

(a) Three

(b) Two

(c) Five

(d) Seven

Answer:

(a) Three

Question 4.

Indian railways is an example of _______ competition.

(a) Perfect competition

(b) Monopoly

(c) Monopolistic competition

(d) Oligopoly

Answer:

(b) Monopoly

Question 5.

Monopoly power achieved through patent right is called ………………………..

(a) Duopoly

(b) Oligopoly

(c) Legal monopoly

(d) Monopolistic competition

Answer:

(c) Legal monopoly

Question 6.

Differentiated products are seen in _______

(a) Perfect competition

(b) Monopoly

(c) Monopolistic

(d) Monopsony

Answer:

(c) Monopolistic

Question 7.

Under perfect competition, the firms are producing …………………………

(a) Firm

(b) Sales

(c) Public sector

(d) Homogeneous

Answer:

(d) Homogeneous

Question 8.

In perfect competition, short run equilibrium is determined by

(a) MC = MR

(b) MC = AC

(c) MR = AR

(d) AR = AC

Answer:

(a) MC = MR

Question 9.

A firm and Industry are one and the same under ……………………

(a) Perfect competition

(b) Duopoly

(c) Oligopoly

(d) Monopoly

Answer:

(d) Monopoly

Question 10.

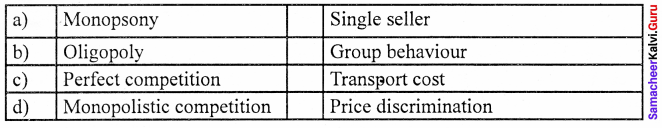

Group behaviour is seen in _______

(a) Perfect competition

(b) Monopoly

(c) Monopolistic competition

(d) Oligopoly

Answer:

(d) Oligopoly

Question 11.

When the monopoly will be an equilibrium?

(a) MC = MR

(b) AC = AR

(c) AC = MR

(d) MC = AR

Answer:

(a) MC = MR

Question 12.

_______ degree of price discrimination wipes out the entire consumer’s surplus.

(a) First

(b) Second

(c) Third

(d) None

Answer:

(a) First

Question 13.

In monopolistic competition, the demand curve is

(a) More elastic

(b) Inelastic

(c) Less elastic

(d) None

Answer:

(a) More elastic

Question 14.

Government controls monopoly by _______

(a) Taxation

(b) Legal methods

(c) Both

(d) None

Answer:

(c) Both

Question 15.

The important feature of non-price competition is _______

(a) Product differentiation

(b) Advertisement

(c) Sales promotion

(d) All the above

Answer:

(d) All the above

Question 16.

The concept of Imperfect Competition was

(a) J.M. Keynes

(b) Irving Fisher

(c) Marshall propounded by

(d) Joan Robinson

Answer:

(d) Joan Robinson

Question 17.

Identify the wrong statement about the features of Duopoly.

(a) There is product differentiation

(b) They fix the price for their product to maximise their profit

(c) Each seller is fully aware of his rival’s motive and actions

(d) Both sellers may collude regarding the sale of commodity.

Answer:

(a) There is product differentiation

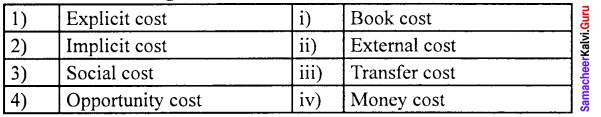

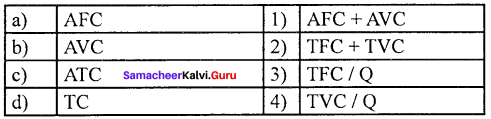

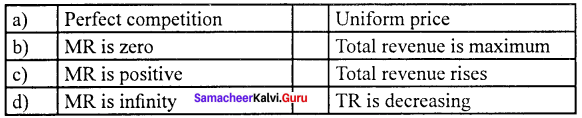

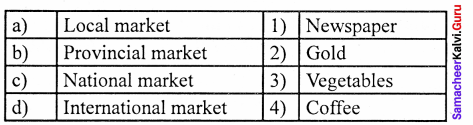

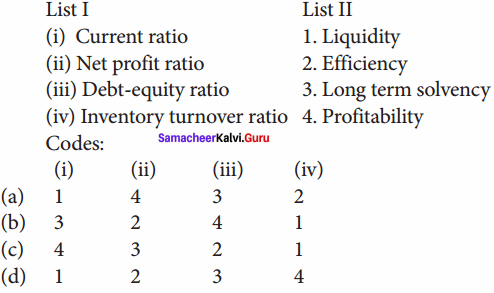

Match the following and choose the answer using the codes given below

Question 1.

(a) 1 2 3 4

(b) 2 4 1 3

(c) 4 3 2 1

(d) 3 4 1 2

Answer:

(b) 2 4 1 3

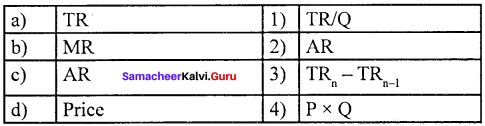

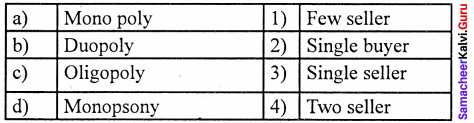

Question 2.

(a) 2 4 1 3

(b) 3 1 4 2

(c) 3 4 1 2

(d) 1 2 3 4

Answer:

(d) 1 2 3 4

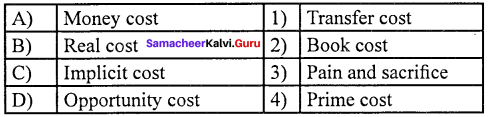

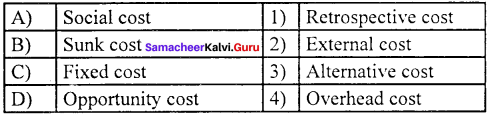

Choose the incorrect pair

Question 3.

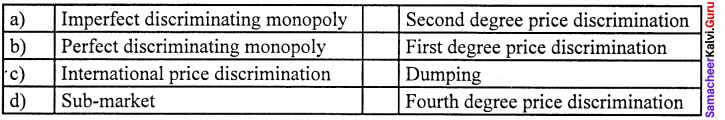

Answer:

(d) Sub-market (iv) Fourth degree price discrimination

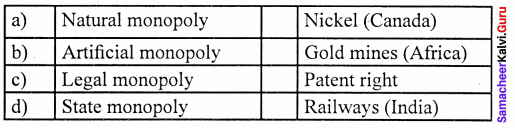

Question 4.

Answer:

(b) Artificial monopoly (ii) Gold mines (Africa)

Choose the odd one out

Question 5.

(a) Personal

(b) Geographical

(c) On the basis of use

(d) Price taker

Answer:

(c) On the basis of use

Question 6.

(a) Individual behaviour

(b) Few large firms

(c) Group behaviour

(d) Price rigidity

Answer:

(a) Individual behaviour

Question 7.

(a) Market period

(b) Short period market

(c) Very long period market

(d) Whole sale market

Answer:

(d) Whole sale market

Choose the incorrect statement

Question 8.

In perfect competition

(a) There are large number of buyers and sellers

(b) Free entry and exit of firm

(c) Price competition is essential

(d) Independent price policy

Answer:

(c) Price competition is essential

Question 9.

(a) In a market there is no exchange of goods.

(b) Commodities will be bought and sold in market.

(c) In market prices are agreeable to buyer and seller.

(d) In market there are buyer and seller of a commodity.

Answer:

(a) In a market there is no exchange of goods.

Analyse the reason for the following

Question 10.

Assertion (A) : Perfect competition is that no one is big enough to have any appreciable

influence over market price.

Reason (R) : Perfect competition is a market situation where there are infinite number of sellers.

(a) Both (A) and (R) are true, (R) is the correct explanation of (A)

(b) Both (A) and (R) are true, (R) is not the correct explanation of (A)

(c) Both (A) and (R) are false.

(d) (A) is true but (R) is false.

Answer:

(a) Both (A) and (R) are true, (R) is the correct explanation of (A)

Question 11.

Assertion (A) : At equilibrium MC cuts MR from below.

Reason (R) : MC cuts MR at two points.

(a) Both (A) and (R) are true, (R) is the correct explanation of (A)

(b) Both (A) and (R) are true, (R) is not the correct explanation of (A)

(c) (A) is true but (R) is false.

(d) (A) is false but (R) is true.

Answer:

(b) Both (A) and (R) are true, (R) is not the correct explanation of (A)

Question 12.

Assertion (A) : In monopoly there exist price discrimination.

Reason (R) : A monopolist is a price maker.

(a) Both (A) and (R) are true, (R) is the correct explanation of (A)

(b) Both (A) and (R) are false

(c) (A) is true but (R) is false.

(d) (A) is false but (R) is true.

Answer:

(a) Both (A) and (R) are true, (R) is the correct explanation of (A)

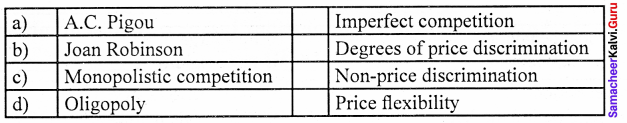

Choose the incorrect pair

Question 13.

Answer:

(c) Monopolistic competition (iii) Non – price discrimination

Question 14.

Answer:

(b) Oligopoly (ii) Group behaviour

Fill in the blanks with suitable option given below

Question 15.

Supply curve in the very short period is ________

(a) Horizontal

(b) Slopes downward

(c) Slopes upward

(d) Vertical

Answer:

(d) Vertical

Question 16.

Differentiated products are seen in ________

(a) Perfect competition

(b) Monopoly

(c) Monopolistic competition

(d) Monopsony

Answer:

(c) Monopolistic competition

Question 17.

Government controls monopoly by ________

(a) Taxation

(b) Legal method

(c) Both

(d) None

Answer:

(c) Both

Choose the best option

Question 18.

________ classified market based on time

(a) Marshall

(b) Adam smith

(c) Chamberlin

(d) Hicks

Answer:

(a) Marshall

Question 19.

In monopolistic competition the demand curve is

(a) Inelastic

(b) More elastic

(c) Less elastic

(d) None

Answer:

(b) More elastic

Question 20.

The important feature of non-price competition is ________

(a) Product differentiation

(b) Advertisement

(c) Sales promotion

(d) All the above

Answer:

(d) All the above

Part – B

Answer the following questions in one or two sentences

Question 1.

Define duopoly?

Answer:

In a duopoly, there are only two sellers who are completely independent and no agreement exists between them.

Question 2.

Define “ Imperfect competition”?

Answer:

Imperfect competition is a competitive market situation where there are many sellers, but they are selling heterogeneous (dissimilar) goods as opposed to the perfect competitive market scenario. As the name suggests, competitive markets are imperfect in nature.

Question 3.

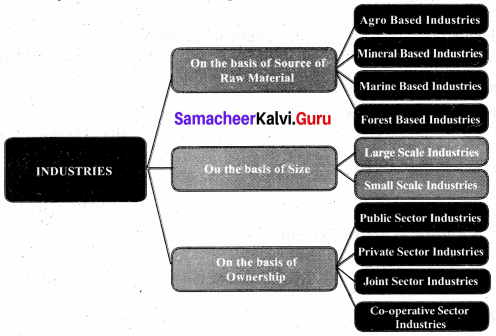

Classify market based on time.

Answer:

- Very short period market (or) Market period.

- Short period market

- Long period market

- Very long period market (or) Secular period market.

Question 4.

How is market classified based on the quantify of a commodity?

Answer:

- Whole-sale market

- Retail market

Question 5.

How can you classify market based on competition ?

Answer:

- Perfect competition market.

- Imperfect competition market which comprises monopoly, monopolistic competition, duopoly, oligopoly etc.

Question 6.

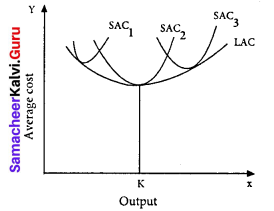

Define long run average cost curve.

Answer:

In the long run all the factors are variable. The LAC curve is an envelope curve as it contains a few average cost curves. It is a flatter ‘U’ shaped one. It is also called as planning curve.

Question 7.

Write a note imperfect competition.

Answer:

This concept was introduced by Joan Robinson and E.H.Chamberlin. Imperfect competition is a competitive market situation where there are many sellers, but they are selling heterogeneous goods. Competitive markets are imperfect in nature.

Question 8.

Explain monopoly.

Answer:

‘Mono’ refers to a single and ‘poly’ to seller. In this way, monopoly refers to a market situation in which there is only one seller of a commodity. There is no scope for competition.

Question 9.

What is dumping ?

Answer:

Dumping refers to practice of the monopolist charging higher price for his product in the local market and lower price in the foreign market. It is called as ‘International price discrimination’.

Question 10.

What is monopsony ?

Answer:

Monopsony is a market structure in which there is only one buyer of a good or service.

Question 11.

What is Bilateral monopoly ?

Answer:

If a single producer of a product faces a single buyer of that product, then it is called as bilateral monopoly.

Question 12.

What are the conditions for short, run and long-run equilibrium in the monopolistic competition ?

Answer:

Short – run equilibrium : MC = MR

Long – run equilibrium has two conditions : MC = MR and AC = AR

Question 13.

Give example for perfect competition.

Answer:

- Online ticket auctions.

- Truck farming

- Salt

- Gravel

- Garage sales

- Online sales in general

Question 14.

What is oligopoly ?

Answer:

Oligopoly is a market situation in which there are a few firms selling homogeneous or differentiated products.

Part – C

Answer the following questions in One Paragraph

Question 1.

Explain the types of markets based on area.

Answer:

The market is classified not only on its geographical spread but also on the nature of the goods exchanged.

1. Local market:

It refers to the products or services which are sold and bought in the place of their production. (Eg.) Fruits, Vegetables etc.

2. Provincial market:

It arises when products or services are sold and bought in a restricted circle. (Eg.) : Provincial newspaper.

3. National market:

It arises when products and services are sold and bought throughout a country. (Eg.) Tea, Coffee, Cement etc.

4. International market:

It arises when products and services are sold and bought at the world level. (Eg.) Petrol, Gold etc.

Question 2.

What is the Duopoly and the characteristics of Duopoly?

Answer:

Duopoly is a special case of the theory of oligopoly in which there are only two sellers. Both the sellers are completely independent and no agreement exists between them. Even though they are independent, a change in the price and output of one will affect the other, and may set a chain of reactions. A seller may, however, assume that his rival is unaffected by what he does, in that case he takes only his own direct influence on the price.

Characteristics of Duopoly:

- Each seller is fully aware of his rival’s motive and actions.

- Both sellers may collude (they agree on all matters regarding the sale of the commodity).

- They may enter into cut-throat competition.

- There is no product differentiation.

- They fix the price for their product with a view to maximising their profit.

- Describe the features of monopolistic competition.

Features of monopolistic competition:

- There are large number of buyers and many sellers.

- Firms under monopolistic competition are price makers. They set their own prices.

- Firms produce differentiated products. It is the key element of monopolistic competition.

- There is a free entry and exit of firms.

- Firms compete with each other by incurring selling cost or expenditure on sales promotion of their products.

- Non – price competition is an essential part of monopolistic competition.

- A firm can follow an independent price policy.

Question 3.

Classify markets based on quantity of the commodity.

Answer:

1. Whole-sale market:

It is for bulk selling and buying of goods. The price is likely to be low compared to retail market. (Eg.) Clothing, Grocery etc.

2. Retail market:

It is the market for commodities in small quantities .(Eg.) Clothing, Vegetable etc.

Question 4.

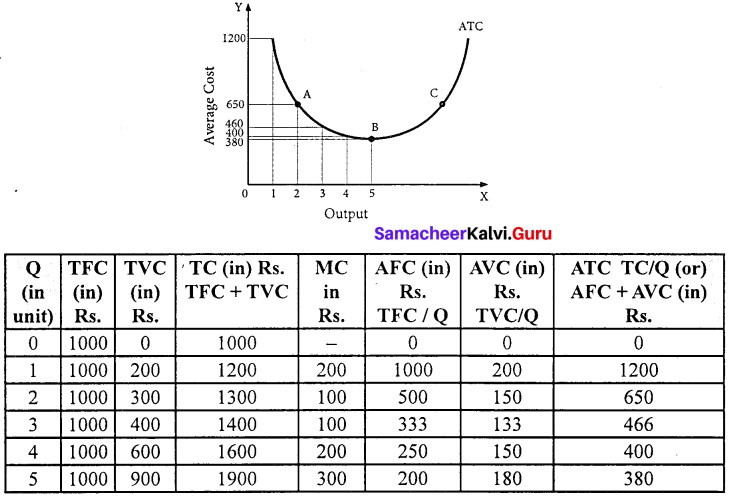

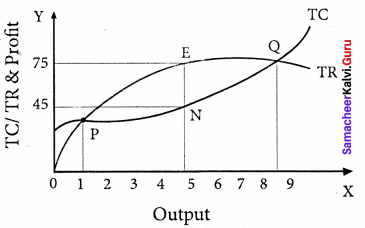

Explain total cost curve approach.

Answer:

In the TC – TR approach, profit is obtained by a firm, through the difference between the TC and the TR.

Equilibrium is obtained at the point where maximum difference between the TC and TR occurs.

Question 5.

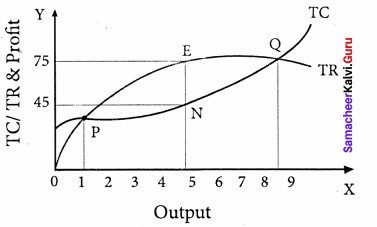

State the hvo conditions for equilibrium using marginal curve approach.

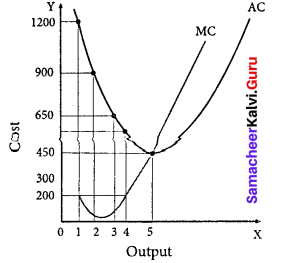

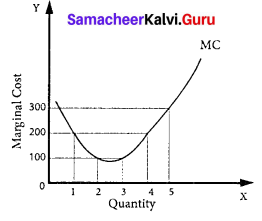

Answer:

1. MC = MR

A rational seller will not be in equilibrium at output level 1, though MC = MR at that point. He continues his production till 5 units where MC < MR. Beyond 5 units of Q, MC > MR where the seller incurs loss. So condition for equilibrium MC – MR. It is a necessary but not a sufficient condition.

2. MC cuts MR curve from below (Sufficient conditions):

MC curve is ‘U’ shaped. MR cuts MC both from above (at point A) and also from below (at point B). Only at point B the equilibrium condition is fulfilled.

Thus for equilibrium under all market situations the two conditions are MC = MR and MC cuts MR from below.

Question 6.

Explain the features of monopoly.

Answer:

- There is a single producer / seller of a product.

- The product of a monopolist is unique and has no close substitute. There is strict barrier for entry of any new firm.

- The monopolist is a price – maker.

- The monopolist earns maximum profit / abnormal profit.

Question 7.

Explain the sources of monopoly power.

Answer:

1. Natural monopoly :

Ownership of the natural raw materials. (Eg.) Gold mines (Africa)

2. State monopoly :

Single supplier of some special services. (Eg.) Railways in India

3. Legal monopoly :

A monopoly firm can get its monopoly power by getting patent rights, trade mark from

the government.

Question 8.

Explain the features of monopolistic competition.

Answer:

- There are large number of buyers and sellers.

- Firms under monopolistic competition are price makers.

- They produce differentiated products.

- There is a free entry and exit of firms.

- Finns compete with each other by incurring selling cost or expenditure on sales promotion.

- Non-price competition is an essential part of monopolistic competition.

- A firm can follow an independent price policy.

Question 9.

Explain the types of price discrimination.

Answer:

1. Personal :

Different prices are charged for different individuals.

(Eg.) Tickets at concessional rate to the senior citizens in railways.

2. Geographical:

Different prices are charged at different places for the same product.

(Eg.) A book sold within India at a price is sold in a foreign country at lower price.

3. On the basis of use :

Different prices are charged according to the use of a product.

(Eg.) TNEB charges lower rate for domestic use of electricity and higher rate for commercial uses.

Part – D

Answer the following questions in about a page

Question 1.

Explain long-run equilibrium in perfect competition.

Answer:

In the long run, all the factors are variable.

The LAC curve is an envelope curve as it contains a few average cost curves.

It is a flatter ‘U’ shaped one. It is also known as planning curve.

- The firms will earn only normal profit.

- All the firms in the market are in equilibrium. So entry and exit of a firm is not possible.

A firm under perfect competition in the long run is a price-taker. It takes the price of the product from the industry. And it superimposes its cost curves on the revenue curves.

Long run equilibrium is at minimum point of LAC. In the diagram AC = AR, at equilibrium E price is 8 and output is 500. At this point, the profit of the firm is only normal.

The condition for long run equilibrium of the price is.

Price = AR = MR = Minimum AC. At this equilibrium.

- SAC > LAC

- Long run equilibrium price is lower than short run equilibrium price.

- Long run equilibrium quantity is larger than short run equilibrium quantity.

Question 2.

Describe the wastes of monopolistic competition?

Answer:

Wastes of Monopolistic Competition:

Generally there are five kinds of wastages under monopolistic competition.

1. Excess capacity:

- Un-utilized capacity is the difference between the optimum output that can be produced and the actual output produced by the firm.

- In the long run, a monopolistic firm produces delibourately output which is less than the optimum output that is the output corresponding to the minimum average cost.

- This leads to excess capacity which is actually as waste in monopolistic competition.

2. Unemployment:

- Under monopolistic competition, the firms produce less than optimum output.

- As a result, the productive capacity is not used to the fullest extent.

- This will lead to unemployment of human resources also.

3. Advertisement:

- There is a lot of waste in competitive advertisements under monopolistic competition.

- The wasteful and competitive advertisements lead to high cost to consumers.

4. Too many varieties of Goods:

- The goods differ in size, shape, style and colour. A reasonable number of varieties would be sufficient.

5. Inefficient firms:

Under monopolistic competition, inefficient firms charge prices higher than their marginal cost. Efficient firms cannot drive out inefficient firms.

Question 3.

Explain long-run equilibrium in perfect competition.

Answer:

Similarities :

- The motive of both the type of market is profit maximisation.

- Condition for equilibrium is MC = MR

Dissimilarities :

Perfect Competition:

- Price taker. As the contribution of a single seller is less he cannot determine the price

- At equilibrium MC = MR = AR (Price)

- AR curve is perfectly elastic and horizontal to X – axis. MR curve is equal to AR and coincides with AR. AR = MR

- Equilibrium is attained at increasing marginal cost condition.

- In the short – run the firm earns super normal profit. In the long run, attracted by super-normal profit new firms enter the industry, which results in normal profit.

- The firms produce optimum quantity of output.

- Price discrimination is not possible, because of the perfectly elastic demand curve.

- Output is maximum and price is minimum.

- Possibility for consumer’s surplus.

Monopoly:

- Price maker. As the firm and industry remains the same, producer fix price for his product.

- At equilibrium MC = MR < AR (Price)

- AR curve is a downward sloping curve. MR falls below AR.

- Equilibrium can be attained during increasing, decreasing and constant marginal cost condition.

- In both short-run and long-run the firm earns super-normal profit because of the barrier to entry.

- The firm produces less than optimum quantity of output.

- Price discrimination is possible.

- Output is minimum and price is maximum.

- As the price is high there is no possibility for consumer’s surplus.

Question 4.

Explain long-run equilibrium of the firm and the group equilibrium in monopolistic competition.

Answer:

In the short run, the firm may earn super normal profit or incur loss. But in the long run, the entry of the new firms in the industry will wipe out the super normal profit earned by the existing firms. The entry of new firms and exit of loss making firms will result in normal profit for the firms in the industry.

In the long run AR curve is more elastic or flatter. Because plenty of substitutes are available.

In the diagram, equilibrium is achieved at point E The equilibrium output is ‘OM’ and the equilibrium price is ‘OP’. AR is ‘MQ’ and MC is also ‘MQ’.

In the long run, the condition for equilibrium is AR = AC And MC = MR. It means that a firm earns normal profit. AR is tangent to the Long run Average Cost (LAC) curve at point ‘Q’.

If you need some more information about Tamilnadu State Board Solutions for 11th Economics Chapter 5 Market Structure and Pricing Questions and Answers then visit our site frequently and get all the resources that you look for. Also, share this page with your friends and make them learn all the concepts thoroughly before the exams.

= 3 months.

= 3 months.

= \(\frac{365}{10}\) = 36.5 days

= \(\frac{365}{10}\) = 36.5 days