Students of 12th can get the pdf links of Tamilnadu State Board Economics Solutions here. You can Download Samacheer Kalvi 12th Economics Book Solutions Chapter 7 International Economics Questions and Answers, Notes Pdf, Guide Pdf helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

Tamilnadu Samacheer Kalvi 12th Economics Solutions Chapter 7 International Economics

It is very important to put the textbook aside while preparing for the exams. So, if you follow Samacheer Kalvi 12th Economics Textbook Solutions you can cover all the topics in Chapter 7 International Economics Questions and Answers. This helps to improve your communication skills.

Samacheer Kalvi 12th Economics International Economics Text Book Back Questions and Answers

Part – A

Multiple Choice Questions.

Question 1.

Trade between two countries is known as ………………………. trade

(a) External

(b) Internal

(c) Inter – regional

(d) Home

Answer:

(a) External

Question 2.

Which of the following factors influence trade?

(a) The stage of development of a product

(b) The relative price of factors of productions

(c) Government

(d) All of the above.

Answer:

(d) All of the above.

Question 3.

International trade differs from domestic trade because of ……………………….

(a) Trade restrictions

(b) Immobility of factors

(c) Different government policies

(d) All the above

Answer:

(d) All the above

Question 4.

In general, a primary reason why nations conduct international trade is because ……………………….

(a) Some nations prefer to produce one thing while others produce another

(b) Resources are not equally distributed among all trading nations

(c) Trade enhances opportunities to accumulate profits

(d) Interest rates are not identical in all trading nations

Answer:

(b) Resources are not equally distributed among all trading nations

Question 5.

Which of the following is a modem theory of international trade?

(a) Absolute cost

(b) Comparative cost

(c) Factor endowment theory

(d) None of these

Answer:

(c) Factor endowment theory

Question 6.

Exchange rates are determined in ……………………….

(a) Money market

(b) Foreign exchange market

(c) Stock market

(d) Capital market

Answer:

(b) Foreign exchange market

Question 7.

Exchange rate for currencies is determined by supply and demand under the system of ……………………….

(a) Fixed exchange rate

(b) Flexible exchange rate

(c) Constant

(d) Government regulated

Answer:

(b) Flexible exchange rate

Question 8.

Net export equals ……………………….

(a) Export × Import

(b) Export + Import

(c) Export – Import

(d) Exports of services only

Answer:

(c) Export – Import

Question 9.

Who among the following enunciated the concept of single factoral terms of trade?

(a) Jacob Viner

(b) G.S.Donens

(c) Taussig

(d) J.S.Mill

Answer:

(a) Jacob Viner

Question 10.

Terms of Trade of a country show ……………………….

(a) Ratio of goods exported and imported

(b) Ratio of import duties

(c) Ratio of prices of exports and imports

(d) Both (a) and (c)

Answer:

(c) Ratio of prices of exports and imports

Question 11.

Favourable trade means value of exports are ………………………. Than that of imports.

(a) More

(b) Less

(c) More or Less

(d) Not more than

Answer:

(a) More

Question 12.

If there is an imbalance in the trade balance (more imports than exports), it can be reduced by ……………………….

(a) Decreasing customs duties

(b) Increasing export duties

(c) Stimulating exports

(d) Stimulating imports

Answer:

(c) Stimulating exports

Question 13.

BOP includes ……………………….

(a) Visible items only

(b) Invisible items only

(c) Both visible and invisible items

(d) Merchandise trade only

Answer:

(c) Both visible and invisible items

Question 14.

Components of balance of payments of a country includes ……………………….

(a) Current account

(b) Official account

(c) Capital account

(d) All of above

Answer:

(d) All of above

Question 15.

In the case of BOT ……………………….

(a) Transactions of goods are recorded.

(b) Transactions of both goods and services are recorded.

(c) Both capital and financial accounts are included.

(d) All of these

Answer:

(a) Transactions of goods are recorded.

Question 16.

Tourism and travel are classified in which of balance of payments accounts?

(a) Merchandise trade account

(b) Services account

(c) Unilateral transfers account

(d) Capital account

Answer:

(b) Services account

Question 17.

Cyclical disequilibrium in BOP occurs because of ……………………….

(a) Different paths of business cycle.

(b) The income elasticity of demand or price elasticity of demand is different.

(c) Long – run changes in an economy

(d) Both (a) and (b)

Answer:

(d) Both (a) and (b)

Question 18.

Which of the following is not an example of foreign direct investment?

(a) The construction of a new auto assembly plant overseas

(b) The acquisition of an existing steel mill overseas

(c) The purchase of bonds or stock issued by a textile company overseas

(d) The creation of a wholly owned business firm overseas

Answer:

(c) The purchase of bonds or stock issued by a textile company overseas

Question 19.

Foreign direct investments not permitted in India ……………………….

(a) Banking

(b) Automic energy

(c) Pharmaceutical

(d) Insurance

Answer:

(b) Automic energy

Question 20.

Benefits of FDI include, theoretically ……………………….

(a) Boost in Economic Growth

(b) Increase in the import and export of goods and services

(c) Increased employment and skill levels

(d) All of these

Answer:

(d) All of these

Part – B

Answer The Following Questions Each Question Carries 2 Marks.

Question 21.

What is International Economics?

Answer:

- International Economics is that branch of economics which is concerned with the exchange of goods and services between two or more countries. Hence the subject matter is mainly related to foreign trade.

- International Economics is a specialized field of Economics which deals with the economic interdependence among countries and studies the effects of such interdependence and the factors that affect it.

Question 22.

Define international trade?

Answer:

International Trade refers to the trade or exchange of goods and services between two or more countries. In other words, it is a trade among different countries or trade across political boundaries. It is also called as ‘external trade’ or ‘foreign trade’ or ‘inter-regional trade’.

Question 23.

State any two merits of trade?

Answer:

- Trade is one of the powerful forces of economic integration.

- The term ‘trade’ means exchange of goods, wares or merchandise among people.

Question 24.

What is the main difference between Adam Smith and Ricardo with regard to the emergence of foreign trade?

Answer:

Adam Smith Foreign Trade:

- According to Adam Smith the basis of International trade was absolute cost advantage.

- Trade between two countries would be mutually beneficial when one country produces a commodity at an absolute cost advantage.

- Adam Smith argued that all nations can be benefitted when there is free trade and specialisation interms of their absolute cost advantage.

Ricardo Foreign Trade:

- Ricardo demonstrates that the basis of trade is the comparative cost difference.

- Trade can take place even if the absolute cost difference is absent but there is comparative cost difference.

- According to Ricardo a country can gain from trade when it produces at relatively lower costs.

Question 25.

Define Terms of Trade?

Answer:

Terms of Trade:

- The gains from international trade depend upon the terms of trade which refers to the ratio of export prices to import prices.

- It is the rate at which the goods of one country are exchanged for goods of another country’.

- It is expressed as the relation between export prices and import prices.

- Terms of trade improves when average price of exports is higher than average price of imports.

Question 26.

What do you mean by balance of payments?

Answer:

Balance of Payments (BOP):

1. BoP is a systematic record of a country’s economic and financial transactions with the rest of the world over a period of time.

2. When a payment is received from a foreign country, it is a credit transaction while a payment to a foreign country is a debit transaction.

3. The principal items shown on the credit side are exports of goods and services, transfer receipts in the form of gift etc., from foreigners, borrowing from abroad, foreign direct investment and official sale of reserve assets including gold to foreign countries and international agencies.

4. The principal items on the debit side include imports of goods and serv ices, transfer payments to foreigners, lending to foreign countries, investments by residents in foreign countries and official purchase of reserve assets or gold from foreign countries and international agencies.

Question 27.

What is meant by Exchange Rate?

Meaning of Foreign Exchange (FOREX):

1. FOREX refers to foreign currencies. The mechanism through which payments are effected between two countries having different currency systems is called FOREX system. It covers methods of payment, rules and regulations of payment and the institutions facilitating such payments.

2. “FOREX is the system or process of converting one national currency into another, and of transferring money from one country to another”.

Part – C

Answer The Following Questions Each Question Carries 3 Marks.

Question 28.

Describe the subject matter of International Economics?

Answer:

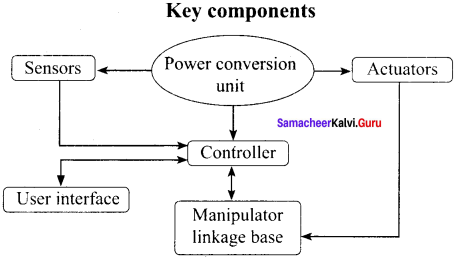

Subject Matter of International Economics:

The subject matter of International Economics includes large number of segments which are classified into the following parts.

1. Pure Theory of Trade:

This component explains the causes for foreign trade, composition, direction and volume of trade, determination of the terms of trade and exchange rate, issues related to balance of trade and balance of payments.

2. Policy Issues:

Under this part, policy issues such as free trade vs. protection, methods of regulating trade, capital and technology flows, use of taxation, subsidies and dumping, exchange control and convertibility, foreign aid, external borrowings and foreign direct investment, measures of correcting disequilibrium in the balance of payments etc are covered.

3. International Cartels and Trade Blocs:

This part deals with the economic integration in the form of international cartels, customs unions, monetary unions, trade blocs, economic unions and the like. It also discusses the operation of Multi National Corporations (MNCs).

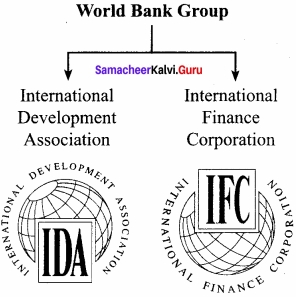

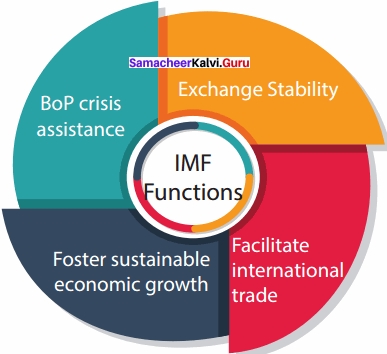

4. International Financial and Trade Regulatory Institutions:

The financial institutions like International Monetary Fund IMF, IBRD, WTO etc which influence international economic transactions and relations shall also be the part of international economics.

Question 29.

Compare the Classical Theory of international trade with Modern Theory of International trade?

Answer:

Classical Theory of International Trade:

- The classical theory explains the phenomenon of international trade on the basis of labour theory of value.

- It presents a one factor (labour) model.

- It attributes the differences in the comparative costs to differences in the productive efficiency of workers in the two countries.

Modern Theory of International Trade:

- The modem theory explains the phenomenon of international trade on the basis of general theory of value.

- It presents a multi – factor (labour and capital) model.

- It attributes the differences in comparative costs to the differences in factor endowments in the two countries.

Question 30.

Explain the Net Barter Terms of Trade and Gross Barter Terms of Trade?

Answer:

1. Net Barter Terms of Trade:

This type was developed by Taussig in 1927.The ratio between the prices of exports and of imports is called the “net barter terms of trade’. It is named by Viner as the ‘commodity terms of trade’.

It is expressed as:

Tn = (P x /Pm ) × 100

Where,

Tn = Net Barter Terms of Trade

Px = Index number of export prices

Pm = Index number of import prices

This is used to measure the gain from international trade. If ‘Tn’ is greater than 100, then it is a favourable terms of trade which will mean that for a rupee of export, more of imports can be received by a country.

2. Gross Barter Terms of Trade:

This was developed by Taussig in 1927 as an improvement over the net terms of trade. It is an index of relationship between total physical quantity of imports and the total physical quantity of exports.

T = (Qm/Qx) × 100

Where,

Qm = Index of import quantities

Qx = Index of export quantities

If for a given quantity of export, more quantity of import can be consumed by a country, then one can say that terms of trade are favourable.

Question 31.

Distinguish between Balance of Trade and Balance of Payments?

Answer:

Balance of Trade:

- Balance of Trade refers to the total value of a country’s exports of commodities and total value of imports of commodities.

- Only export and import of commodities are included in the statement of Balance of Trade of a country.

- The Balance of Trade between the values of goods exchanged between two countries.

- Balance of Trade is a merchandise items or visible items only.

Balance of Payments:

- Balance of payments is a systematic record of a country’s economic and financial transactions with the rest of the world over a period of time.

- The principal items shown on the credit side are exports of goods and services, transfer receipts in the form of gift, etc.

- The Balance of payments between the values of goods and services changed between two countries.

- Balance of payments is a both visible and non – visible items.

Question 32.

What are import quotas?

Answer:

Import Control: Imports may be controlled by

- Imposing or enhancing import duties

- Restricting imports through import quotas

- Licensing and even prohibiting altogether the import of certain non-essential items. But this would encourage smuggling.

Question 33.

Write a brief note on flexible exchange rate?

Answer:

Flexible Exchange Rates: Under the flexible exchange rate (also known as floating exchange rate) system, exchange rates are freely determined in an open market by market forces of

demand and supply

Question 34.

State the objectives of Foreign Direct Investment.

Answer:

Objectives of FDI:

FDI has the following objectives.

- Sales Expansion

- Acquisition of resources

- Diversification

- Minimization of competitive risk.

- FDI may help to increase the investment level and thereby the income and employment in the host country.

- Direct foreign investment may facilitate transfer of technology to the recipient country.

- FDI may also bring revenue to the government of host country when it taxes profits of foreign firms or gets royalties from concession agreements.

- A part of profit from direct foreign investment may be ploughed back into the expansion, modernization or development of related industries.

- It may kindle a managerial revolution in the recipient country through professional management and sophisticated management techniques.

- Foreign capital may enable the country to increase its exports and reduce import requirements. And thereby ease BoP disequilibrium.

- Foreign investment may also help increase competition and break domestic monopolies.

- If FDI adds more value to output in the recipient country than the return on capital from foreign investment, then the social returns are greater than the private returns on foreign investment.

- By bringing capital and foreign exchange FDI may help in filling the savings gap and the foreign exchange gap in order to achieve the goal of national economic development.

- Foreign investments may stimulate domestic enterprise to invest in ancillary industries in collaboration with foreign enterprises.

Part – D

Answer The Following Questions Each Question Carries 5 Marks.

Question 35.

Discuss the differences between Internal Trade and International Trade?

Answer:

Internal Trade:

- Trade takes place between different individuals and firms within the same nation.

- Labour and capital move freely from one region to another.

- There will be free flow of goods and services since there are no restrictions.

- There is only one common currency.

- The physical and geographical conditions of a country are more or less similar.

- Trade and financial regulations are more or less the same.

- There is no difference in political affiliations, customs and habits of the people and government policies.

International Trade:

- Trade takes place between different individuals and firms in different countries.

- Labour and capital do not move easily from one nation to another.

- Goods and services do not easily move from one country to another since there are a number of restrictions like tariff and quota.

- There are different currencies.

- There are differences in physical and geographical conditions of the two countries.

- Trade and financial regulations such as interest rate, trade laws differ between countries.

- Differences are pronounced in political affiliations, habits and customs of the people and government policies

Question 36.

Explain briefly the Comparative Cost Theory?

Answer:

Ricardo’s Theory of Comparative Cost Advantage:

1. David Ricardo, the British economist in his ‘Principles of Political Economy and Taxation’ published in 1817, formulated a systematic theory called ‘Comparative Cost Theory’.

2. Ricardo demonstrates that the basis of trade is the comparative cost difference. In other words, trade can take place even if the absolute cost difference is absent but there is comparative cost difference.

3. According to Ricardo, a country can gain from trade when it produces at relatively lower costs. Even when a country enjoys absolute advantage in both goods, the country would specialize in the production and export of those goods which are relatively more advantageous.

Assumptions:

- There are only two nations and two commodities (2 × 2 model)

- Labour is the only element of cost of production.

- All labourers are of equal efficiency.

- Labour is perfectly mobile within the country but perfectly immobile between countries, (v) Production is subject

- To the law of constant returns.

- Foreign trade is free from all barriers.

- No change in technology.

- No transport cost.

- Perfect competition.

- Full employment.

- No government intervention.

Illustration:

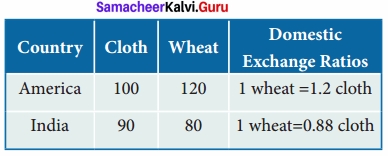

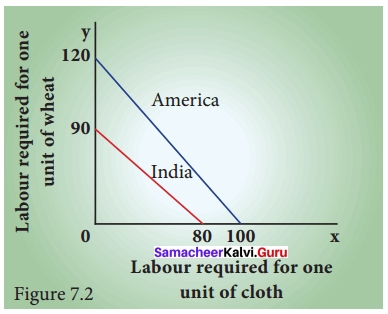

Ricardo’s theory of comparative cost can be explained with a hypothetical example of production costs of cloth and wheat in America and India.

It is evident from the example that India has an absolute advantage in production of both cloth and wheat.

However, India should concentrate on the production of wheat in which she enjoys a comparative cost advantage. (80/120 < 90/100). For America the comparative cost disadvantage is lesser in cloth production. Hence America will specialize in the production of cloth and export it to India in exchange for wheat. (Any exchange ratio between 0.88 units and 1.2 units of cloth against one unit of wheat represents gain for both the nations).

With trade, India can get 1 unit of cloth and 1 unit of wheat by using its 160 labour units. In the absence of trade, for getting this benefit, India will have to use 170 units of labour. America also gains from this trade. With trade, America can get 1 unit of cloth and one unit of wheat by using its 200 units of labour. Otherwise, America will have to use 220 units of labour for getting 1 unit of cloth and 1 unit of wheat.

Question 37.

Discuss the Modern Theory of International Trade?

Answer:

Modern Theory of International Trade:

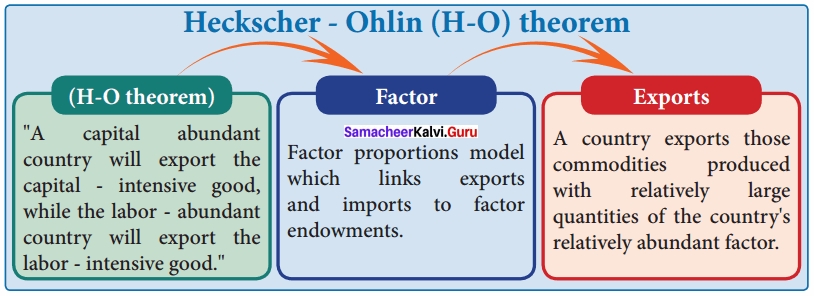

Introduction:

The modem theory of international trade was developed by Swedish economist Eli Heckscher and his student Bertil Ohlin in 1919. This model was based on the Ricardian theory of international trade. This theory says that the basis for international trade is the difference in factor endowments. It is otherwise called as ‘Factor Endowment Theory’.

The Theory:

The classical theory argued that the basis for foreign trade was comparative cost difference and it considered only labour factor. But the modem theory of international trade explains the causes for such comparative cost difference. This theory attributes international differences in comparative costs to:

- Difference in the endowments of factors of production between countries, and

- Differences in the factor proportions required in production.

Assumptions:

- There are two countries, two commodities and two factors. (2 × 2 × 2 model)

- Countries differ in factor endowments.

- Commodities are categorized in terms of factor intensity.

- Countries use same production technology.

- Countries have identical demand conditions.

- There is perfect competition in both product and factor markets in both the countries

Explanation:

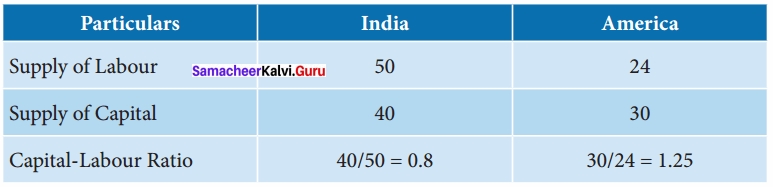

According to Heckscher – Ohlin, “a capital – abundant country will export the capital – intensive goods, while the labour-abundant country will export the labour – intensive goods”. A factor is regarded abundant or scare in relation to the quantum of other factors. A country can be regarded as richly endowed with capital only if the ratio of capital to other factors is higher than other countries

Illustration:

In the above example, even though India has more capital in absolute terms, America is more richly endowed with capital because the ratio of capital in India is 0.8 which is less than that in America where it is 1.25. The following diagram illustrates the pattern of word trade.

Limitations:

- Factor endowment of a country may change over time.

- The efficiency of the same factor (say labour) may differ in the two countries. For example, America may be labour scarce in terms of number of workers. But in terms of efficiency, the total labour may be larger.

Question 38.

Explain the types of Terms of Trade given by Viner?

Answer:

Terms of Trade related to the Interchange between Productive Resources:

1. The Single Factoral Terms of Trade:

Viner has devised another concept called “the single factoral terms of trade” as an improvement upon the commodity terms of trade. It represents the ratio of export – price index to the import – price index adjusted for changes in the productivity of a country’s factors in the production of exports. Symbolically, it can be stated as

Tf = (Px / Pm ) Fx

Where, Tf stands for single factoral terms of trade index. Fx stands for productivity in exports (which is measured as the index of cost in terms of quantity of factors of production used per unit of export).

2. Double Factoral Terms of Trade:

Viner constructed another index called “Double factoral terms of Trade”. It is expressed as

Tff = (Px / Pm )(Fx / Fm)

which takes into account the productivity in country’s exports, as well as the productivity of foreign factors.

Here, Fm represents import index (which is measured as the index of cost in terms of quantity of factors of production employed per unit of imports).

Question 39.

Bring out the components of balance of payments account?

Answer:

Components of BOPs:

The credit and debit items are shown vertically in the BOP account of a country. Horizontally, they are divided into three categories, i.e.

- The current account,

- The capital account and

- The official settlements account or official reserve assets account.

1. The Current Account:

It includes all international trade transactions of goods and services, international service transactions (i.e. tourism, transportation and royalty fees) and international unilateral transfers (i.e. gifts and foreign aid).

2. The Capital Account:

Financial transactions consisting of direct investment and purchases of interest-bearing financial instruments, non-interest bearing demand deposits and gold fall under the capital account.

3. The Official Reserve Assets Account:

Official reserve transactions consist of movements of international reserves by governments and dfficial agencies to accommodate imbalances arising from the current and capital accounts.

The official reserve assets of a country include its gold stock, holdings of its convertible foreign currencies and Special Drawing Rights (SDRs) and its net position in the International Monetary Fund (IMF).

Balance of payment (BOP) Account Chart

Credit (Receipts) – Debit (Payments) = Balance [Deficit (-), Surplus (+)]

Deficit if Debit > Credit

Question 40.

Discuss the various types of disequilibrium in the balance of payments?

Answer:

Types BOP Disequilibrium:

There are three main types of BOP Disequilibrium, which are discussed below.

- Cyclical Disequilibrium,

- Secular Disequilibrium,

- Structural Disequilibrium.

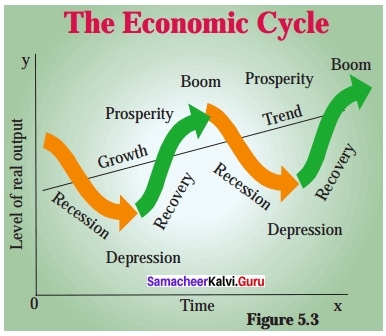

1. Cyclical Disequilibrium:

Cyclical disequilibrium occurs because of two reasons. First, two countries may be passing through different phases of business cycle. Secondly, the elasticities of demand may differ between countries.

2. Secular Disequilibrium:

The secular or long-run disequilibrium in BOP occurs because of long – run and deep seated changes in an economy as it advances from one stage of growth to another. In the initial stages of development, domestic investment exceeds domestic savings and imports exceed exports, as it happens in India since 1951.

3. Structural Disequilibrium:

Structural changes in the economy may also cause balance of payments disequilibrium. Such structural changes include development of alternative sources of supply, development of better substitutes, exhaustion of productive resources or changes in transport routes and costs.

Question 41.

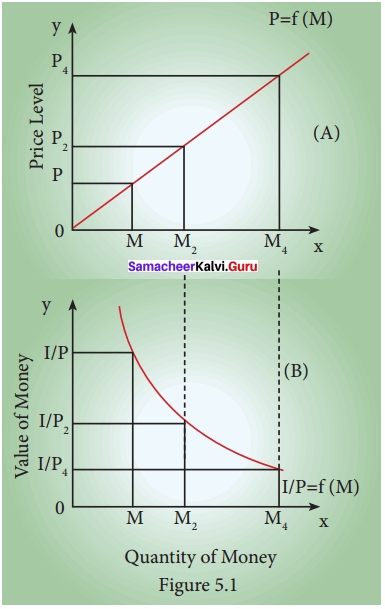

How the Rate of Exchange is determined? Illustrate?

Answer:

Determinants of Exchange Rates:

Exchange rates are determined by numerous factors and they are related to the trading relationship between two countries.

Factors determining Exchange Rate:

- Differentials in Inflation

- Differential in Interest Rates

- Current Account Deficits

- Public Debt

- Terms of Trade

- Political and Economic Stability

- Recession

- Speculation

1. Differentials in Inflation:

- Inflation and exchange rates are inversely related.

- A country with a consistently lower inflation rate exhibits a rising currency value, as its purchasing power increases relative to other currencies.

2. Differentials in Interest Rates:

- There is a high degree of correlation between interest rates, inflation and exchange rates.

- Central banks can influence over both inflation and exchange rates by manipulating interest rates.

- Higher interest rates attract foreign capital and cause the exchange rate to rise and vice versa.

3. Current Account Deficits:

- A deficit in the current account implies excess of payments over receipts.

- The country resorts to borrowing capital from foreign sources to make up the deficit.

- Excess demand for foreign currency lowers a country’s exchange rate.

4. Public Debt:

- Large public debts are driving out foreign investors, because it leads to inflation.

- As a result, exchange rate will be lower.

5. Terms of Trade:

- A country’s terms of trade also determines the exchange rate.

- If the price of a country’s exports rises by a greater rate than that of its imports, its terms ‘ of trade will improve.

- Favorable terms of trade imply greater demand for the country’s exports and thus BoP becomes favorable.

6. Political and Economic Stability:

If a nation’s political climate is stable and economic performance is good, its currency value will be appreciated by attracting more foreign capital.

7. Recession:

- Interest rates are low during the recession phase.

- This will decrease inflow of foreign capital.

- As a result, a currency will be depreciated against other currencies, thereby lowering the exchange rate.

8. Speculation:

- If a country’s currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future.

- This results in appreciation of the exchange rate.

- Beside the above determinants, relative dominance in the global politics and the power to announce economic sanctions over other countries also determine exchange rates.

Question 42.

Explain the relationship between Foreign Direct Investment and economic development?

Answer:

Foreign Direct Investment (FDI) and Trade:

- FDI is an important factor in global economy.

- Foreign trade and FDI are closely related. In developing countries like India

- FDI in the natural resource sector, including plantations, increases trade volume.

- Foreign production by FDI is useful to substitute foreign trade.

- FDI is also influenced by the income generated from the trade and regional integration schemes.

- FDI is helpful to accelerate the economic growth by facilitating essential imports needed for carrying out development programmes like capital goods, technical know-how, raw materials and other inputs and even scarce consumer goods.

- FDI may be required to fill the trade gap.

- FDI is encouraged by the factors such as foreign exchange shortage, desire to create employment and acceleration of the pace of economic development.

- Many developing countries strongly prefer foreign investment to imports.

- However, the real impact of FDI on different sections of an economy.

Samacheer Kalvi 12th Economics International Economics Addtional Questions and Answers

Part – I

Multiple Choice Questions.

Question 1.

Foreign trade means ………………………..

(a) Trade between nations of the world

(b) Trade among different states

(c) Trade among two states

(d) Trade with one nation

Answer:

(a) Trade between nations of the world

Question 2.

Balance of Trade means

(a) Import and export of invisible items only

(b) Import and export of both visible and invisible items

(c) Import of visible items only

(d) Import and export of visible items only

Answer:

(d) Import and export of visible items only

Question 3.

International trade is regulated at present by ………………………..

(a) IBRD

(b) WTO

(c) OMF

(d) GATT

Answer:

(b) WTO

Question 4.

The exports of India are broadly classified into ……………………….. categories.

(a) Two

(b) Three

(c) Four

(d) Five

Answer:

(c) Four

Question 5.

The New Export – Import policy gives a further push to ………………………..

(a) Liberalisation

(b) Mixed system

(c) Capitalism

(d) Socialism

Answer:

(a) Liberalisation

Question 6.

The World Trade organisation is a ………………………..

(a) Promote of private foreign investment

(b) Promoter of International monetary co-operation

(c) Lateral trade agreement

(d) New trade body to settle trade disputes between nations

Answer:

(d) New trade body to settle trade disputes between nations

Question 7.

To promote ……………………….. stability is one of the aims of IMF.

(a) Exchange

(b) Money

(c) Investment

(d) Finance

Answer:

(a) Exchange

Question 8.

The New Export Import policy was implemented in ………………………..

(a) 1990 – 1995

(b) 1991 – 1996

(c) 1992 – 1997

(d) 1993 – 1998

Answer:

(c) 1992 – 1997

Question 9.

The role of WTO is to regulate trade among the nations of the ………………………..

(a) Trade

(b) Organisation

(c) World

(d) Regulation

Answer:

(c) World

Question 10.

The WTO was setup in the year ………………………..

(a) 1995

(b)1885

(c) 1875

(d) 1865

Answer:

(a) 1995

Question 11.

……………………….. means value of imports is in excess of the value exports.

(a) Balance of Trade

(b) Unfavourable balance of trade

(c) Favourable balance of trade

(d) Export trade

Answer:

(b) Unfavourable balance of trade

Question 12.

……………………….. items means the imports and exports of services and other foreign transfer transactions.

(a) Invisible

(b) Visible

(c) Exports

(d) Imports

Answer:

(a) Invisible

Question 13.

Foreign trade increases worker’s welfare atleast ……………………….. ways.

(a) Two

(b) Three

(c) Four

(d) Five

Answer:

(c) Four

Question 14.

……………………….. trade refers to the trade or exchange of goods and services between two or more countries.

(a) Internal

(b) External

(c) International

(d) Domestic

Answer:

(c) International

Question 15.

If trade is done on large scale it is called ………………………..

(a) Whole sale trade

(b) State trade

(c) Central trade

(d) World trade

Answer:

(a) Whole sale trade

Question 16.

The relationship between value of exports and value of imports is known as ………………………..

(a) EXIM

(b) Foreign exchange

(c) Trade

(d) Terms of trade

Answer:

(d) Terms of trade

Question 17.

If the value of exports is greater than value of imports then it is known as ……………………….. terms of trade.

(a) Unfavourable

(b) Favourable

(c) Moderate

(d) Low

Answer:

(b) Favourable

Question 18.

Imports of India may be divided into ……………………….. parts.

(a) Two

(b) Three

(c) Four

(d) Five

Answer:

(b) Three

Question 19.

……………………….. means imports and exports of commodities.

(a) EXIM

(b) Visible items

(c) Non visible items

(d) Foreign exchange

Answer:

(b) Visible items

Question 20.

……………………….. means exports and imports may be exactly equal.

(a) Balance of trade

(b) Balance of payments

(c) Balanced balance of Trade

(d) Balanced balance of payments

Answer:

(c) Balanced balance of Trade

Question 21.

A special branch of Economics which primarily deals with the basics of ……………………….. trade.

(a) Internal

(b) External

(c) International

(d) Foreign trade

Answer:

(c) International

Question 22.

FDI objective is called ………………………..

(a) Sales expansion

(b) Export expansion

(c) Import expansion

(d) EXIM expansion

Answer:

(a) Sales expansion

Question 23.

The currency of another country is called ………………………..

(a) Money transfer

(b) Money exchange

(c) Foreign exchange

(d) Foreign transfer

Answer:

(c) Foreign exchange

Question 24.

Abundance in the availability of a factor in a country is called ………………………..

(a) Endowment policy

(b) Comparative cost

(c) Absolute cost

(d) Factor Endowment

Answer:

(d) Factor Endowment

Question 25.

Foreign Investment mostly takes the form of ………………………..

(a) Indirect investment

(b) Direct investment

(c) IMF investment

(d) World bank investment

Answer:

(b) Direct investment

II. Match the following and choose the correct answer by using codes given below:

Question 1.

A. Internal Trade – (i) International trade

B. Modem Theory – (ii) Labour

C. Classical Theory – (iii) Geographical boundaries

D. Modem Theory – (iv) Eli Heckscher

Codes:

(a) A (ii) B (iii) C (iv) D (i )

(b) A (iii) B (i) C (ii) D (iv)

(c) A (iv) B (ii) C (i) D (iii)

(d) A (i) B (iv) C (iii) D (ii)

Answer:

(b) A (iii) B (i) C (ii) D (iv)

Question 2.

A. Export – (i) Disequillibrium

B. Secular – (ii) Surplus goods

C. Delibrate measure – (iii) Foreign loans

D. Monetary measures – (iv) Exchange control

Codes:

(a) A (ii) B (i) C (iii) D (iv)

(b) A (i) B (ii) C (iv) D (iii)

(c) A (iii) B (iv) C (ii) D (i)

(d) A (iv) B (iii) C (i) D (ii)

Answer:

(a) A (ii) B (i) C (iii) D (iv)

Question 3.

A. Adam Smith – (i) Foreign Exchange

B. Eli Heckscher – (ii) Absolute cost advantage

C. Movement of goods – (iii) Modem theory of International trade

D. FOREX – (iv) Visible trade

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (ii) B (iii) C (iv) D (i)

(c) A (iv) B (i) C (ii) D (iii)

(d) A (iii) B (iv) C (i) D (ii)

Answer:

(b) A (ii) B (iii) C (iv) D (i)

Question 4.

A. Term of trade – (i) Official reserve

B. FDI – (ii) Exchange rate

C. Gold stock – (iii) Income terms of trade

D. G.S; Dorrance – (iv) Global economy

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (iv) B (iii) C (ii) D (i)

(c) A (ii) B (iv) C (i) D (iii)

(d) A (iii) B (i) C (iv) D (ii)

Answer:

(c) A (ii) B (iv) C (i) D (iii)

Question 5.

A. Net Barter Terms of Trade – (i) Tf = (Px / Pm)Fs

B. Gross Barter Terms of Trade – (ii) Tn = (Ps / Pm) × 100

C. Income Terms of Trade – (iii) Tg = (Qm / Qs) × 100

D. Single Factoral Terms of Trade – (iv) Ts = (Ps / Pm)Qs

Codes:

(a) A (i) B (ii) C (iii) D (iv)

(b) A (iv) B (iv) C (i) D (ii)

(c) A (iv) B (i) C (ii) D (iii)

(d) A (ii) B (iii) C (iv) D (i)

Answer:

(d) A (ii) B (iii) C (iv) D (i)

III. State whether the statements are true or false.

Question 1.

(i) Trade is one of the powerful forces of economic integration.

(ii) Price of a commodity is measured by the amount of labour required to produce it.

(a) Both (i) and (ii) are false

(b) Both (i) and (ii) are true

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(b) Both (i) and (ii) are true

Question 2.

(i) International Economics is a specialized field of economics.

(ii) Inflation and exchange rates are direct relationship.

(a) Both (i) and (ii) are true

(b) Both (i) and (ii) are false

(c) (i) is false but (ii) is true

(d) (i) is true but (ii) is false .

Answer:

(d) (i) is true but (ii) is false.

Question 3.

(i) Movement of goods are called “Visible Trade”.

(ii) Only export and import of commodities are included in the statement of balance of trade of the country.

(a) Both (i) and (ii) are false

(b) Both (i) and (ii) are true

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(b) Both (i) and (ii) are true

Question 4.

(i) The Income terms of trade was given by Taussig.

(ii) Gross Barter Terms of trade was developed by G.S. Dorrance.

(a) Both (i) and (ii) are false

(b) Both (i) and (ii) are true

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(a) Both (i) and (ii) are false

Question 5.

(i) Viner constructed another index called “Double Factoral terms of Trade”.

(ii) Viner has devised another concept called the “Single factoral terms of trade”.

(a) Both (i) and (ii) are false

(b) Both (i) and (ii) are true

(c) (i) is true but (ii) is false

(d) (i) is false but (ii) is true

Answer:

(b) Both (i) and (ii) are true

IV. Which of the following is correctly matched.

Question 1.

(a) David Ricardo – Factor Endowment Theory

(b) Eli Heckscher – British Economist

(c) Marshall – Swedish Economist

(d) Adam Smith – Theory of Absolute cost advantage

Answer:

(d) Adam Smith – Theory of Absolute cost advantage

Question 2.

(a) TN = (Px / Pm) x 100 – Net Barter Term of Trade

(b) T = (Qm / Qx) x 100 – Income Terms of Trade

(c) Ty = (Px / Pm) Qx – Gross Barter Terms of Trade

(d) Tff = (Px / Pm)(Fx / Fm) – Single Factoral Terms of Trade

Answer:

(a) TN = (Px / Pm) x 100 – Net Barter Term of Trade

Question 3.

(a) SDR – Special Drawing Rights

(b) IMF – India Monetary Fund

(c) BOP – Balance of Price

(d) BOT – Balance of Technology

Answer:

(a) SDR – Special Drawing Rights

Question 4.

(a) NER – Normal Exchange Rate

(b) RER – Real Exchange Ratio

(c) NEER – Normal Effective Exchange Rate

(d) REER – Real Effective Exchange Rate

Answer:

(d) REER – Real Effective Exchange Rate

Question 5.

(a) FDI – Foreign Direct Investment

(b) FOREX – Foreign Export

(c) UDC – Under Development Consumption

(d) MNC – Multi National Country

Answer:

(a) FDI – Foreign Direct Investment

V. Which of the following is not correctly matched.

Question 1.

(a) P2 – Price level in India

(b) Pf – Price level in abroad (say VS)

(c) e – Nominal exchange rate is flexible

(d) Px – Price index of exports

Answer:

(c) e – Nominal exchange rate is flexible

Question 2.

(a) Internal Trade – Trade with in Nation

(b) External Trade – Trade between two countries

(c) Balance of Trade – Visible Trade

(d) Income Terms of Trade – Adam smith

Answer:

(d) Income Terms of Trade – Adam smith

Question 3.

(a) FOREX – Foreign Exchange

(b) WTO – World Trade Organisation

(c) FDI – Foreign Direct Investment

(d) IBRD – india Bank Recruitment Development

Answer:

(d) IBRD – india Bank Recruitment Development

Question 4.

(a) Cartels – Economic Integration

(b) Scarce factor – Imports

(c) Factor endowment theory – Ohlin and Ricardo

(d) Labour cost – Unrealistic

Answer:

(c) Factor endowment theory – Ohlin and Ricardo

Question 5.

(a) Intra – regional trade – Internal trade

(b) World Bank – IMF

(c) Types of Exchange Rate – Fixed exchange rate system

(d) Equillibrium Exchange Rate – David Ricardo

Answer:

(d) Equillibrium Exchange Rate – David Ricardo

VI. Pick the odd one out.

Question 1.

The major sectors benefied from FDi in India are ………………….

(a) Financial Sector

(b) Insurance

(c) Telecommunication

(d) Agriculture

Answer:

(d) Agriculture

Question 2.

Determinants of Exchange Rates

(a) Differentials in Inflation

(b) Differntials in Interest Rates

(c) Current Account Deficits

(d) Public people

Answer:

(d) Public people

Question 3.

Types of Exchange Rates

(a) REAL

(b) NEER

(c) Nominal exchange rate

(d) Real exchange rate

Answer:

(a) REAL

Question 4.

Export promotion is ………………….

(a) Reduction of duties

(b) Import Incentives

(c) Export subsidies

(d) Export Incentives

Answer:

(b) Import Incentives

Question 5.

Monetary measures is ………………………

(a) Monetary contraction

(b) Devaluation

(c) Tourism Development

(d) Exchange control

Answer:

(c) Tourism Development

VII. Assertion and Reason.

Question 1.

Assertion (A): David Ricardo was formulated as an explicit and precise theory.

Reason (R): David Ricardo developed the theory of absolute cost advantage.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 2.

Assertion (A): Gains from International trade.

Reason (R): International trade also known as domestic trade.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Question 3.

Assertion (A): FDI is an Domestic Economy.

Reason (R): FDI is an Global Economy.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(d) ‘A’ is false but ‘R’ is true

Question 4.

Assertion (A): Exchange control means the state intervention.

Reason (R): Exchange control means the forex market.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

Question 5.

Assertion (A): Price of a commodity is measured by the amount of labour required to produce it.

Reason (R): Trade is one of the Demerit.

(a) Both ‘A’ and ‘R’ are true and ‘R’ is the correct explanation to ‘A’

(b) Both ‘A’ and ‘R’ are true but ‘R’ is not the correct explanation to ‘A’

(c) ‘A’ is true but ‘R’ is false

(d) ‘A’ is false but ‘R’ is true

Answer:

(c) ‘A’ is true but ‘R’ is false

Part – B

Answer The Following Questions In One or Two Sentences.

Question 1.

Define “Domestic Trade”?

Answer:

- It refers to the exchange of goods and services within the political and geographical boundaries of a nation.

- It is a trade within a country.

- This is also known as ‘domestic trade’ or ‘home trade’ or ‘intra-regional trade’.

Question 2.

State Ricardo’s Theory of comparative cost advantage criticisms?

Answer:

Criticisms:

- Labour cost is a small portion of the total cost. Hence, theory based on labour cost is unrealistic.

- Labourers in different countries are not equal in efficiency.

Question 3.

Write Factor endowment model?

Answer:

Factor endowment model:

- Developed by Heckscher and Ohlin

- Countries with a relative factor abundance can specialise and trade

- Abundance of skilled labour → specialisation → export → exchange for goods are services produced by countries with abundance of unskilled labour

- Exports embody the abundant factor

- Imports embody the scarce factor

Question 4.

Write Modern Theory of International Trade differences in comparative costs?

Answer:

Modem Theory of International Trade theory attributes international differences in comparative costs to:

- Difference in the endowments of factors of production between countries, and

- Differences in the factor proportions required in production.

Question 5.

Write Modern Theory of International Trade Limitations?

Answer:

Limitations:

- Factor endowment of a country may change over time.

- The efficiency of the same factor (say labour) may differ in the two countries. For example, America may be labour scarce in terms of number of workers. But in terms of efficiency, the total labour may be larger.

Question 6.

Define “Visible Trade”?

Answer:

Visible Trade:

Only export and import of commodities are included in the statement of Balance of Trade of a country. Movements of goods (export and imports of commodities) are also known as ‘visible trade’,

Question 7.

Define “Balance of Payments Disequillibrium”?

Answer:

Balance of Payments Disequilibrium:

The BoP is said to be balanced when the receipts (R) and payments (P) are just equal, i.e.,

R / P = 1

Question 8.

Write favourable and unfavourable balance of payments and equations?

Answer:

Favourable BoP:

When receipts exceed payments, the BoP is said to be favourable. That is,

R / P > 1.

Unfavourable BOP:

When receipts are less than payments, the BoP is said to be unfavourable or adverse. That is,

R / P < 1.

Part – C

Answer The Following Questions In One Paragraph.

Question 1.

Write Adam Smith’s theory of Absolute Cost Advantage Assumptions?

Answer:

Assumptions:

- There are two countries and two commodities (2 x 2 model).

- Labour is the only factor of production.

- Labour units are homogeneous.

- The cost or price of a commodity is measured by the amount of labour required to produce it.

- There is no transport cost.

Question 2.

Write Ricardo’s Theory of Comparative Cost Advantage Assumptions/

Answer:

Assumptions:

- There are only two nations and two commodities (2 × 2 model)

- Labour is the only element of cost of production.

- All labourer s are of equal efficiency.

- Labour is perfectly mobile within the country but perfectly immobile between countries.

- Production is subject to the law of constant returns.

- Foreign trade is free from all barriers.

- No change in technology.

- No transport cost.

- Perfect competition.

- Full employment.

- No government intervention.

Question 3.

What are International Specialization gains?

Answer:

International specialization offers the following gains.

- Better utilization of resources.

- Concentration in the production of goods in which it has a comparative advantage.

- Saving in time.

- Perfection of skills in production.

- Improvement in the techniques of production.

- Increased production.

- Higher standard of living in the trading countries.

Question 4.

Write favourable and unfavourable balance of Trade?

Answer:

Favourable BOT:

When the total value of commodity exports of a country exceeds the total value of commodity imports of that country, it is said that the country has a ‘favourable’ balance of trade.

Unfavourable BOT:

If total value of commodity exports of a country is less than the total . value of commodity imports of that country, that country is said to have an ‘unfavourable’ balance of trade.

Part – D

Answer The Following Questions In About A page.

Question 1.

Explain the Adam Smith’s Theory of Absolute Cost Advantage Theory and Assumptions with diagram?

Answer:

Adam Smith’s Theory of Absolute Cost Advantage:

Adam Smith argued that all nations can be benefitted when there is free trade and specialisation in terms of their absolute cost advantage.

The Theory:

1. According to Adam Smith, the basis of international trade was absolute cost advantage.

2. Trade between two countries would be mutually beneficial when one country produces a commodity at an absolute cost advantage over the other country which in turn produces another commodity at an absolute cost advantage over the first country.

Assumptions:

- There are two countries and two commodities (2 × 2 model).

- Labour is the only factor of production.

- Labour units are homogeneous.

- The cost or price of a commodity is measured by the amount of labour required to produce it.

- There is no transport cost.

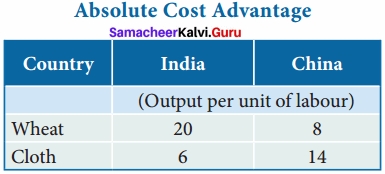

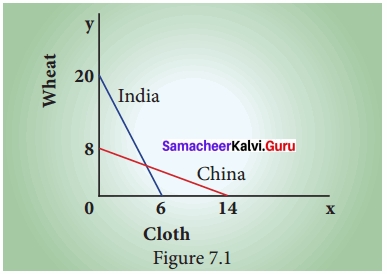

Illustration:

Absolute cost advantage theory can be illustrated with the help of the following example.

- From the illustration, it is clear that India has an absolute advantage in the production of wheat over China and China has an absolute advantage in the production of cloth over India.

- Therefore, India should specialize in the production of wheat and import cloth from China.

- China should specialize in the production of cloth and import wheat from India.

- This kind of trade would be mutually beneficial to both India and China.

Question 2.

Briefly explain the gains from International Trade Categories?

Answer:

Gains from International Trade:

- International trade helps a country to export its surplus goods to other countries and secure a better market for it.

- Similarly, international trade helps a country to import the goods which cannot be produced at all or can be produced at a higher cost.

- The gains from international trade may be categorized under four heads.

I. Efficient Production:

- International trade enables each participatory country to specialize in the production of goods in which it has absolute or comparative advantages.

- International specialization offers the following gains.

- Better utilization of resources.

- Concentration in the production of goods in which it has a comparative advantage.

- Saving in time.

- Perfection of skills in production.

- Improvement in the techniques of production.

- Increased production.

- Higher standard of living in the trading countries.

II. Equalization of Prices between Countries:

International trade may help to equalize prices in all the trading countries.

- Prices of goods are equalized between the countries (However, in reality it has not happened).

- The difference is only with regard to the cost of transportation.

- Prices of factors of production are also equalized (However, in reality it has not happened).

III. Equitable Distribution of Scarce Materials:

International trade may help the trading countries to have equitable distribution of scarce resources.

IV. General Advantages of International Trade:

- Availability of variety of goods for consumption.

- Generation of more employment opportunities.

- Industrialization of backward nations.

- Improvement in relationship among countries (However, in reality it has not happened).

- Division of labour and specialisation.

- Expansion in transport facilities.

Question 3.

Describe the Types of Terms of Trades?

Answer:

Types of Terms of Trade:

The different concepts of terms of trade were classified by Gerald M.Meier into the following three categories:

Terms of Trade related to the Ratio of Exchange between Commodities:

1. Net Barter Terms of Trade:

- This type was developed by Taussig in 1927.

- The ratio between the prices of exports and of imports is called the “net barter terms of trade’.

- It is named by Viner as the ‘commodity terms of trade’.

It is expressed as:

Tn = (Px / Pm ) × 100

Where,

Tn = Net Barter Terms of Trade

Px = Index number of export prices

Pm = Index number of import prices

This is used to measure the gain from international trade.

If ‘Tn’ is greater than 100, then it is a favourable terms of trade which will mean that for a rupee of export, more of imports can be received by a country.

2. Gross Barter Terms of Trade:

- This was developed by Taussig in 1927 as an improvement over the net terms of trade.

- It is an index of relationship between total physical quantity of imports and the total physical quantity of exports.

T = (Qm / Qx) × 100 Where,

Qm = Index of import quantities .

Qx = Index of export quantities

If for a given quantity of export, more quantity of import can be consumed by a country, then one can say that terms of trade are favourable.

3. Income Terms of Trade:

- The income terms of trade was given by G.S.Dorrance in 1948.

- It is the index of the value of exports divided by the price index for imports multiplied by quantity index of experts.

- In other words, it is the net barter terms of trade of a country multiplied by its exports – volume index.

T = (Px / Pm) Q

Where,

Px = Price index of exports

Pm = Price index of imports

Qx = Quantity index of exports

Question 4.

Briefly explain causes for Balance of payments disequillibrium?

Answer:

Causes for BoP Disequilibrium:

The following are the major causes producing disequilibrium in the balance of payments of a country.

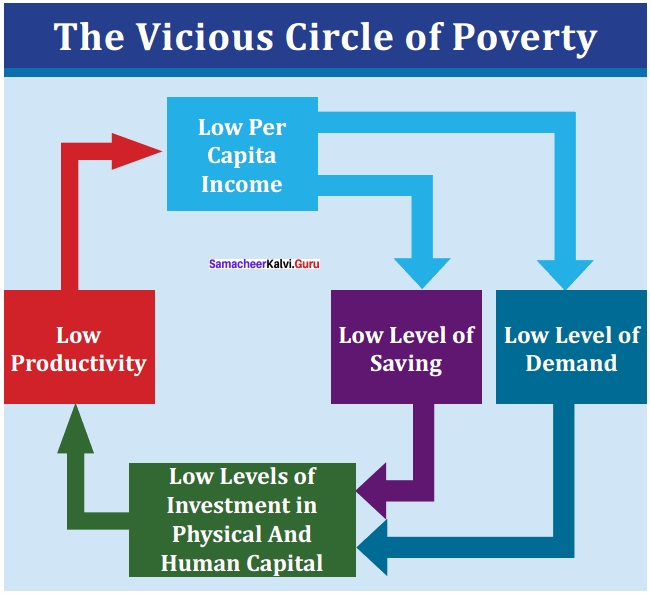

(I) Cyclical Fluctuation:

- Cyclical disequilibrium in different countries is caused by their cyclical fluctuations, their phases and magnitude.

- World trade shrinks during depression while trade flourishes during prosperity.

(II) Structural Changes:

- Structural disequilibrium is caused by the structural changes brought by huge development and investment programmes in the developing economies.

- Such economies may have high propensity to import for want of capital for rapid industrialization, while export may not be boosted up to that extent.

(III) Development Expenditure:

- Development disequilibrium is caused by rapid economic development which results in income and price effects.

- The less developed countries in the early stage of development are not self sufficient.

- Income, savings and investment are abysmally low.

- They depend upon developed countries for import of commodities, capital and technology.

- Export potential is low and import intensity is high.

- So the LDCs suffer from adverse BoP.

(IV) Consumerism:

- Balance of payments position of a country is adversely affected by a huge increase in consumption.

- This increases the need for imports and decreases the capacity to export.

(V) Demonstration Effect:

- Deficit in the balance of payments of developing countries is also caused by demonstration effect which influences the people in UDCs to imitate western styled goods.

- This will raise the propensity to import causing adverse balance of payments.

- This is good for the developed countries.

(VI) Borrowing:

- International borrowing and investment may cause a deficit in the balance of payments.

- When the international borrowing is heavy, a country’s balance of payments will be adverse since it repays loans with interest.

- Servicing of debt is a huge burden. That is why the UDCs are forced to borrow more, (viz) Technological Backwardness:

- Due to technological backwardness, the people (Indians) are unable to use the energy (Solar) available with them.

- As a result they import huge petroleum products from foreign countries, increasing the trade deficit.

(VII) Technological Backwardness:

- Due to technological backwardness, the people (Indians) are unable to use the energy (Solar) available with them.

- As a result they import huge petroleum products from foreign countries, increasing the trade deficit.

(VIII) Global Politics:

1. The rich countries (e.g. USA) need to sell their weapons to promote their economy and generate employment.

2. Hence, wars between countries (for example Iran and Irag, Pakistan and India) are stimulated In order to win the wars, the poor countries are forced to buy the weapons from weapon – rich countries, using their export earnings and creating trade deficit.

3. Thus UDCs are trapped forever.

Share this Tamilnadu State Board 12th Economics Solutions Chapter 7 International Economics Questions and Answers with your friends to help them to overcome the grammar issues in exams. Keep visiting this site frequently to get the latest information on different subjects. Clarify your doubts by posting the comments and get the answers in an easy manner.