Students can Download Tamil Nadu 12th Accountancy Model Question Paper 1 English Medium Pdf, Tamil Nadu 12th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 12th Accountancy Model Question Paper 1 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 2.30 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

When capital in the beginning is ₹ 10,000 drawings during the year ₹ 6,000 profit made during the year ₹ 2,000 and the additional capital introduced is ₹ 3,000 find the amount of capital at the end ________.

(a) ₹ 9,000

(b) ₹ 11,000

(c) ₹ 21,000

(d) ₹ 3,000

Answer:

(a) ₹ 9,000

Question 2.

Opening balance of debtors ₹ 30,000 Cash received ₹ 1,00,000, credit sales ₹ 90,000; closing balance of debtors is _______.

(a) ₹ 30,000

(b) ₹ 1,30,000

(c) ₹ 40,000

(d) ₹ 20,000

Answer:

(d) ₹ 20,000

Question 3.

Donations received for a specific purpose is ________.

(a) Revenue receipt

(b) Capital receipt

(c) Revenue expenditure

(d) Capital expenditure

Answer:

(b) Capital receipt

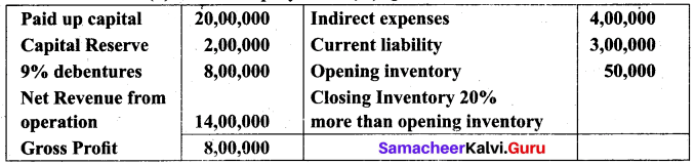

![]()

Question 4.

There are 500 members in a club paying ₹ 100 as annual subscription due but not received for the current year each is ₹ 200. Subscription received in advance ₹ 300. Find out the amount of subscription to be shown in income and expenditure account.

(a) ₹ 50,000

(b) ₹ 50,200

(c) ₹ 49,900

(d) ₹ 49,800

Answer:

(a) ₹ 50,000

Question 5.

Pick the odd one out.

(a) Partners share profits and losses equally

(b) Interest on partners capital is allowed at 7% P.a

(c) No salary or remuneration is allowed

(d) Interest an loan from partners is allowed at 6% P.a

Answer:

(b) Interest on partners capital is allowed at 7% P.a

Question 6.

Profit after interest on drawings interest on capital and remuneration is ₹ 10,500. Geetha a partner is entitled to receive commission @ 5% on profits after changing such commission find out commission ______.

(a) ₹ 50

(b) ₹ 150

(c) ₹ 550

(d) ₹ 500

Answer:

(d) ₹ 500

Question 7.

Which of these is an asset which is not fictitious but intangible in nature having realisable value.

(a) Furniture

(b) Machinery

(c) Building

(d) Goodwill

Answer:

(d) Goodwill

Question 8.

Goodwill is an asset that represents _______.

(a) Fictitious asset

(b) The market value of the company’s trade name

(c) The value of reputation of a firm

(d) None of these

Answer:

(c) The value of reputation of a firm

Question 9.

James and Kamal are sharing profits and losses ratio 5:3. They admit Sunil as a partner giving him 1/5 share of profits. Find out the sacrificing ratio _________.

(a) 1:3

(b) 3:1

(c) 5:3

(d) 3:5

Answer:

(c) 5:3

![]()

Question 10.

Balaji and Kamalesh are partners sharing profits and losses ratio 2:1. They admit Yogesh into partnership. The new profit sharing ratio between Balaji, Kamalesh and Yogesh is agreed to 3:1:1. Find the sacrificing ratio between Balaji and Kamalesh _______.

(a) 1:3

(6) 3:1

(c) 2:1

(d) 1:2

Answer:

(d) 1:2

Question 11.

A, B and C are partners sharing profits in the ratio of 4:2:3 C retires. The new profit sharing ratio between A and B will be ________.

(a) 4:3

(6) 3:4

(c) 2:1

(d) 1:2

Answer:

(c) 2:1

Question 12.

X, Y and Z were partners, sharing profit and losses equally. X died on 1st April 2019. Find out the share of X in the profit of 2019 based on the profit of 2018 which showed ₹ 36000 ________.

(a) ₹ 1,000

(b) ₹ 3,000

(c) ₹ 12,000

(d) ₹ 36,000

Answer:

(b) ₹ 3,000

Question 13.

If a share of ₹ 10 on which ₹ 8 has been paid up is forfeited. Minimum reissue price is _________.

(a) ₹ 10 per share

(b) ₹ 8 per share

(c) ₹ 5 per share

(d) ₹ 2 per share

Answer:

(d) ₹ 2 per share

Question 14.

Supreme Ltd forfeited 100 shares of ₹ 10 each for non – payment of final call of ₹ 2 per share. All these shares were reissued at ₹ 9 per share. What amount will be transferred to capital reserve account?

(a) ₹ 700

(b) ₹ 800

(c) ₹ 900

(d) ₹ 1000

Answer:

(a) ₹ 700

Question 15.

In a common size balance sheet, if the percentage of non-current assets is 75. What would be the percentage of current assets?

(a) 175

(b) 125

(c) 25

(d) 100

Answer:

(c) 25

![]()

Question 16.

Expenses of a business for the first year were ₹ 80,000. In the second year it was increased, to ₹ 88,000. What is the trend % in the second year?

(a) 10%

(b) 110%

(c) 90%

(d) 11%

Answer:

(b) 110%

Question 17.

Current liabilities ₹ 40,000; Current assets ₹ 1,00,000. Inventory ₹ 20,000. Quick ratio is ________.

(a) 1:1

(b) 2:5:1

(c) 2:1

(d) 1:2

Answer:

(c) 2:1

Question 18.

Cost of revenue from operations ₹ 3,00,000; Inventory in the beginning of the year ₹ 60,000; Inventory at the close of the year ₹ 40,000. Inventory turnover ratio is ________.

(a) 2 times

(b) 3 times

(c) 6 times

(d) 8 times

Answer:

(c) 6 times

Question 19.

₹ 50,000 withdrawn from bank for office use. In which voucher type, this transaction will be recorded ______.

(a) Contra voucher

(b) Receipt voucher

(c) Payment voucher

(d) Sales voucher

Answer:

(a) Contra voucher

Question 20.

In which voucher type credit purchase of furniture is recorded in Tally _________.

(a) Receipt voucher

(b) Journal voucher

(c) Purchase voucher

(d) Payment voucher

Answer:

(b) Journal voucher

Part – II

Answer any seven questions in which question No. 30 is compulsory. [7 × 2 = 14]

Question 21.

What is conversion method?

Answer:

It is one of the methods to find out profit or loss of a business when accounts are kept under single entry system. If it is desired to calculate the profit or loss by preparing trading and profit and loss account under single entry system. Then it is called conversion method. It is conversion of single entry into double entry.

![]()

Question 22.

Give four examples for capital receipts of not-for-profit organisation.

Answer:

- Life membership fees

- Legacies

- Sale of fixed assets

- Specific donations

Question 23.

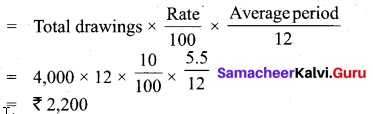

Sundar drew regularly ₹ 4,000 at their end of every month. Calculate interest on drawings at 10 % P.a. interest on drawings of Sundar

Answer:

Interest on drawings of Sundar

Question 24.

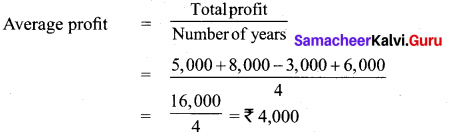

From the following information, calculate the value of goodwill on the basis of 3 years purchase of average profits of last four years 2015 profit – ₹ 5,000; 2016 profit – ₹ 8,000; 2017 loss – ₹ 3,000; 2018 profit – ₹ 6,000.

Answer:

Goodwill = Average profit × No. of years of purchase

Good will = Average profit × No. of years of purchase

= ₹ 4,000 × 3

Goodwill = ₹ 12,000

Question 25.

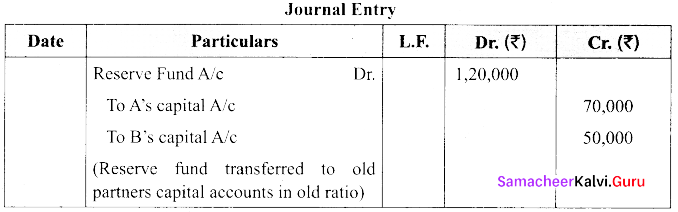

A and B were partners of the firm ratio 7:5 on 1.4.2018 the firm’s book showed a reserve fund ₹ 1,20,000 on the above date they decided to admit C into the firm pass entry.

Answer:

Question 26.

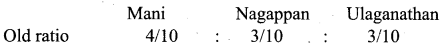

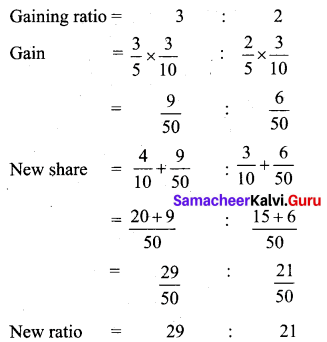

Mani, Nagappan, Ulaganathan are partner Sharing profit with ratio of 4:3:3. Ulaganathan retires and share is taken by Mani and Nagappan in the ratio of 8:2. Calculate new ratio.

Answer:

Calculation of new ratio:

![]()

Question 27.

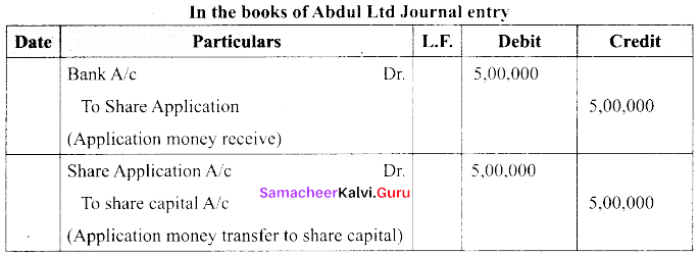

Abdul Ltd issues 50,000 shares of ₹ 10 each payable fully on application pass the entry shares are issued at.

Answer:

Question 28.

What is meant by “Financial Analysis”?

Answer:

Financial Analysis is a systematic process of classifying the data into simple groups and making a comparison of various groups with one another to pin-point the strong points and weakness of the business.

Question 29.

Give any two differences between current ratio & Quick ratio.

Answer:

Current Ratio:

- It indicates whether the firm is in a position to pay its current liabilities with in a year.

- Ideal Standard Ratio is 2:1

Quick Ratio:

- It indicates whether the firm is in a position to pay its current liabilities immediately with in a month.

- Quick Ratio Standard is 1:1

Question 30.

What are accounting reports?

Answer:

Accounting report is a compilation of accounting information that are derived from the accounting records of a business concern. Accounting reports may be classified as routine reports and special purpose reports.

Part – III

Answer any seven questions in which question No. 40 is compulsory. [7 × 3 = 21]

Question 31.

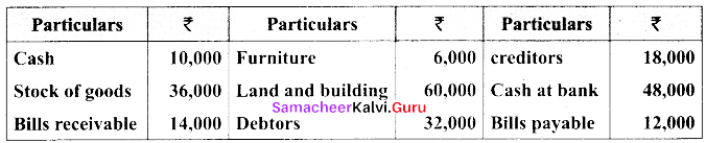

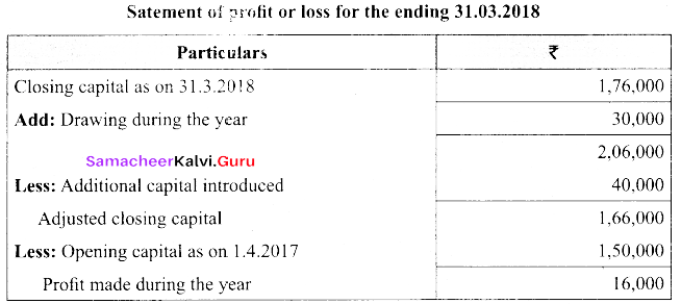

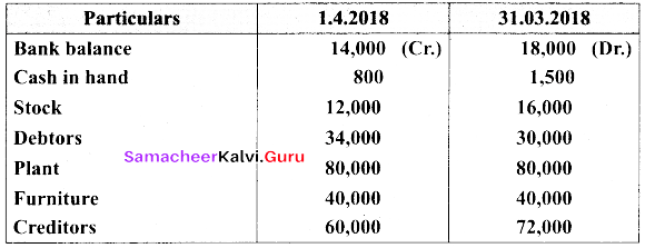

On 1st April Ganesh started his capital of ₹ 1,50,000. He did not main proper books of accounts. Following particulars are available from his books as on 31.03.2018.

Answer:

During the year he with drew ₹ 30,000 for his personal use. He introduced further capital of ₹ 40,000 during the year. Calculate his profit or loss.

Answer:

![]()

Question 32.

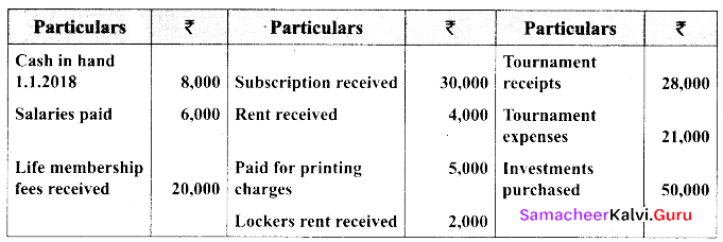

From the information given below, prepare receipts and payments account of Kurunji sports club for the year ended 31.12.2018.

Answer:

Question 33.

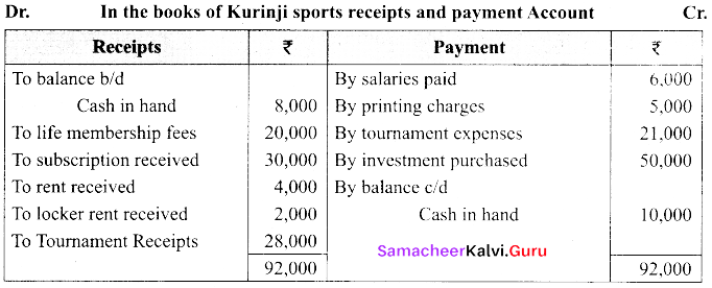

A, B and C are partners in a firm sharing profit and losses equally. As per the terms of the partnership deed B is allowed a monthly salary of ₹ 2,000 and ‘C’ is allowed a commission of ₹ 6,000 per annum for their contribution to the business of the firm. You are required to pass the necessary journal entry assume that their capitals are fluctuating.

Answer:

Salary of ‘B’ = ₹ 2,000 × 12 = ₹ 24,000

Commission of ‘C’ = 6,000

Question 34.

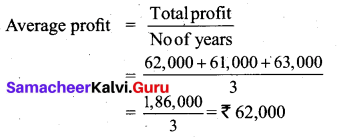

From the following information compute the value of goodwill be capitalising super profit.

(i) Capital employed ₹ 4,00,000

(ii) Normal Rate of return is 10%

(iii) Profit for 2016 – ₹ 62,000; 2017 – ₹ 61,000; 2018 – ₹ 63,000

Calculation of adjusted profit

Answer:

Normal profit = Capital employed × Normal rate of return

= ₹ 4,00,000 × 10%

= ₹ 40,000

Super profit = Average profit – Normal profit

= ₹ 62,000 – ₹ 40,000

= ₹ 22,000

Question 35.

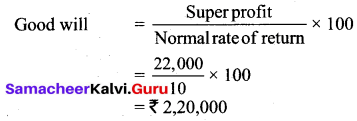

A and B are partners sharing profits in the ratio of 3:2 ‘C’ is admitted as a new partner and the new profit sharing ratio is decided as 5: 3: 2. The following revaluations are made. Pass journal entries.

(i) The value of building increased by ₹ 15,000

(ii) The value of the machinery is decreased by ₹ 4,000

(iii) Provision for doubtful debtors is made for ₹ 1,000

Answer:

![]()

Question 36.

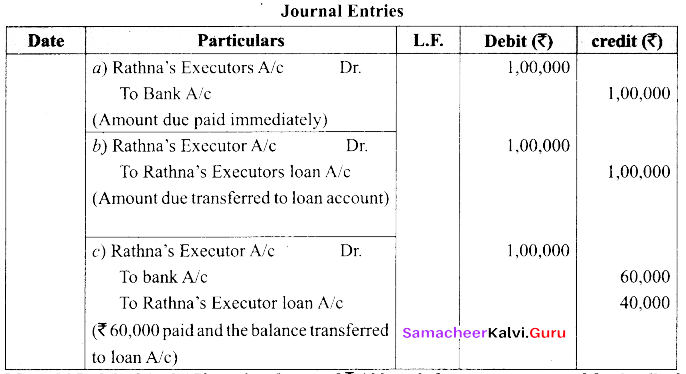

Rathna, Basker and Ibrahim are partners sharing profit and losses in the ratio of 2:3:4 respectively. Rathna died on 31st December, 2018. Final amount due to her showed a credit balance of ₹ 1,00,000. Pass journal entries if,

(а) The amount due is paid off immediately by cheque

(b) The amount due is not paid immediately

(c) ₹ 60,000 is paid immediately by cheque.

Answer:

Question 37.

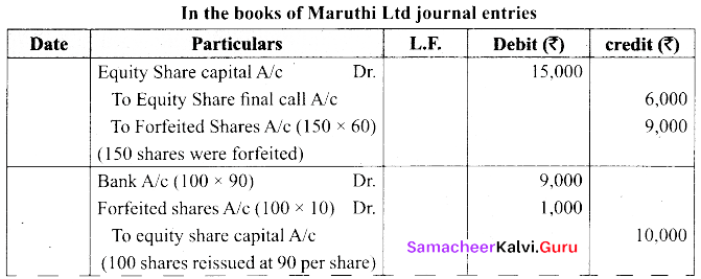

Maruthi Ltd forfeited 150 equity shares of ₹ 100 each for non payment of final call of ₹ 40 per share of these 100 shares were reissued at ₹ 90 per share pass journal entries for forfeiture and reissue.

Answer:

Forfeited shares amount of 150 shares ₹ 9,000

Gain or loss = 100 × (90 – 40)

= 100 × 50

= ₹ 5,000

Question 38.

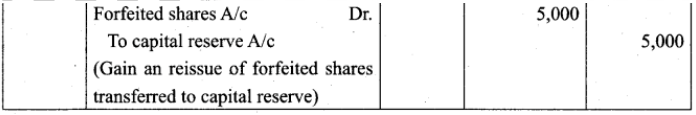

From the following information calculate (i) Debt equity ratio (ii) Working Capital Turnover Ratio.

| Particulars | ₹ |

| Net revenue from operation | 60,00,000 |

| Cost of revenue from operation | 45,00,000 |

| Other current assets | 11,00,000 |

| Current liabilities | 4,00,000 |

| Paid up share capital | 6,00,000 |

| 6% debentures | 3,00,000 |

| 9% loan | 1,00,000 |

| Debenture Redemption Reserve | 2,00,000 |

| Closing Inventors | 1,00,000 |

Answer:

(i) Debt Equity Ratio = \(\frac{\text { Debt }}{\text { Equity }}\)

Debt = 6% debentures + 9% loan

= ₹ 3,00,000 + ₹ 1,00,000 = ₹ 4,00,000

Equity = Paid up share capital + Debenture Redemption Reserve

= 6,00,000 + 2,00,000 = 8,00,000

Debt Equity Ratio = \(\frac{4,00,000}{8,00,000}\) = 0.5 = 1

(ii)

Working Capital = Other Current Assets + Closing Inventors – Current Liabilities

= ₹ 11,00,000 + ₹ 1,00,000 – ₹ 4,00,000 = 8,00,000.

Working capital turnover ratio = \(\frac{60,00,000}{8,00,000}\) =7.5 times

Question 39.

Write a short note on (i) Horizontal Analysis (ii) Vertical Analysis

Answer:

(i) Horizontal Analysis:

Financial statements for a number of years are reviewed and analysed. Figures for two or more years are contained in such type of analysis and these figures are placed side – by – side to facilitate comparison. Such analysis indicates the increase or decrease in these items not only in absolute figures but also in percentage form.

(ii) Vertical Analysis:

Financial statements for a single year or on a particular date are reviewed and analysed with the help of proper devices like ratios. It involves a study of the quantitative relationship among various items of balance sheet or profit and loss account.

![]()

Question 40.

Write any three Applications of Computerised Accounting System.

Answer:

(i) Maintaining accounting records:

In computerised accounting system, accounting records can be maintained easily and efficiently for long time period. It does not require a large amount of physical space. It facilitates fast and accurate retrieval of data and information.

(ii) Inventory management:

Computerised accounting system facilitates efficient management of inventory. Fast moving, slow moving and absolete inventory can be identified. Updated information about availability of inventory, level of inventory etc can be obtained instantly.

(iii) Report generation:

Computerised accounting system helps to generate various routine and special purpose reports.

Part – IV

Answer all the questions. [7 × 5 = 35]

Question 41.

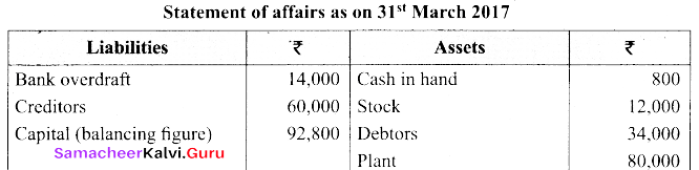

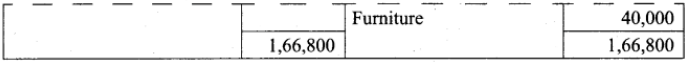

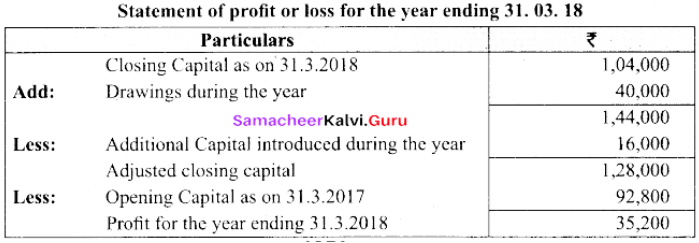

(a) Ahmed does not keep proper books of accounts. Find the profit or loss made by him for the year ending 31st march 2018.

Ahmed had withdrawn ₹ 40,000 for his personal use. He had introduced ₹ 16,000 as . capital for expansion of his business. A provision of 5% on debtors is to be made. Plant is to be depreciated at 10%.

Answer:

Calculation of opening capital:

Calculation of closing capital:

[OR]

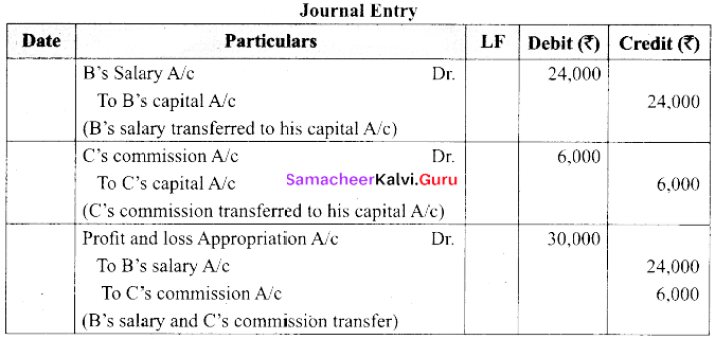

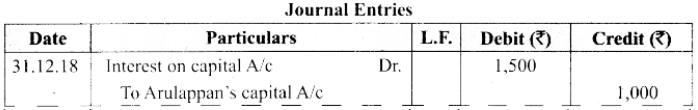

(b) Arulappan and nallasamy are partners in a firm sharing profit and losses in the ratio 4:1 on 1st January 2018 their capitals were ₹ 20,000 and ₹ 10,000 respectively. The partnership deed specifies the following.

(i) Interest on capital is to be allowed 5%P.a

(ii) Interest on drawings charged to Arulappan and Nallasamy are ₹ 200 and ₹ 300 respectively.

(iii) The net profit of the firm before considering interest on capital and interest on drawings amounted to ₹ 18,000.

Give necessary journal entries and prepare profit and loss appropriation account for the year ending 31st December 2018. Assume that the capitals are fluctuating.

Answer:

![]()

Question 42.

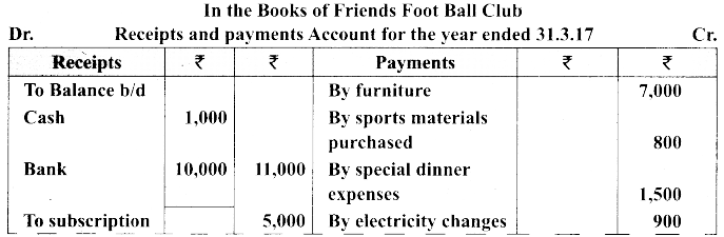

(a) From the following receipts and payments of friends football club for the year ending 31st march 2017.

Prepare income and expenditure for the year ending 31st March 2017 and the balance sheet as on that date.

Answer:

Additional information:

(i) The club had furniture of ₹ 12,000 on 1st April 2016. Ignore depreciation on furniture.

(ii) Subscription outstanding for 2016-17 – ₹ 600

(iii) Stock of sports materials on 31.3.2017 – ₹ 100

(iv) Capital fund as on 1st April 2016 was ₹ 23,000

Answer:

[OR]

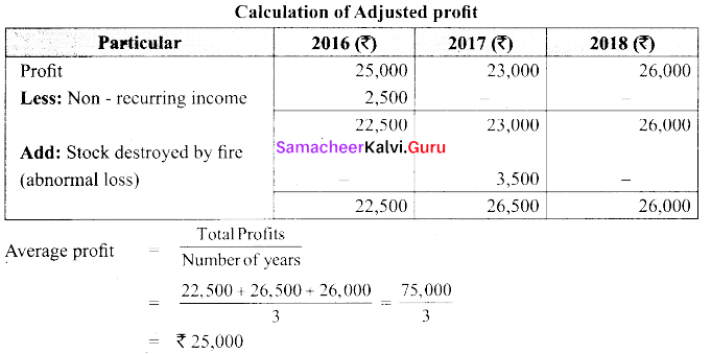

(b) The following particulars are available in respect of the business carried on by a partnership firm.

(i) Profits earned 2016 – ₹ 25,000; 2017 – ₹ 23,000; 2018 – ₹ 26,000

(ii) Profit of 2016 includes a non – recurring income of ₹ 2,500.

(iii) Profit of 2017 is reduced by ₹ 3,500 due to stock destroyed by fire.

(iv) The stock was not insured. But it is decided to insure the stock in future. The insurance premium is estimated to be ₹ 250 per annum.

You are required to calculate the value of goodwill of the firm on the basis of 2 years purchase of average profits of the last three years.

Answer:

Goodwill = Average profit × Number of years of purchase

= 24,750 × 2

= ₹ 49,500

Question 43.

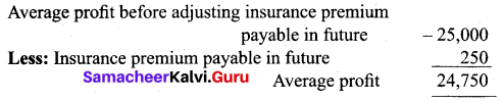

(a) The following particular calculate the goodwill on the

(i) Basis of two years purchase of super profits earned on average basis during the above mentioned three years by

(ii) Capitalisation method. The firm earned net profit for 3 years 2013 – ₹ 1,90,000; 2014 – ₹ 2,20,000; 2015 – ₹ 2,50,000. The capital employed in the firm ₹ 4,00,000, risk involved 15% is considered to be a fair return on the capital. The remuneration of the partners during the period ₹ 1,00,000 P.a.

Answer:

(i)

Super profit = Average profit – Normal profit

= 2,20,000 – 1,60,000 = ₹ 60,000

Goodwill = Super profit × No. of. years purchase

= 60,000 × 2

= ₹ 1,20,000

(ii) Capitalisation method:

Goodwill = Capitalised Value of Average Profit – Actual capital employed

Average profit = 2,20,000 – 1,00,000

= ₹ 1,20,000

Capitalised value of average profit = Average profit × \(\frac{100}{\text { Rate of return }}\)

= 1,20,000 × \(\frac{100}{15}\) = ₹ 8,00,000

Good will = 8,00,000 – 4,00,000

= ₹ 4,00,000

[OR]

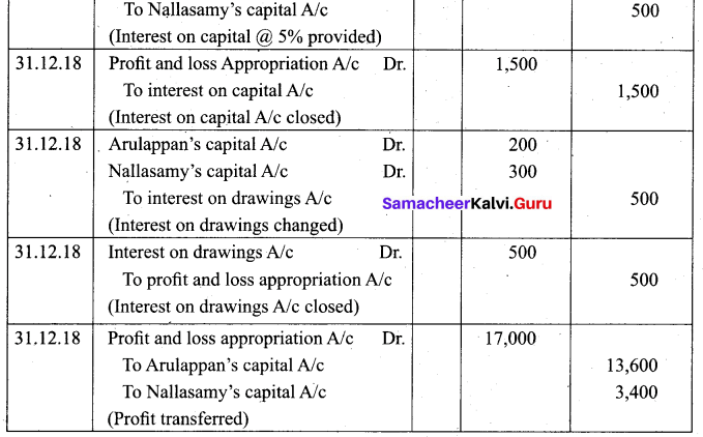

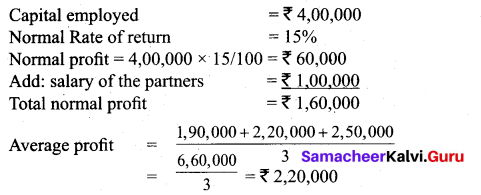

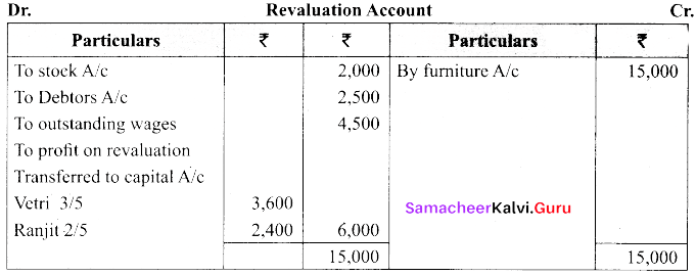

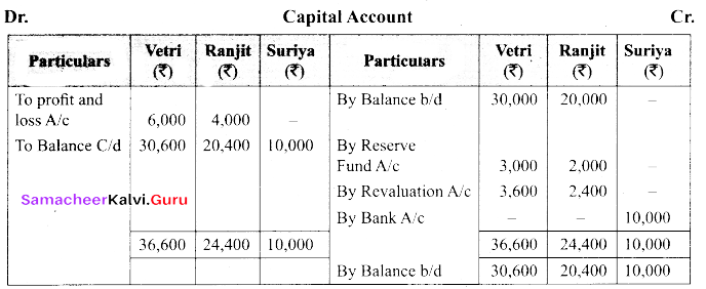

(b) Vetri and Ranjit are partners sharing profit in the ratio 3:2. Their balance sheet as on 31st December 2017 is as under.

On 1.1.2018 they admit suriya into their firm as a partner on the following arrangements.

(i) Suriya brings ₹ 10,000 as capital for 1/4% share of profit

(ii) Stock to be depreciated by 10%

(iii) Debtors to be revalued at ₹ 7,500.

(iv) Furniture to be revalued at ₹ 40,000.

(v) There ia an outstanding wages ₹ 4,500 not yet recorded.Prepare revaluation account, partners capital account and the balance sheet of the firm after admission.

Answer:

![]()

Question 44.

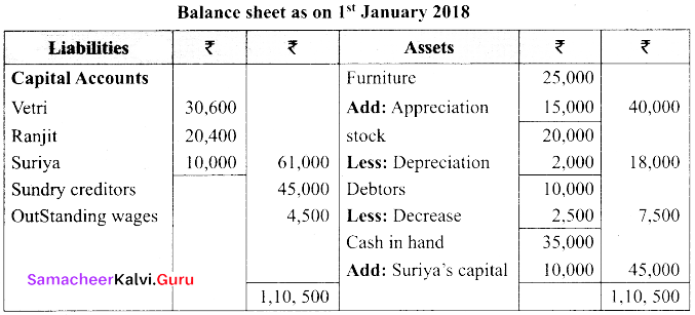

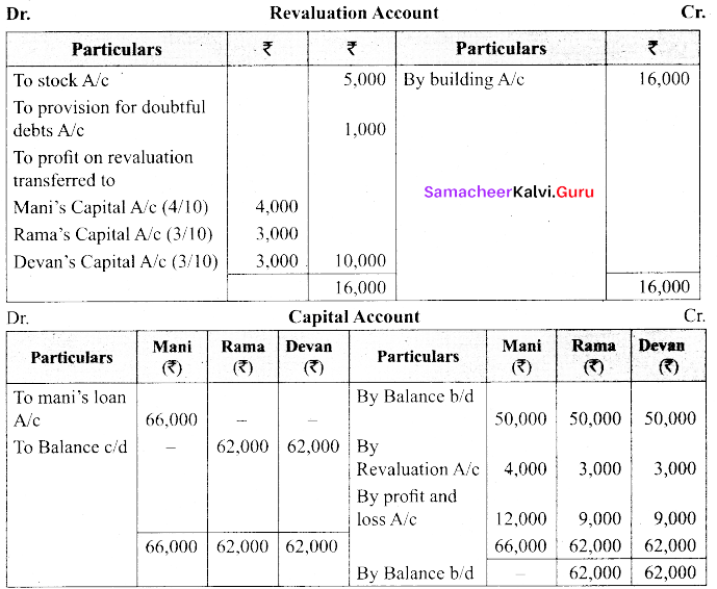

(a)Mani, Rama, Devan are partners in a firm sharing profit and losses in the ratio of 4:3:3. Their balance sheet as on 31st March 2019.

Mani retired from the partnership on 31.03.2019. subject to the following adjustment.

(i) Stock to be depreciated ₹ 5,000.

(ii) Provision for doubtful debts to be created for ₹ 1,000.

(iii) Buildings to be appreciated by ₹ 16,000. The final amount due to Mani is not paid immediately prepare revaluation A/c, Capital Account.

Answer:

[OR]

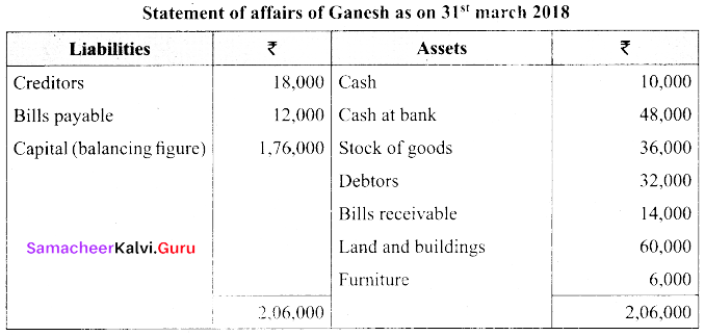

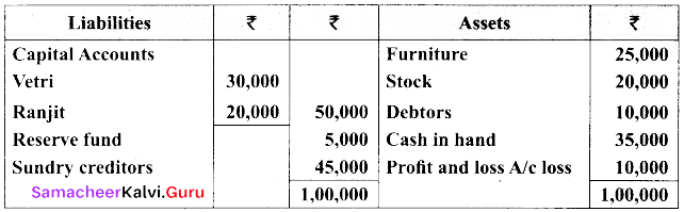

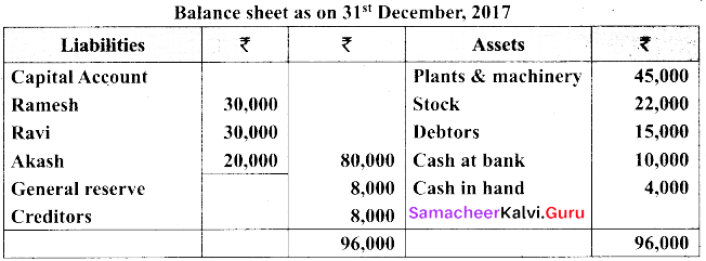

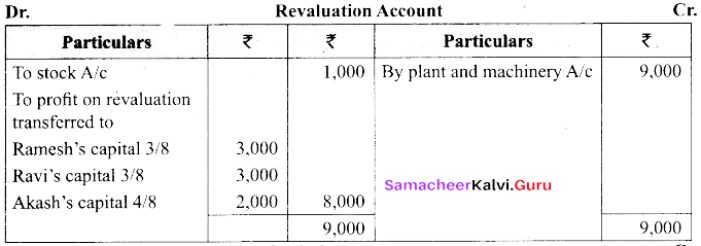

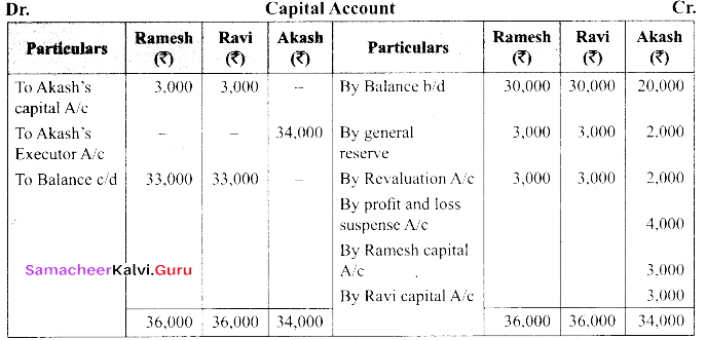

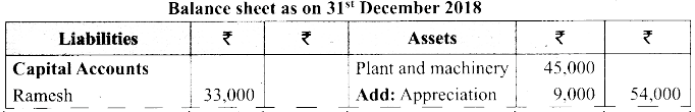

(b) Ramesh, Ravi, Akash are partners who share profits and losses in their capital ratio. Their balance sheet as on 31.12.17.

Akash died on 31.03.2018. On the death of Akash the following adjustment are made.

(i) Plant and machinery is to be valued at ₹ 54,000.

(ii) Stock to be depreciated by ₹ 1,000.

(iii) Goodwill of the firm is valued at ₹ 24,000.

(iv) Share of profit of akash is to be calculated from the closing of the last financial year to the date of death on the basis of the average of the three completed year profit before death Profit for 2015,2016, 2017 were ₹ 66,000; ₹ 60,000; ₹ 66,000 respectively. Prepare the necessary ledger accounts and the balance sheet.

Answer:

(i) Profit sharing ratio = capital ratio = 30,000 : 30,000 : 20,000 i.e. 3:3:2

Gaining ratio between Ramesh and Ravi = Old profit sharing Ratio = 3:3 i.e. 1 : 1

(ii) Calculation of Akash’s share of current years profit

![]()

Current year’s profit upto the date of death = 64,000 × 3/12 = ₹ 16,000

Akash’s share of current year’s profit = 16,000 × 2/8 = ₹ 4,000

(iii) Akash’s share of goodwill = 24,000 × 2/8 = ₹ 6,000

It is to be borne by Ramesh and Ravi in the gaining ratio = 1:1

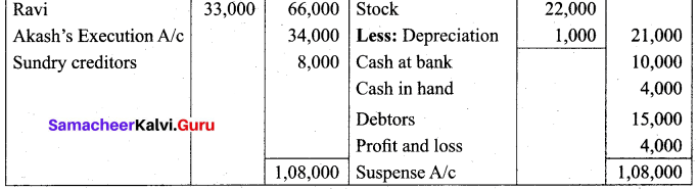

Question 45.

(a) Keerthiga company issued share of ₹ 10 each at 10% premium. Payable ₹ 2 on application, ₹ 3 on allotment (including premium), ₹ 3 on first call and ₹ 3 on second and final call. Journalise the transactions relating to forfeiture of shares for the following situations.

(i) Mohan who holds 50 shares failed to pay the second and final call and his shares were forfeited.

(it) Mohan who holds 50 shares failed to pay the allotment money first call and second and final call money and his shares were forfeited.

(iii) Mohan who holds 50-shares failed to pay the allotment money and first call and his shares were forfeited after the first call.

Answer:

[OR]

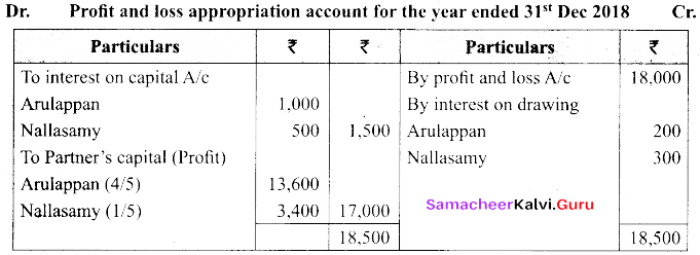

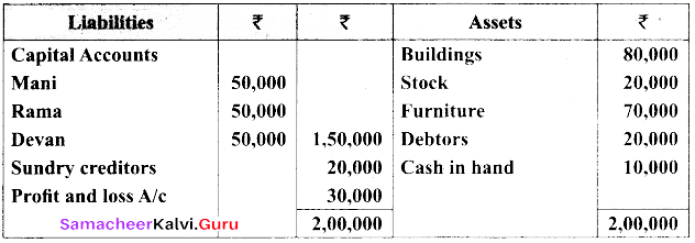

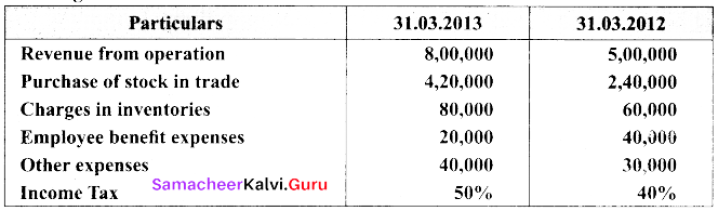

(b) Prepare comparative statement of profit and loss of Ahmed Ltd with the helps of following information.

Employees benefit expenses = Salaries wages, PF, staff welfare

Answer:

![]()

Question 46.

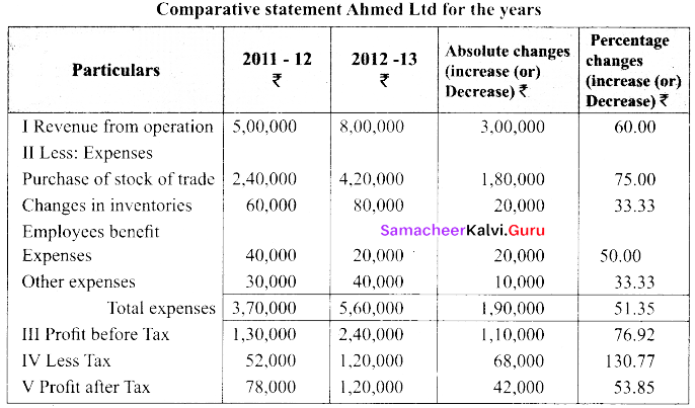

(a) From the following particulars of Neithal Ltd calculate trend percentage.

Answer:

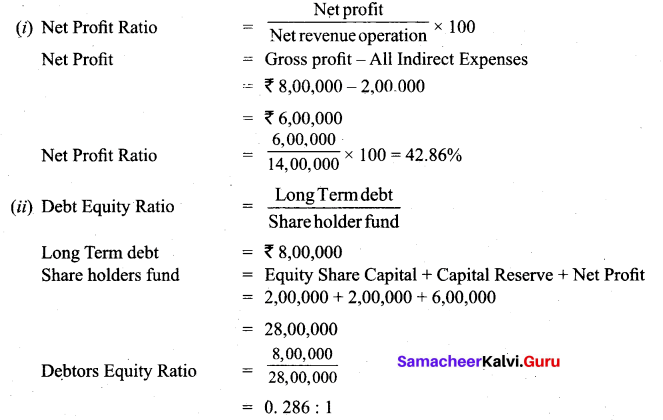

(b) From the following information calculate the following ratio.

(i) Net Profit Ratio

(ii) Debtors Equity Ratio

(iii) Quick Ratio

Answer:

![]()

Question 47.

(a) What are the Sailent Feature of tally ERP.9?

Answer:

(i) A leading accounting package:

The first version of Tally was released in 1988 and through continuous development is now recognised as one of the leading accounting packages across the world with over a quarter million of customer Tally’s market share is more than 90%.

(ii) No accounting codes:

Unlike other computerised accounting packages which require numeric codes. Tally ERP 9 pioneered the “no accounting codes” concept.

Tally ERP 9 users have the freedom to allocate meaningful names in plain English to their data items in the system.

(iii) Compute business solution:

Tally ERP 9 provides a comprehensive solution to the accounting and inventory needs of a business. The packages comprises financial accounting book keeping and inventory accounting. It also has various tools to extract interpret and present data.

(iv) Speed:

It allows the user to maintain multiple companies and with unlimited levels of classification and grouping capabilities. It also allows dried down facility from report level to transaction level.

(v) Versatibility:

Tally ERP is suitable for a range of organisations from small grocery stores to large corporations with international locations and operations.

(vi) Online help:

The Tally ERP 9 online help (AH + H) provides instant assistance on basic and advanced feathers or any other relavent topics of Tally ERP. 9.

[OR]

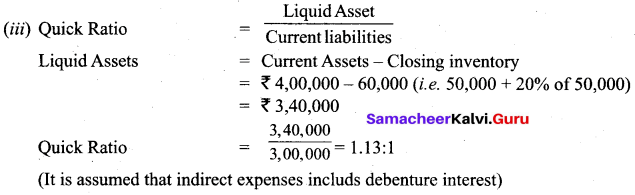

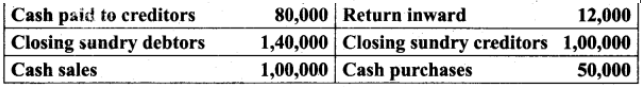

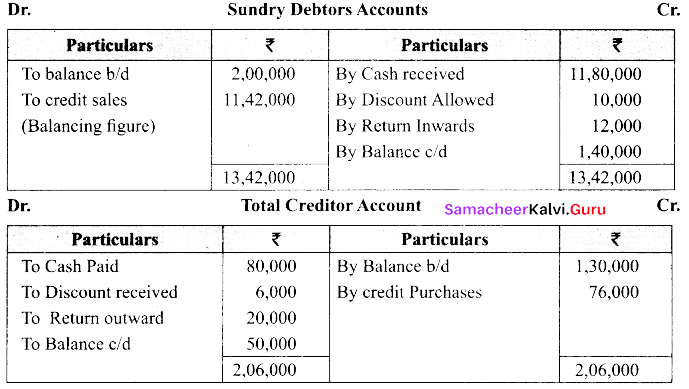

(b) Find out total purchases and total sales from the following details by preparing necessary accounts.

Answer:

Total sales = Cash sales + Credit sales

= ₹ 1,00,000 + ₹ 11,42,000

= ₹ 12,42,000

Total purchases = Cash purchases + Credit purchases

= ₹ 50,000 + ₹ 76,000

= ₹ 1,26,000