Students can Download Tamil Nadu 11th Accountancy Model Question Paper 2 English Medium Pdf, Tamil Nadu 11th Accountancy Model Question Papers helps you to revise the complete Tamilnadu State Board New Syllabus and score more marks in your examinations.

TN State Board 11th Accountancy Model Question Paper 2 English Medium

General Instructions:

- The question paper comprises of four parts.

- You are to attempt all the parts. An internal choice of questions is provided wherever applicable.

- All questions of Part I, II, III, and IV are to be attempted separately.

- Question numbers 1 to 20 in Part I are Multiple Choice Questions of one mark each.

These are to be answered by choosing the most suitable answer from the given four alternatives and writing the option code and the corresponding answer. - Question numbers 21 to 30 in Part II are two-mark questions. These are to be answered in about one or two sentences.

- Question numbers 31 to 40 in Part III are three-mark questions. These are to be answered in the above three to five short sentences.

- Question numbers 41 to 47 in Part IV are five-mark questions. These are to be answered in detail Draw diagrams wherever necessary.

Time: 3 Hours

Maximum Marks: 90

Part – I

Answer all the questions. Choose the correct answer. [20 × 1 = 20]

Question 1.

In …………, Luca Pacioli an Italian developed double-entry book-keeping system.

(a) 1494

(b) 1944

(c) 1894

(d) 1794

Answer:

(a) 1494

![]()

Question 2.

Which of the following does not follow dual aspect concept?

(a) Increase in one asset and decrease in other asset

(b) Increase in both asset and liability

(c) Decrease in one asset and decrease in other asset

(d) Increase in one asset and increase in capital

Answer:

(c) Decrease in one asset and decrease in other asset

Question 3.

Which one of the following is representative personal account?

(a) Buildings A/c

(b) Outstanding salary A/c

(c) Mahesh A/c

(d) Balan & Co.

Answer:

(b) Outstanding salary A/c

Question 4.

Prepaid rent is a ……………………….

(a) Nominal A/c

(b) Personal A/c

(c) Real A/c

(d) Representative personal A/c

Answer:

(d) Representative personal A/c

![]()

Question 5.

The amount brought into the business by the proprietor should be credited to ……………..

(a) Cash A/c

(b) Drawings A/c

(d) Representative personal A/c

(d) Suspense A/c

Answer:

(d) Representative personal A/c

Question 6.

A list which contains balances of accounts to know whether the debit and credit balances are

matched is …………

(a) Journal

(b) Day book

(c) Trial balance

(d) Balance sheet

Answer:

(c) Trial balance

Question 7.

Which of the following method(s) can be used for preparing trial balance?

(a) Balance method

(b) Total method

(c) Total and balance method

(d) (a), (b) and (c)

Answer:

(d) (a), (b) and (c)

Question 8.

Sales return book is used to record …………….

(a) Returns of goods by the customer for which cash is paid immediately

(b) Returns of goods by the customer for which cash is not paid immediately

(c) Returns of assets by the customer for which cash is not paid immediately

(d) Returns of assets by the customer for which cash is paid immediately

Answer:

(b) Returns of goods by the customer for which cash is not paid immediately

Question 9.

Purchase of fixed assets on credit basis is recorded in

(a) Purchases book

(b) Sales book

(c) Purchases returns book

(d) Journal proper

Answer:

(d) Journal proper

![]()

Question 10.

The balance in the petty cash book is ……….

(a) An expense

(b) A profit

(c) An asset

(d) A liability

Answer:

(c) An asset

Question 11.

When money is withdrawn from bank, the bank ………………..

(a) Credits customer’s account

(b) Debits customer’s account

(c) Debits and credits customer’s account

(d) None of these

Answer:

(b) Debits customer’s account

Question 12.

Which of the following errors will not affect the trial balance?

(a) Wrong balancing of an account

(b) Posting an amount in the wrong account but on the correct side

(c) Wrong totalling of an account

(d) Carried forward wrong amount in a ledger account

Answer:

(b) Posting an amount in the wrong account but on the correct side

Question 13.

Goods returned by Senguttuvan were taken into stock, but no entry was passed in the books, while rectifying this error, which of the following accounts should be debited?

(a) Senguttuvan account

(b) Sales returns account

(c) Returns outward account

(d) Purchases returns account

Answer:

(b) Sales returns account

Question 14.

Cash received from sale of fixed assets is credited to ………..

(a) Profit and loss account

(b) Fixed asset account

(e) Depreciation account

(d) Bank account

Answer:

(b) Fixed asset account

Question 15.

Depreciation is caused by ……………..

(a) Lapse of time

(b) Usage

(c) Obsolescence

(d) (a), (b) and (c)

Answer:

(d) (a), (b) and (c)

![]()

Question 16.

Revenue expenditure is intended to benefit ………………

(a) Past period

(b) Future period

(c) Current period

(d) Any period

Answer:

(c) Current period

Question 17.

Pre-operative expenses are ………………….

(a) Revenue expenditure

(b) Prepaid revenue expenditure

(c) Deferred revenue expenditure

(d) Capital expenditure

Answer:

(d) Capital expenditure

Question 18.

Bank overdraft should be shown………………….

(a) In the trading account

(b) Profit and loss account

(c) On the liabilities side

(d) On the assets side

Answer:

(c) On the liabilities side

Question 19.

If there is no existing provision for doubtful debts, provision created for doubtful debts is………………….

(a) Debited to bad debts account

(b) Debited to sundry debtors account

(c) Credited to bad debts account

(d) Debited to profit and loss account

Answer:

(d) Debited to profit and loss account

Question 20.

One of the limitations of computerized accounting system is ……………….

(a) System software

(b) Accuracy

(c) Versatility

(d) Storage

Answer:

(a) System software

Part – II

Answer any seven questions in which question No. 21 is compulsory: [7 × 2 = 14]

Question 21.

Who are External users?

Answer:

External users are the persons who are outside the organisation but piake use of accounting information for their purposes.

Question 22.

What is Real account?

Answer:

All accounts relating to tangible and intangible properties and possessions are called real accounts. .

Question 23.

Write any two procedure for balancing an account.

Answer:

- The debit and credit columns of an account are to be totalled separately.

- The difference between the two totals is to be ascertained.

![]()

Question 24.

Mention any two features of trial balance.

Answer:

- Trial balance contains the balances of all ledger accounts.

- It is prepared on a specific date, that is why, the word, “as on ” is used at the top.

Question 25.

What is Purchases book?

Answer:

Purchases book is a subsidiary book in which only credit purchases of goods are recorded.

Question 26.

What is Contra entry?

Answer:

When the two accounts involved in a transactions are cash account and bank account, then both the aspects are entered in the cash book itself. As both the debit and credit aspects of a transaction are recorded in the cash book, such entries are called contra entries.

Question 27.

What is bank overdraft?

Answer:

It is not possible to have unfavourable cash balance in the cash book. But, it is possible to have unfavourable balance in the bank account. When the business is not having sufficient money in its bank account, it can borrow money from the bank. As a result of this, amount is overdrawn from bank.

Question 28.

What is compensating errors?

Answer:

The errors that make up for each other or neutralise each other are known as compensating errors.

Question 29.

Define Depreciation.

Answer:

According to R.N. Carter, “Depreciation is the gradual and permanent decrease in the value of an asset from any cause”.

Question 30.

What is opening entry?

Answer:

The balances of various accounts which are not closed at the end of the accounting period are carried forward to the next accounting period.

Part – III

Answer any seven questions in which question No. 31 is compulsory: [7 × 3 = 21]

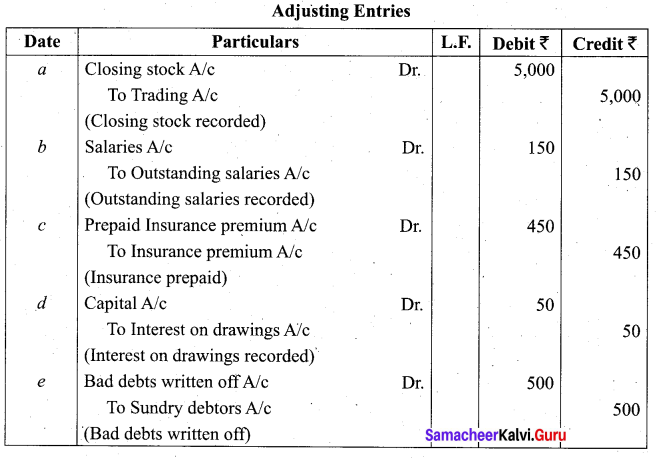

Question 31.

From the following balances taken from the books of Saravanan, calculate gross profit for the year ended December 31, 2017.

Answer:

Question 32.

Mention any three limitations of computerised accounting system.

Answer:

- Heavy cost of installation

- Cost of trading and

- Fear of unemployment.

Question 33.

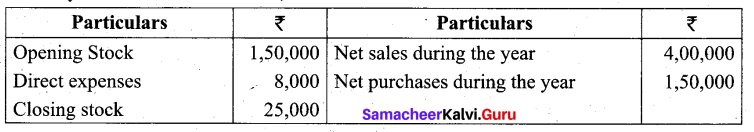

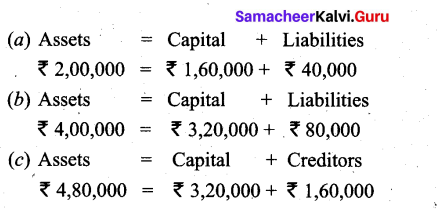

Complete the accounting equation.

Answer:

![]()

Question 34.

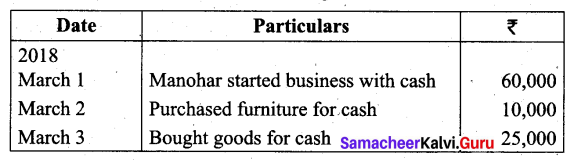

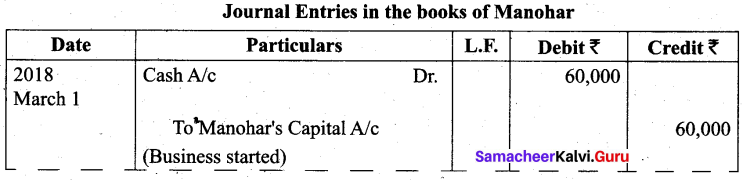

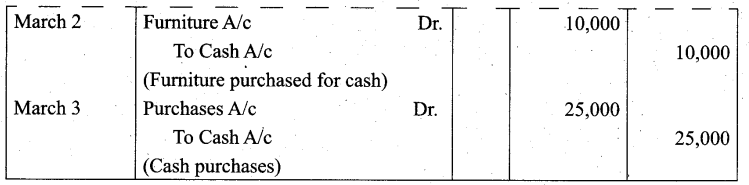

Give journal entries for the following transactions.

Answer:

Question 35.

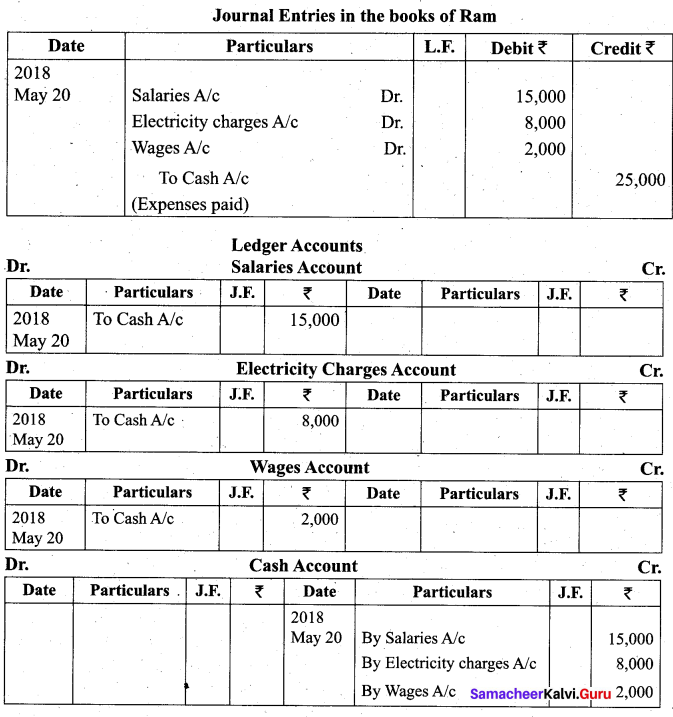

Journalise the following transactions and post them to ledger. On May 20, 2018, Ram paid salaries ₹ 15,000; electricity charges ₹ 8,000 and wages ₹ 2,000.

Answer:

Question 36.

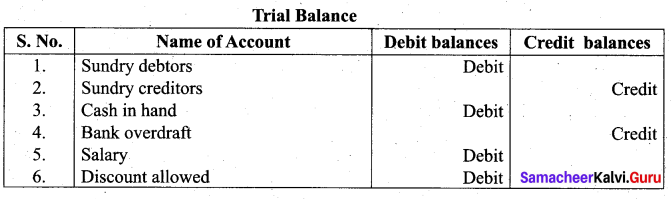

State whether the balance of each of the following accounts should be placed in the debit or the credit column of the trial balance.

1. Sundry debtors 2. Sundry creditors 3. Cash in hand 4. Bank overdraft 5. Salary 6. Discount allowed

Answer:

![]()

Question 37.

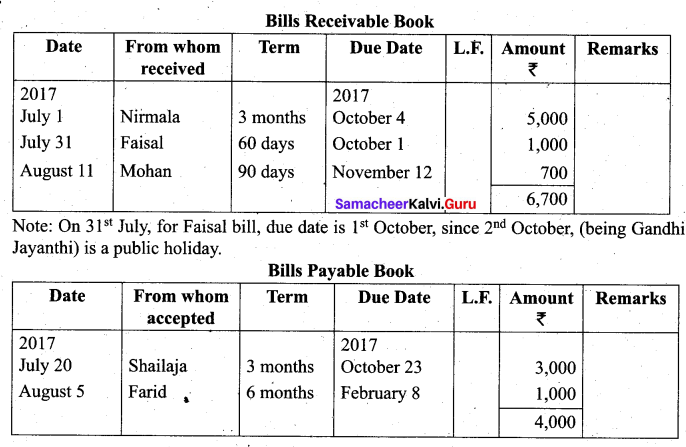

The preparation of the bills receivable and bills payable books is explained through the following examples:

Answer:

|

Date |

Particulars |

| 2017 July 1 | Acceptance received from Nirmala for ₹ 5,000 payable after 3 months. |

| July 20 | Acceptance given to Shailaja’s bill for ₹ 3,000 payable after 3 months. |

| July 31 | Acceptance received from Faisal for ₹ 1,000 payable after 60 days. |

| Aug 5 | Farid’s bill for ₹ 1,000 payable after 6 months accepted. |

| Aug 11 | Mohan’s acceptance for ₹ 700 payable after 90 days received |

Answer:

Question 38.

What are the advantages of petty cash book (any three)?

Answer:

- There can be better control over petty payments.

- There is saving of time of the main cashier.

- Cash book is not loaded with many petty payments.

Question 39.

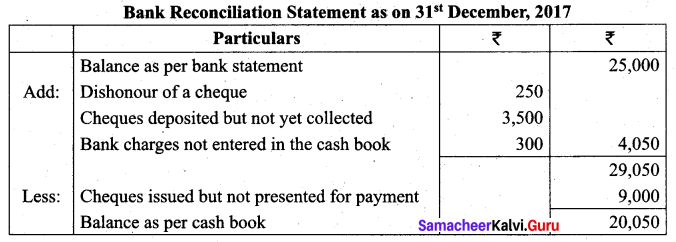

Prepare bank reconciliation statement as on 31st December, 2017 from the following informations.

(a) Balance as per bank statement (pass book) is ₹ 25,000.

(b) No record has been made in the cash book for a dishonour of a cheque for ₹ 250.

(c) Cheques deposited into bank amounting to ₹ 3,500twere not yet collected.

(d) Bank charges of ₹ 300 have not been entered in the cash books.

(e) Cheques issued amounting for ₹ 9,000 have been presented for payment.

Answer:

![]()

Question 40.

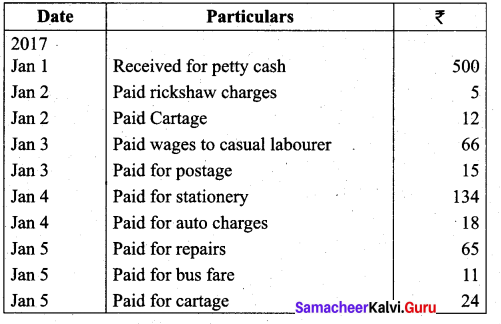

Prepare an analytical petty cash book from the following information on the imprest systems:

Answer:

Part – IV

Answer all the questions: [7 × 5 = 35]

Question 41.

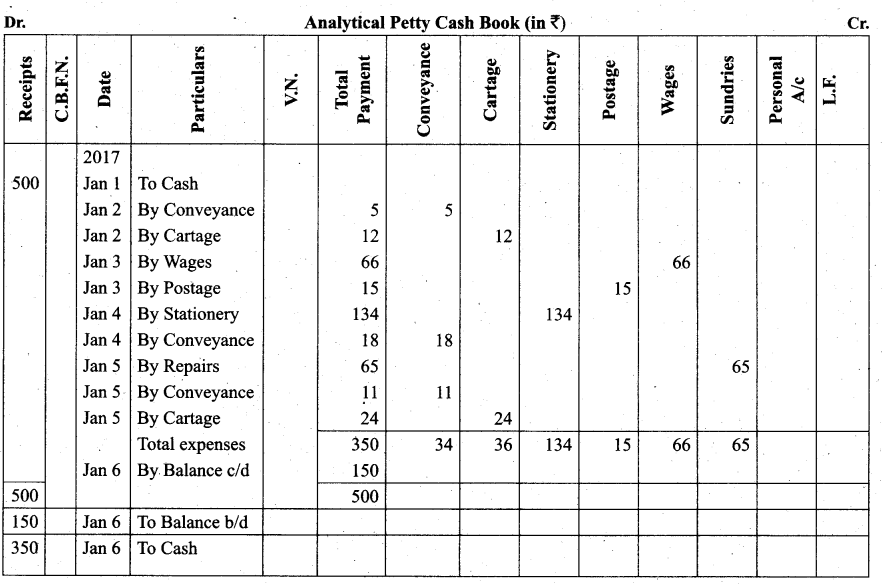

(a) Pass journal entries for the following:

| S.No. | Particulars |

₹ |

| 1. | Commenced business with cash | 1,00,000 |

| 2. | Deposited cash with bank | 40,000 |

| 3. | Purchased goods for cash | 5,000 |

| 4. | Sold goods to Vignesh | 10,000 |

| 5. | Paid salaries by cash | 5,000 |

Answer:

![]()

[OR]

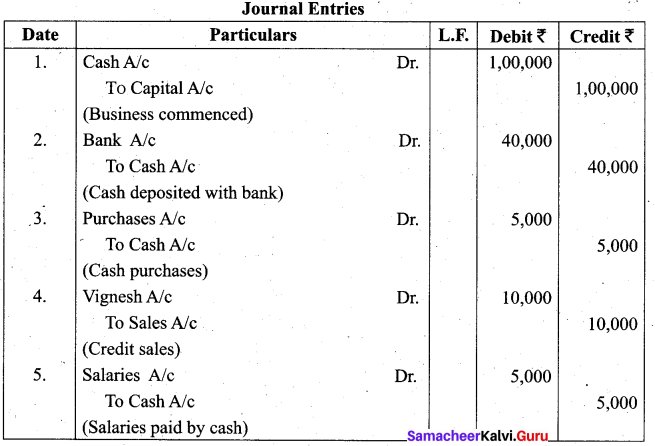

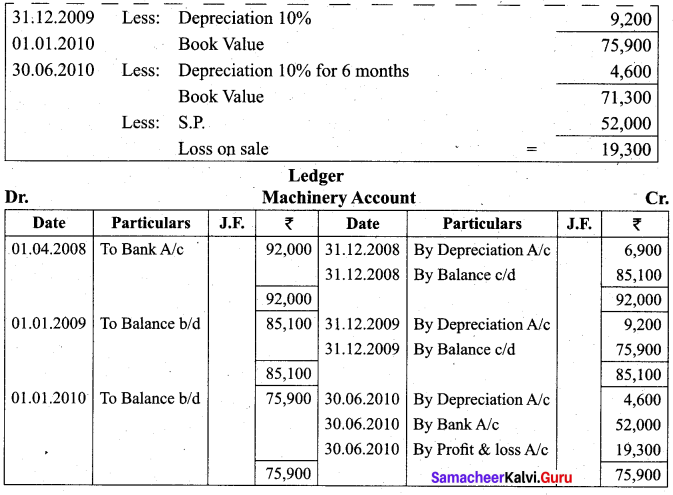

(b) On 1st April 2008, Sudha and Company purchased machinery for ₹ 64,000. To instal the machinery expenses incurred was ₹ 28,000. Depreciate machinery 10% p.a. under straight line method. On 30th June, 2010 the worn out machinery was sold for ₹ 52,000. The books are closed on 31st December every year. Show machinery account.

Answer:

Question 42.

(a) Rectify the following errors which were located at the time of preparing the trial balance.

1. The total of the discount column on the debit side of the cash book of ₹ 225 was posted twice.

2. Goods of the value of ₹ 75 returned by Ponnalagu was not posted to her account.

3. Cash received from Herosini ₹ 1,000 was not posted.

4. Interest received ₹ 300 has not been posted.

5. Rent paid ₹ 100 was posted to rent account as ₹ 10.

Answer:

1. Discount account should be debited with ₹ 225.

2. Sales return account should be credited with ₹ 75.

3. Cash account should be debited with ₹ 1,000.

4. Interest account should be debited with ₹ 300.

5. Rent account should be credited with ₹ 90.

[OR]

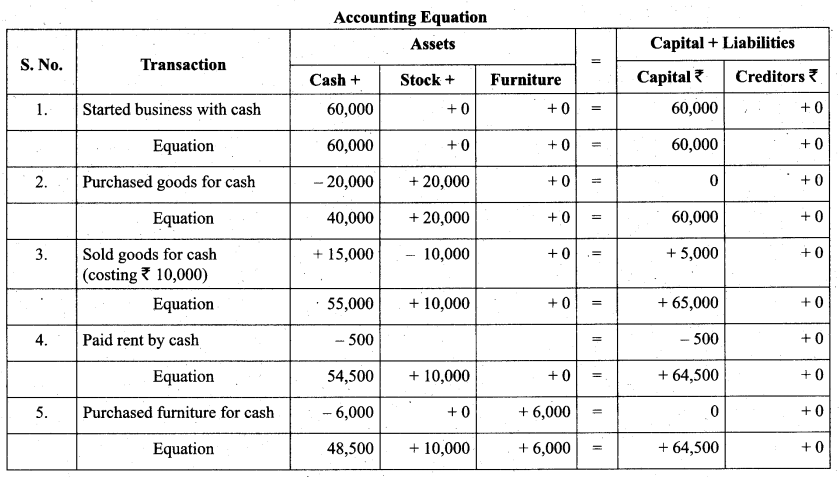

(b) Show the accounting equation on the basis of the following:

| S.No. | Particulars |

₹ |

| 1. | Started business with cash | 60,000 |

| 2. | Purchased goods for cash | 20,000 |

| 3. | Sold goods for cash costing ₹ 10,000 for | 15,000 |

| 4. | Paid rent by cash | 500 |

| 5. | Purchased furniture for cash | 6,000 |

Answer:

![]()

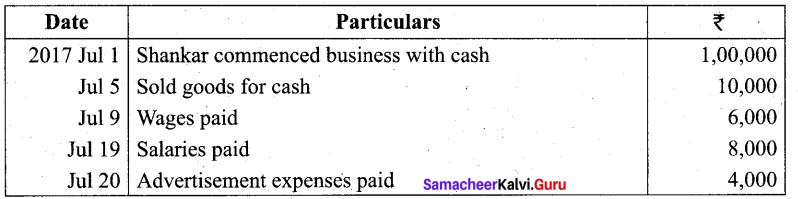

Question 43.

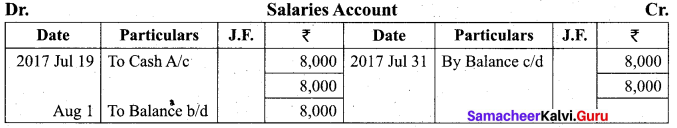

(a) Show the direct ledger postings for the following transactions.

Answer:

[OR]

(b) State whether the following are capital or revenue.

1. ₹ 5,000 spent towards additions to buildings.

2. Second-hand motor car purchased for ₹ 30,000 and paid ₹ 2,000 as repairs immediately.

3. ₹ 10,000 was spent on painting the new factory.

4. Freight and cartage on the new machine ₹ 150, erection charges ? 200.

5. ₹ 150 spent on repairs before using a second hand car purchased recently.

Answer:

1. Capital expenditure

2. Capital expenditure

3. Capital expenditure

4. Capital expenditure

5. Capital expenditure

![]()

Question 44.

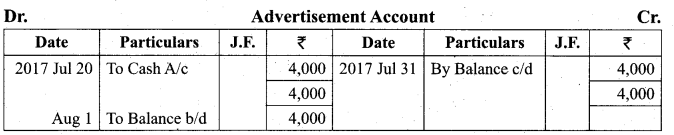

(a) Prepare trial balance as on 31st March, 2017.

| Particulars |

₹ |

| Capital | 60,000 |

| Purchases | 58,000 |

| Advertising expenses | 5,000 |

| Lighting | 8,00 |

| Car expenses | 1,200 |

| Discount received | 3,250 |

| Plant and machinery | 40,000 |

| Sales | 82,000 |

| Drawings | 5,250 |

| Motor car | 35,000 |

Answer:

[OR]

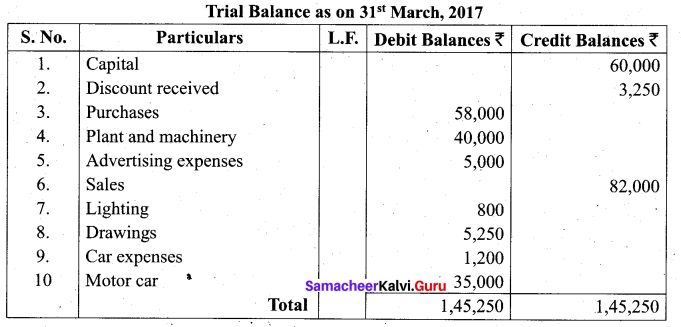

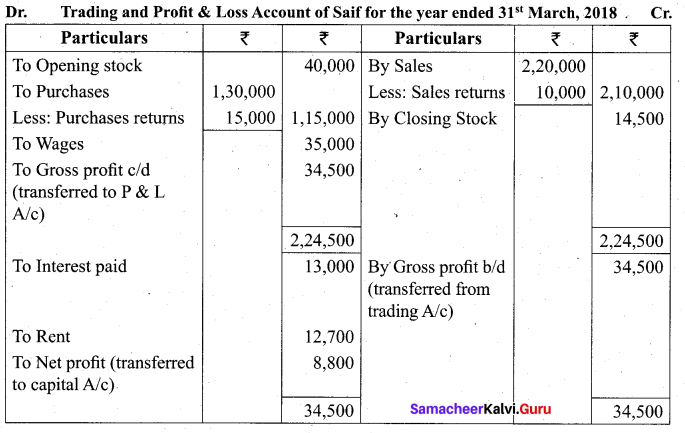

(b) From the trial balances given by Saif, prepare final accounts for the year ended 31st March, 2018 in his books.

Answer:

Question 45.

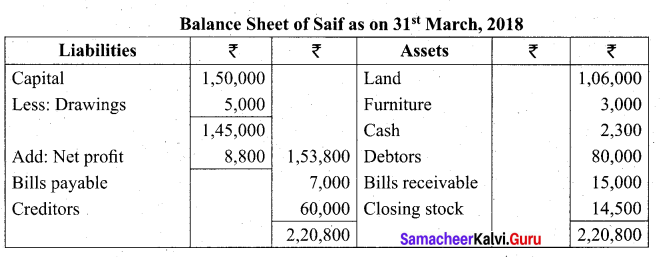

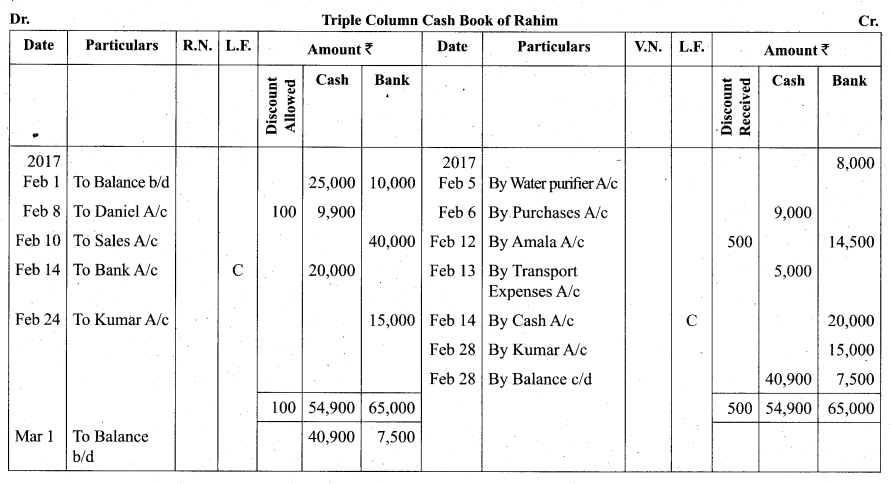

(a) Prepare Sales book and sales returns book of M/s. Ponni and Co.

| Date |

Particulars |

| 2017 Aug 1 | Sold goods to Senthil as per Invoice No. 68 for ₹ 20,500 on credit. |

| Aug 4 | Sold goods to Madhavan as per Invoice No. 74 for ₹ 12,800 on credit. |

| Aug 7 | Sold goods to Kanagasabai as per Invoice No. 78 for ₹ 7,500 on credit. |

| Aug 15 | Returns inward by Senthil as per credit note No.7 for ₹ 1,500 for which cash is not paid. |

| Aug 20 | Sold goods to Selvam for ₹ 13,300 for cash. |

| Aug 25 | Sales returns of? 1,800 by Madhavan as per credit note No. 11 for which cash is not paid. |

Answer:

![]()

[OR]

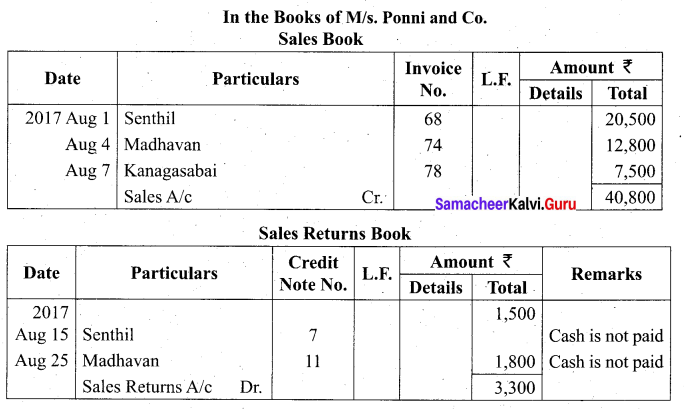

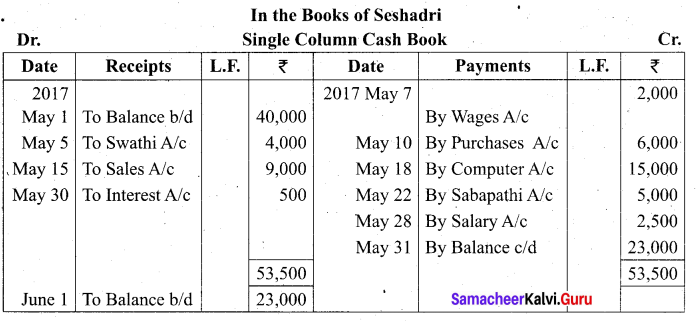

(b) Enter the following transactions in a single column cash book of Seshadri for May, 2017.

Answer:

Question 46.

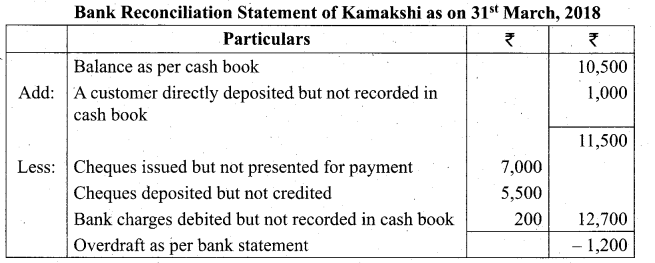

(a) From the following particulars of Kamakshi traders, prepare a bank reconciliation

statement as on 31st March, 2018.

a. Debit balance as per cash book ₹ 10,500.

b. Cheques deposited into bank amounting to ₹ 5,500 credited by bank, but entered twice in the cash book.

c. Cheques issued and presented for payment amounting to ₹ 7,000 omitted in the cash book.

d. Cheque book charges debited by the bank ₹ 200 not recorded in the cash book.

e. Cash of ₹ 1,000 deposited by a customer of the business in cash deposit machine not recorded in the cash book.

Answer:

[OR]

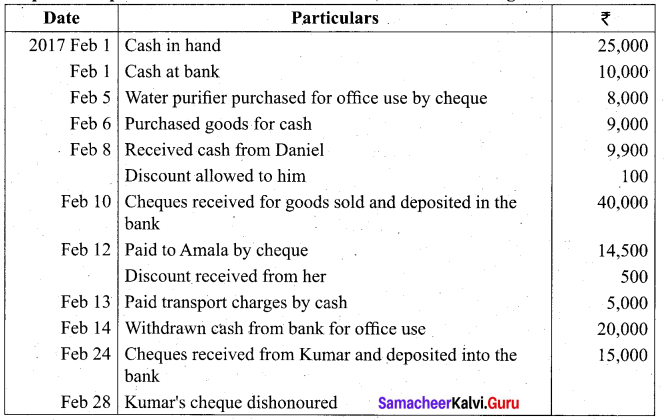

(b) Prepare a Triple Column Cash book of Rahim from the following transactions.

Answer:

![]()

Question 47.

(a) Sharmili & Co. incurred the following expenses during the year 2018. Classify the following items under capital or revenue.

1. Purchase of furniture of ₹ 1,000,

2. Purchase of second hand machinery ₹ 4,000.

3. ₹ 50 paid for carriage on goods purchased.

4. ₹ 175 paid for repairs on second hand machinery as soon as it was purchased.

5. ₹ 600 wages paid for installation of plant.

Answer:

1. Capital expenditure

2. Capital expenditure

3. Revenue expenditure

4. Capital expenditure

5. Capital expenditure

[OR]

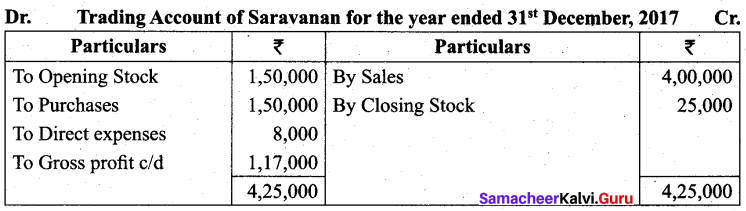

(b) Pass adjusting entries for the following:

a. The closing stock was valued at ₹ 5,000.

b. Outstanding salaries ₹ 150.

c. Insurance prepaid ₹ 450.

d. Interest on drawings ₹ 50.

e. Write off bad debts ₹ 500.

Answer: