Enhance your subject knowledge with Tamilnadu State Board Solutions for 11th Commerce Chapter 8 Securities and Exchange Board of India (SEBI) Questions and Answers and learn all the underlying concepts easily. Make sure to learn the subject from Tamilnadu State Board Solutions Chapter 8 Securities and Exchange Board of India (SEBI) Questions and Answers PDF on a day to day basis and score well in your exams. You can Download Samacheer Kalvi 11th Commerce Book Solutions Questions and Answers are given after enormous research by people having high subject knowledge and for better scoring grade. You can rely on them and prepare any topic of Commerce as per your convenience easily.

Tamilnadu Samacheer Kalvi 12th Commerce Solutions Chapter 8 Securities and Exchange Board of India (SEBI)

Students those who are looking for Tamilnadu State Board Solutions Chapter 8 Securities and Exchange Board of India (SEBI) Questions and Answers Concepts can find them all in one place from our site Tamilnadu State Board Solutions. Simply click on the links available to prepare the corresponding topics of Samacheer Kalvi 11th Commerce Book Solutions Questions and Answers easily. Clarify all your queries from chapter wise different questions to be familiar with the kind of questions appearing in the exam. Thus, you can increase your score and get higher grade in the final exam.

Samacheer Kalvi 12th Commerce Securities and Exchange Board of India (SEBI) Textbook Exercise Questions and Answers

I. Choose the Correct Answer

Question 1.

Securities Exchange Board of India was first established in the year _________

(a) 1988

(b) 1992

(c) 1995

(d) 1998

Answer:

(a) 1988

Question 2.

The headquarters of SEBI is _________

(a) Calcutta

(b) Bombay

(c) Chennai

(d) Delhi

Answer:

(b) Bombay

Question 3.

In which year SEBI was constituted as the regulator of capital markets in India?

(a) 1988

(b) 1992

(c) 2014

(d) 2013

Answer:

(a) 1988

Question 4.

Registering and controlling the functioning of collective investment schemes as _________

(a) Mutual Funds

(b) Listing

(c) Rematerialisation

(d) Dematerialization

Answer:

(d) Dematerialization

Question 5.

SEBI is empowered by the Finance ministry to nominate members on the Governing body of every stock exchange.

(a) 5

(b) 3

(c) 6

(d) 1

Answer:

(b) 3

Question 6.

The process of converting physical shares into electronic form is called _________

(a) Dematerialisation

(b) Delisting

(c) Materialisation

(d) Debarring

Answer:

(a) Dematerialisation

Question 7.

Trading in dematerialized shares commenced on the NSE in _________

(a) January 1996

(b) June 1998

(c) December 1996

(d) December 1998

Answer:

(c) December 1996

Question 8.

_________ was the first company to trade its shares in Demat form.

(a) Tata Industries

(b) Reliance Industries

(c) Infosys

(d) Birla Industries

Answer:

(b) Reliance Industries

Question 9.

_________ enables small investors to participate in the investment on share capital of large companies.

(a) Mutual Funds

(b) Shares

(c) Debentures

(d) Fixed deposits

Answer:

(a) Mutual Funds

Question 10.

PAN stands for _________

(a) Permanent Amount Number

(b) Primary Account Number

(c) Permanent Account Number

(d) Permanent Account Nominee

Answer:

(c) Permanent Account Number

II. Very Short Answer Questions

Question 1.

Write a short notes on SEBI.

Answer:

Securities and exchange Board of India (SEBI) was first established in the year 1988 as a non- statutory body for regulating the securities market.

Question 2.

Write any two objectives of SEBI.

Answer:

The first objective of SEBI is to regulate stock exchanges so that efficient services may be provided to all the parties operating there. Another objective is to supervise/check the activities of the brokers and other middlemen in order to control the capital market.

Question 3.

What is Demat account?

Answer:

A demat account holds all the shares that are purchased in electronic or dematerialized form.

Question 4.

Mention the headquarters of SEBI.

Answer:

SEBI has its headquarters at the business district of BandraKurla Complex in Mumbai, and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai and Ahmedabad, respectively.

Question 5.

What are the various ID proofs?

Answer:

Proof of identity: PAN card, voter’s ID, passport, driver’s license, bank attestation, IT returns, electricity bill, telephone bill, ID cards with applicant’s photo issued by the central or state government are the ID proofs.

III. Short Answer Questions

Question 1.

What is meant by Dematerialization?

Answer:

Dematerialization is the process by which physical share certificates of an investor are taken back by the company/registrar and destroyed. Then an equivalent number of securities in the electronic form are credited to the investors account with his Depository Participant.

Question 2.

What are the documents required for a Demat account?

Answer:

For opening a demat account, we submit proof of identity and address along with a passport size photo and the account opening form.

Documents for Identity: Pan card, Voters ID, Passport, Driver’s License, IT Returns, Electricity and Telephone Bills are the Identity documents.

Documents for Address: Ration card, Passport, Voter’s ID card, Driving License, Telephone Bills, Electricity bills are the address documents.

Question 3.

What is the power of SEBI under Securities Contract Act?

Answer:

For effective regulation of stock exchange, the Ministry of Finance issued a Notification on 13 September, 1994 delegating several of its powers under the Securities Contracts (Regulations) Act to SEBI is also empowered by the Finance Ministry to nominate three members on the Governing Body of every stock exchange.

Question 4.

What is meant by Insiders trading? .

Answer:

Insider trading means the buying and selling of securities by directors, promoters, etc., who have access to some confidential information about the company. This affects the interests of the general investors and is essential to check this tendency.

Question 5.

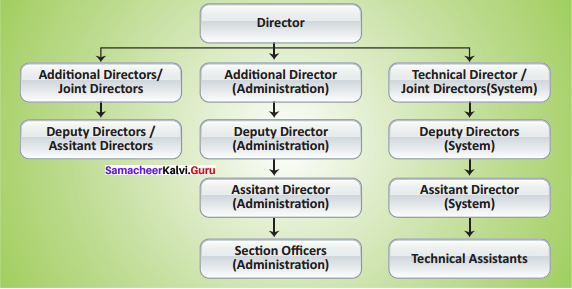

Draw the organization structure of SEBI.

Answer:

The SEBI is managed by its members, which consists of following.

IV. Long Answer Questions

Question 1.

What are the functions of SEBI?

Answer:

SEBI performs three key functions: quasi-legislative, quasi-judicial and quasi-executive.

- Safeguarding the interests of investors by means of adequate education and guidance.

- Regulating and controlling the business on stock markets.

- Conduct inspection and inquiries of stock exchanges, intermediaries and self-regulating organizations.

- Barring insider trading in securities.

- Prohibiting deceptive and unfair methods used by financial intermediaries operating in securities market.

- Registering and controlling the functioning of stock brokers, sub-brokers, share transfer agents, bankers, trustees, underwriters who are linked to securities market.

- SEBI issues Guidelines and Instructions to businesses orgnisations for issue of shares,

- Registering and controlling the functioning of collective investment schemes such as mutual funds.

Question 2.

Explain the powers of SEBI

Answer:

The various powers of a SEBI are explained below:

- Powers Relating to Stock Exchanges and Intermediaries: SEBI has wide powers to get the information from the stock exchange and intermediaries regarding their business transactions for inspection.

- Power to Impose Monetary Penalties: SEBI has power to impose monetary penalties on capital market intermediaries for violations.

- Power to Initiate Actions in Functions Assigned

- Power to Regulate Insider Trading: SEBI has power to regulate insider trading or can regulate the functions of merchant banker.

- Powers Under Securities Contracts Act: For the regulation of stock exchange, the Ministry of Finance issued a notification, for delegating several of its powers under the securities contract Act.

Question 3.

What are the benefits of Dematerialisation?

Answer:

Benefits of Dematerialisation:

- The risks relating to physical certificates like loss, theft, forgery are eliminated completely with a Demat Account.

- The risk of paper work enables quicker transactions and higher efficiency in trading.

- The shares which are created through mergers and consolidation of companies are credited automatically in the Demat account.

- There is no stamp duty for transfer of securities.

- Certain banks also permit holding of both equity and debt securities in a single account

- A Demat account holder can buy or sell any amount of shares.

Samacheer Kalvi 12th Commerce Securities and Exchange Board of India (SEBI) Additional Questions and Answers

I. A. Choose the Correct Answer:

Question 1.

SEBI got the statutory powers in the year _____

(a) 1988

(b) 1992

(c) 1969

(d) 1980

Answer:

(b) 1992

B. Fill in the blanks

Question 1.

The first objective of SEBI is to regulate ______

Answer:

Stock exchanges

II. Very Short Answer Questions

Question 1.

Name the three key functions of SEBI.

Answer:

SEBI performs three key functions.

They are:

- quasi-legislative

- quasi-judicial

- quasi-executive

Question 2.

Write a note on PAN.

Answer:

PAN, or permanent account number, is a unique 10-digit alphanumeric identity allotted to each taxpayer by the Income Tax Department. It also serves as an identity proof.

Case Study

Question (a)

Koushikaa’s father has gifted her the shares of a large cement company with which he had been working. The securities were in physical form. She already has a bank account and does not possess any other forms of securities. She wishes to sell the shares and approached a registered broker for the purpose. Mention one mandatory detail which she will have to provide with the broker.

Answer:

Mandatory Detail:

- The shares can be sold by opening a Demat account.

- She has to mention the no of shares of the cement company.

- Without paper work shares can be transferred through dematerialisation.

- Shares can be transferred to the person who wants to purchase.

- Also mention the name of the company, Type of share, amount of share capital.

Question (b)

Mr. Kulandaivel was the Chairman of Thangam Bank. The bank was earning good profits. Shareholders were happy as the bank was paying regular dividends. The market price of their share was also steadily rising. The bank was about to announce taking over the ‘Trinity Bank’. Mr. Kulandaivel knew that the share price of Thangam Bank would rise on this announcement. Being a part of the bank, he was not allowed to buy shares of the bank. He called one of the his rich friends Mr. Chandrasekaran and asked him to invest ? 5 crores in shares of his bank promising him the capital gains.

As expected, the share prices went up by 40% and the market price of Chandrasekaran’s shares was now tl crores. He earned a profit of ?2 crores. He gave ?1 crore to Mr. Kulandaivel and kept ? crore with himself. On regular inspection and by conducting enquires of the brokers involved, the Securities and Exchange Board of India (SEBI) was able to detect this irregularity. The SEBI imposed a heavy penalty on Mr. Kulandaivel. By quoting the lines from the above paragraph, identify and state any two functions that were performed by SEBI in the above case.

Answer:

Functions performed by SEBI in this case:

- The market price of their share were informed and controlled by SEBI.

- On regular inspection and conducting enquiries, Exchange Board of India was able to detect this irregularity. The SEBI imposed a heavy penalty on Mr. Kulandaivel.

We as a team believe the information prevailing regarding the Tamilnadu State Board Solutions for 11th Commerce Chapter 8 Securities and Exchange Board of India (SEBI) Questions and Answers has been helpful in clearing your doubts to the fullest. For any other help do leave us your suggestions and we will look into them. Stay in touch to get the latest updates on Tamilnadu State Board Solutions for different subjects in the blink of an eye.